Pershing Square Activist Presentation Deck

N

A Revised Proposal for Creating Value

at McDonald's

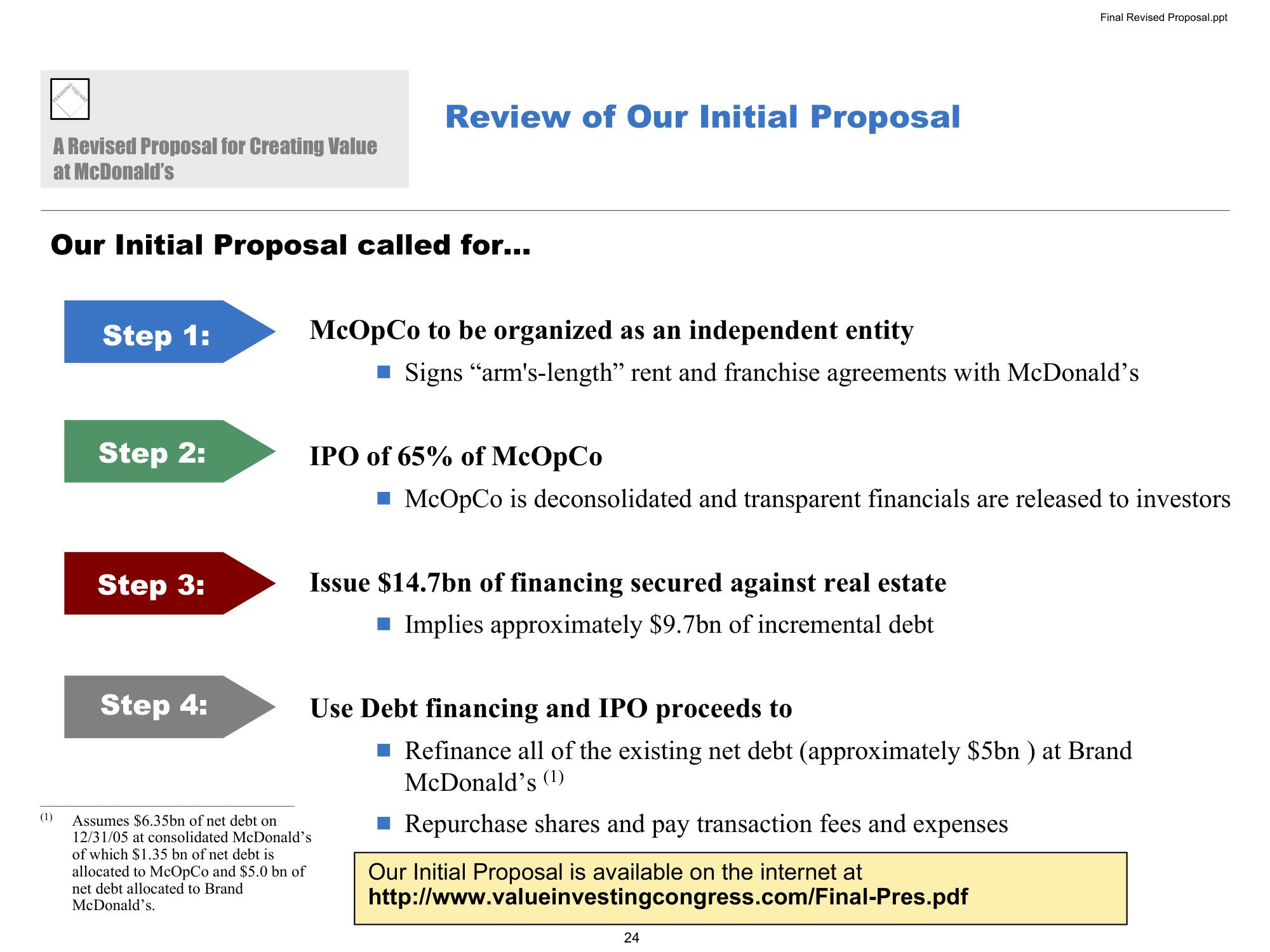

Our Initial Proposal called for...

(1)

Step 1:

Step 2:

Step 3:

Step 4:

Review of Our Initial Proposal

McOpCo to be organized as an independent entity

■ Signs "arm's-length" rent and franchise agreements with McDonald's

IPO of 65% of McOpCo

Issue $14.7bn of financing secured against real estate

■ Implies approximately $9.7bn of incremental debt

Assumes $6.35bn of net debt on

12/31/05 at consolidated McDonald's

of which $1.35 bn of net debt is

allocated to McOpCo and $5.0 bn of

net debt allocated to Brand

McDonald's.

McOpCo is deconsolidated and transparent financials are released to investors

Final Revised Proposal.ppt

Use Debt financing and IPO proceeds to

■ Refinance all of the existing net debt (approximately $5bn ) at Brand

McDonald's (¹)

Repurchase shares and pay transaction fees and expenses

Our Initial Proposal is available on the internet at

http://www.valueinvestingcongress.com/Final-Pres.pdf

24View entire presentation