AMC Mergers and Acquisitions Presentation Deck

Combined Prospect Better for Carmike Shareholders than Standalone

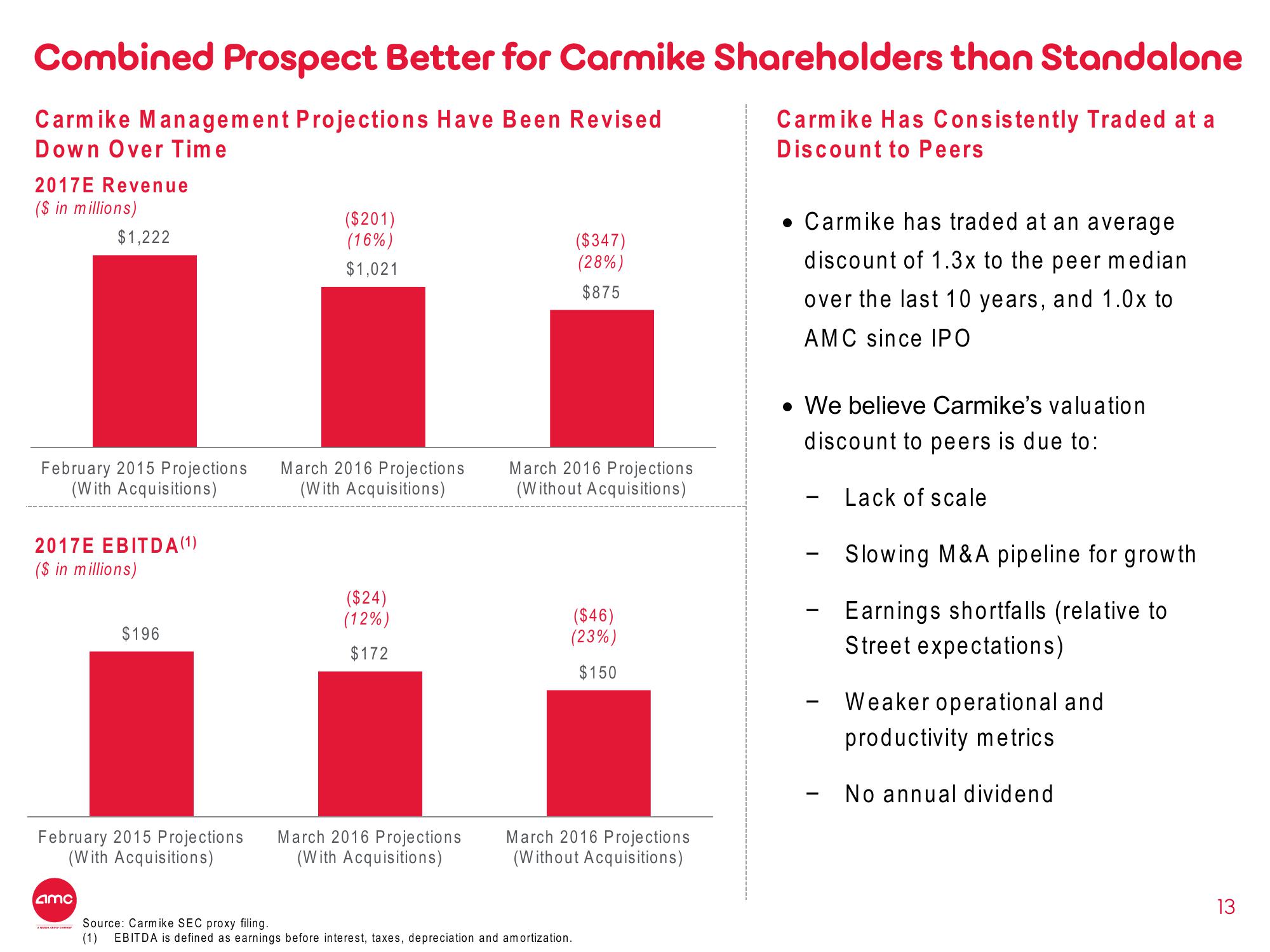

Carmike Management Projections Have Been Revised

Carmike Has Consistently Traded at a

Discount to Peers

Down Over Time

2017E Revenue

($ in millions)

$1,222

February 2015 Projections

(With Acquisitions)

2017E EBITDA (1)

($ in millions)

amc

$196

February 2015 Projections

(With Acquisitions)

($201)

(16%)

$1,021

March 2016 Projections

(With Acquisitions)

($24)

(12%)

$172

March 2016 Projections

(With Acquisitions)

($347)

(28%)

$875

March 2016 Projections

(Without Acquisitions)

($46)

(23%)

$150

March 2016 Projections

(Without Acquisitions)

Source: Carmike SEC proxy filing.

(1) EBITDA is defined as earnings before interest, taxes, depreciation and amortization.

. Carmike has traded at an average

discount of 1.3x to the peer median

over the last 10 years, and 1.0x to

AMC since IPO

• We believe Carmike's valuation

discount to peers is due to:

Lack of scale

Slowing M&A pipeline for growth

Earnings shortfalls (relative to

Street expectations)

Weaker operational and

productivity metrics

No annual dividend

13View entire presentation