Tudor, Pickering, Holt & Co Investment Banking

Supplemental Calculation Detail | AMGP Proposal

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

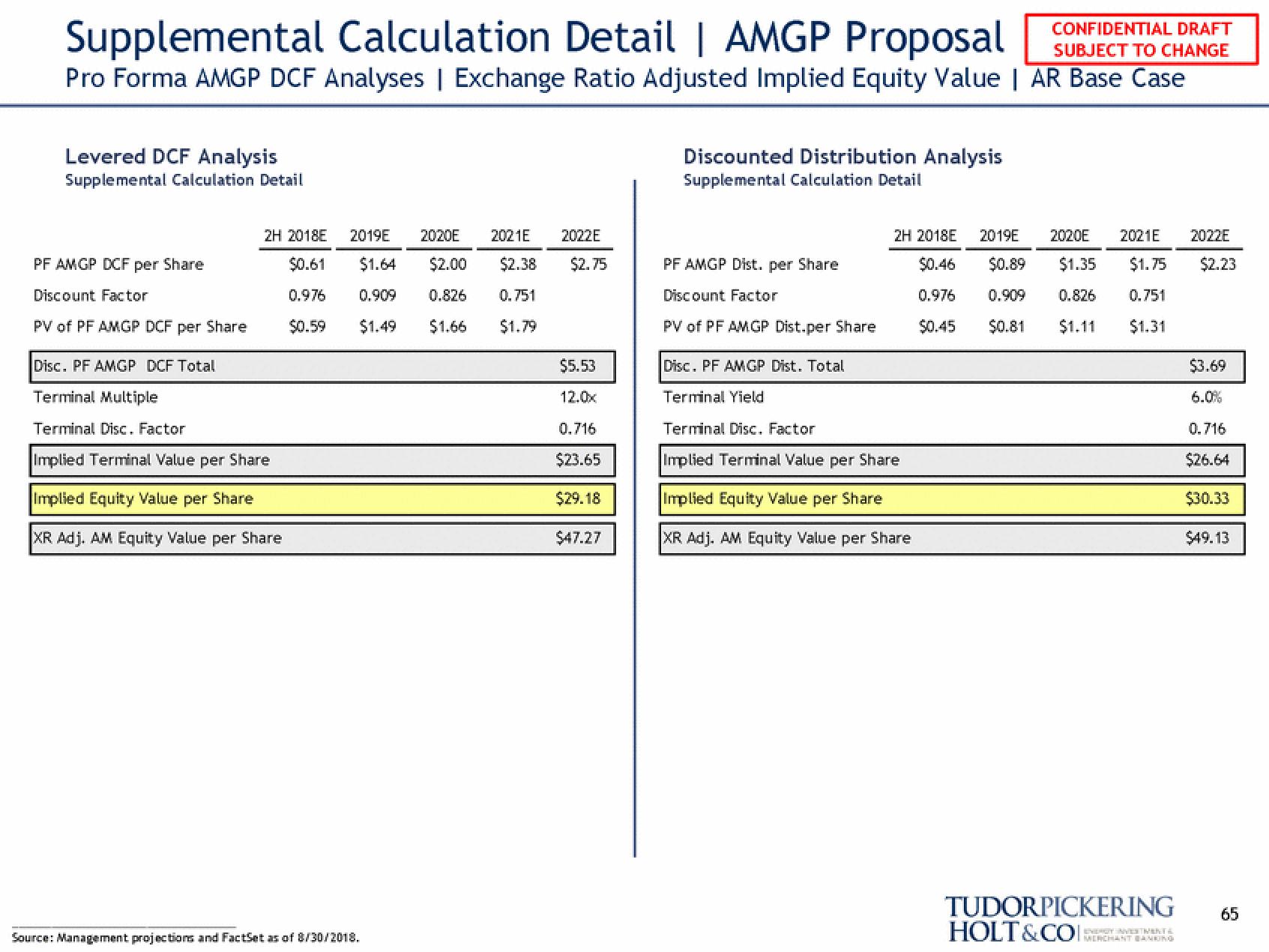

Pro Forma AMGP DCF Analyses | Exchange Ratio Adjusted Implied Equity Value | AR Base Case

Levered DCF Analysis

Supplemental Calculation Detail

PF AMGP DCF per Share

Discount Factor

PV of PF AMGP DCF per Share

2H 2018E 2019E 2020E 2021E 2022E

$0.61

$1.64 $2.00 $2.38

$2.75

0.976

0.909 0.826 0.751

$0.59

$1.49 $1.66 $1.79

Disc. PF AMGP DCF Total

Terminal Multiple

Terminal Disc. Factor

Implied Terminal Value per Share

Implied Equity Value per Share

XR Adj. AM Equity Value per Share

Source: Management projections and FactSet as of 8/30/2018.

$5.53

12.0x

0.716

$23.65

$29.18

$47.27

Discounted Distribution Analysis

Supplemental Calculation Detail

PF AMGP Dist. per Share

Discount Factor

PV of PF AMGP Dist.per Share

Disc. PF AMGP Dist. Total

Terminal Yield

2H 2018E 2019E

$0.46

0.976

$0.45

Terminal Disc. Factor

Implied Terminal Value per Share

Implied Equity Value per Share

XR Adj. AM Equity Value per Share

2020E 2021E 2022E

$1.35 $1.75 $2.23

0.751

$1.31

$0.89

0.909 0.826

$0.81

$1.11

TUDORPICKERING

HOLT&COI:

ENERGY INVESTIMENTS

MERCHANT BANKING

$3.69

6.0%

0.716

$26.64

$30.33

$49.13

65View entire presentation