Engine No. 1 Activist Presentation Deck

Despite these dynamics, ExxonMobil has repeatedly

committed to more aggressive spending than the industry

●

●

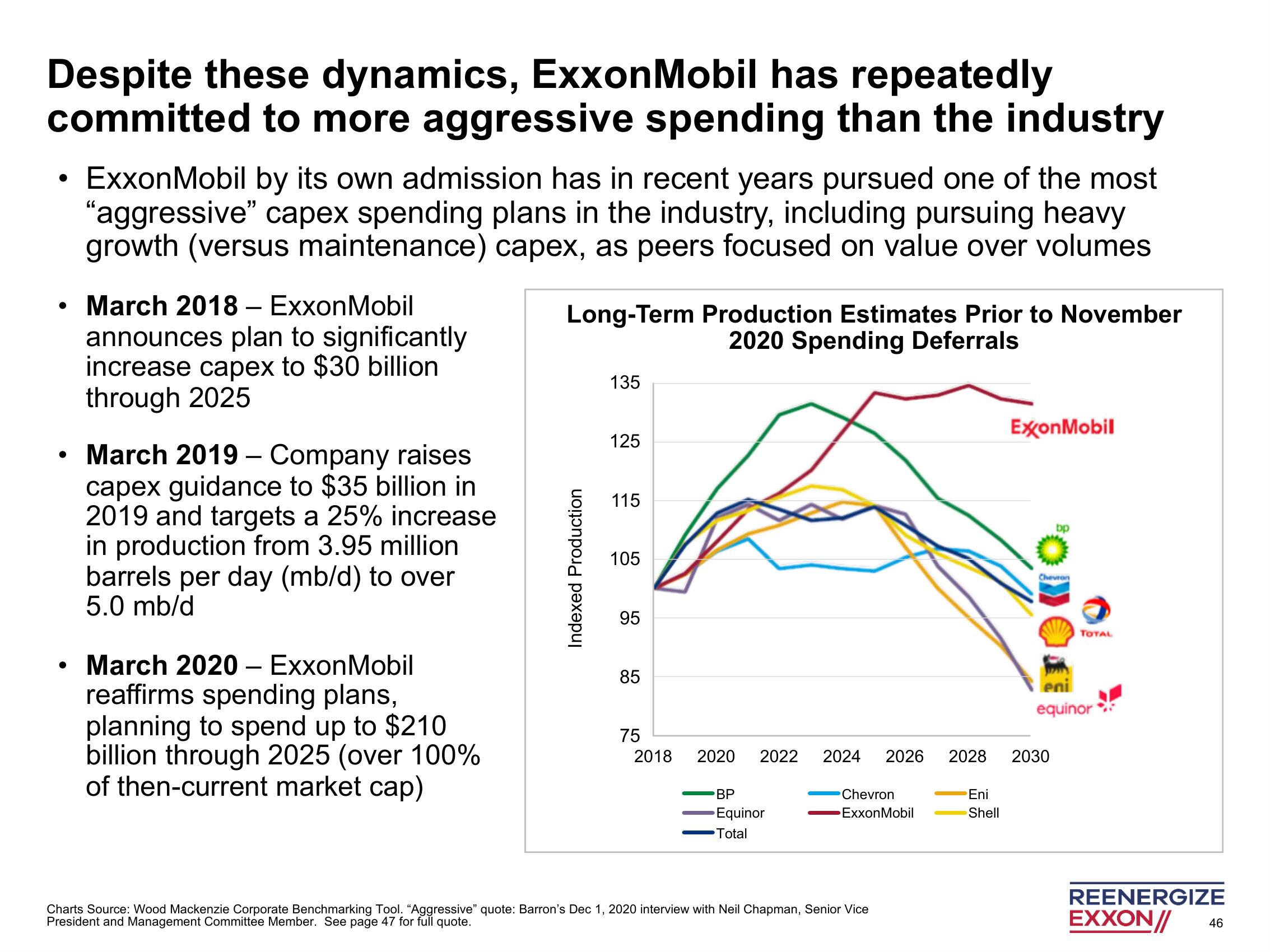

ExxonMobil by its own admission has in recent years pursued one of the most

"aggressive" capex spending plans in the industry, including pursuing heavy

growth (versus maintenance) capex, as peers focused on value over volumes

March 2018 - ExxonMobil

announces plan to significantly

increase capex to $30 billion

through 2025

March 2019 - Company raises

capex guidance to $35 billion in

2019 and targets a 25% increase

in production from 3.95 million

barrels per day (mb/d) to over

5.0 mb/d

• March 2020 - ExxonMobil

reaffirms spending plans,

planning to spend up to $210

billion through 2025 (over 100%

of then-current market cap)

Long-Term Production Estimates Prior to November

2020 Spending Deferrals

Indexed Production

135

125

115

105

95

85

75

2018

2020 2022 2024 2026

BP

Equinor

Total

Chevron

ExxonMobil

Charts Source: Wood Mackenzie Corporate Benchmarking Tool. "Aggressive" quote: Barron's Dec 1, 2020 interview with Neil Chapman, Senior Vice

President and Management Committee Member. See page 47 for full quote.

ExxonMobil

Eni

Shell

bp

Chevron

2028 2030

TOTAL

eni

equinor

REENERGIZE

EXXON//

46View entire presentation