Apollo Global Management Investor Day Presentation Deck

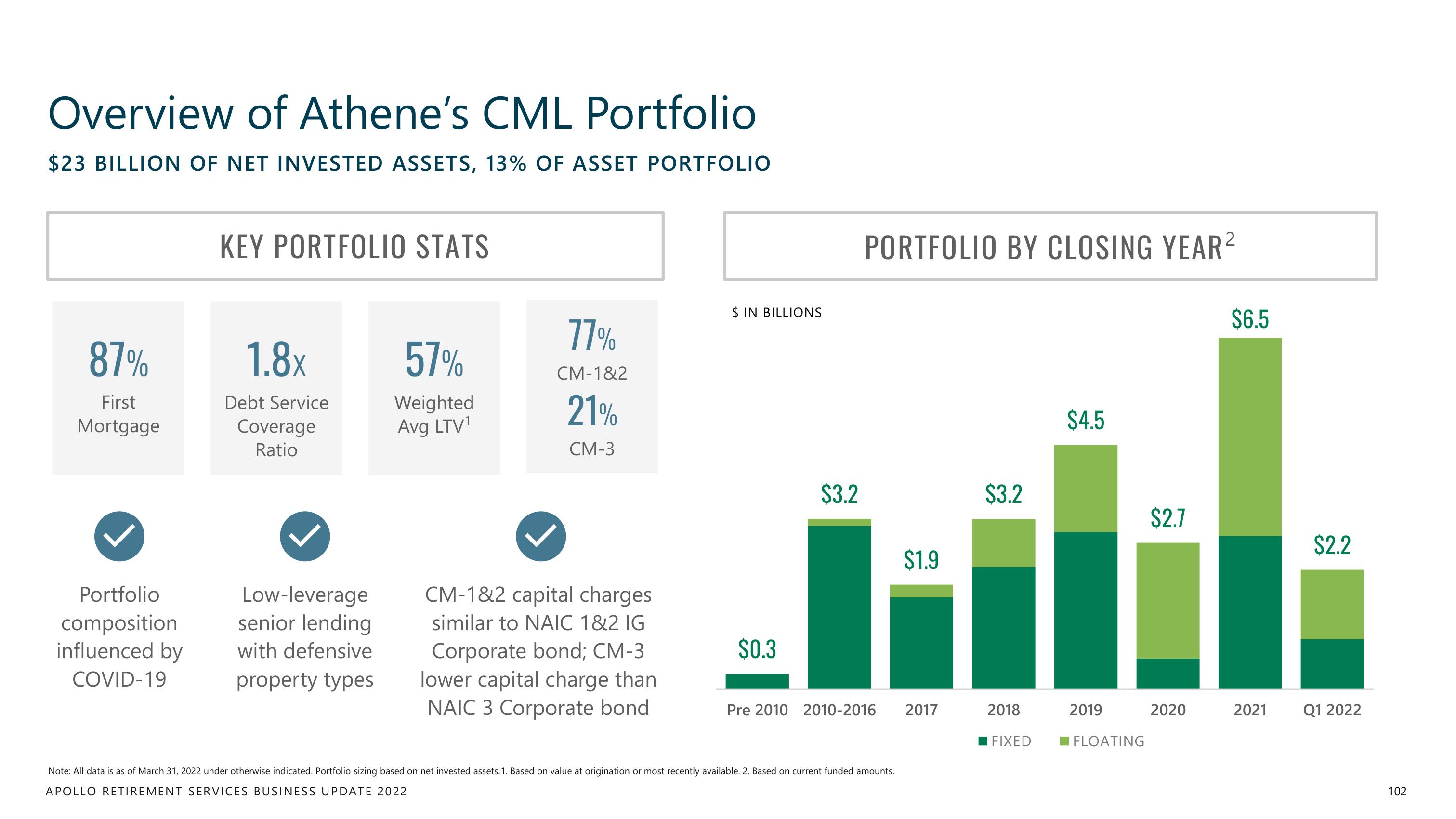

Overview of Athene's CML Portfolio

$23 BILLION OF NET INVESTED ASSETS, 13% OF ASSET PORTFOLIO

87%

First

Mortgage

Portfolio

composition

influenced by

COVID-19

KEY PORTFOLIO STATS

1.8x

Debt Service

Coverage

Ratio

Low-leverage

senior lending

with defensive

property types

57%

Weighted

Avg LTV¹

77%

CM-1&2

21%

CM-3

CM-1&2 capital charges

similar to NAIC 1&2 IG

Corporate bond; CM-3

lower capital charge than

NAIC 3 Corporate bond

$ IN BILLIONS

$0.3

$3.2

2

PORTFOLIO BY CLOSING YEAR ²

Pre 2010 2010-2016

Note: All data is as of March 31, 2022 under otherwise indicated. Portfolio sizing based on net invested assets. 1. Based on value at origination or most recently available. 2. Based on current funded amounts.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

$1.9

2017

$3.2

2018

FIXED

$4.5

2019

FLOATING

$2.7

2020

$6.5

2021

$2.2

Q1 2022

102View entire presentation