Investor Presentation

debt maturity progression

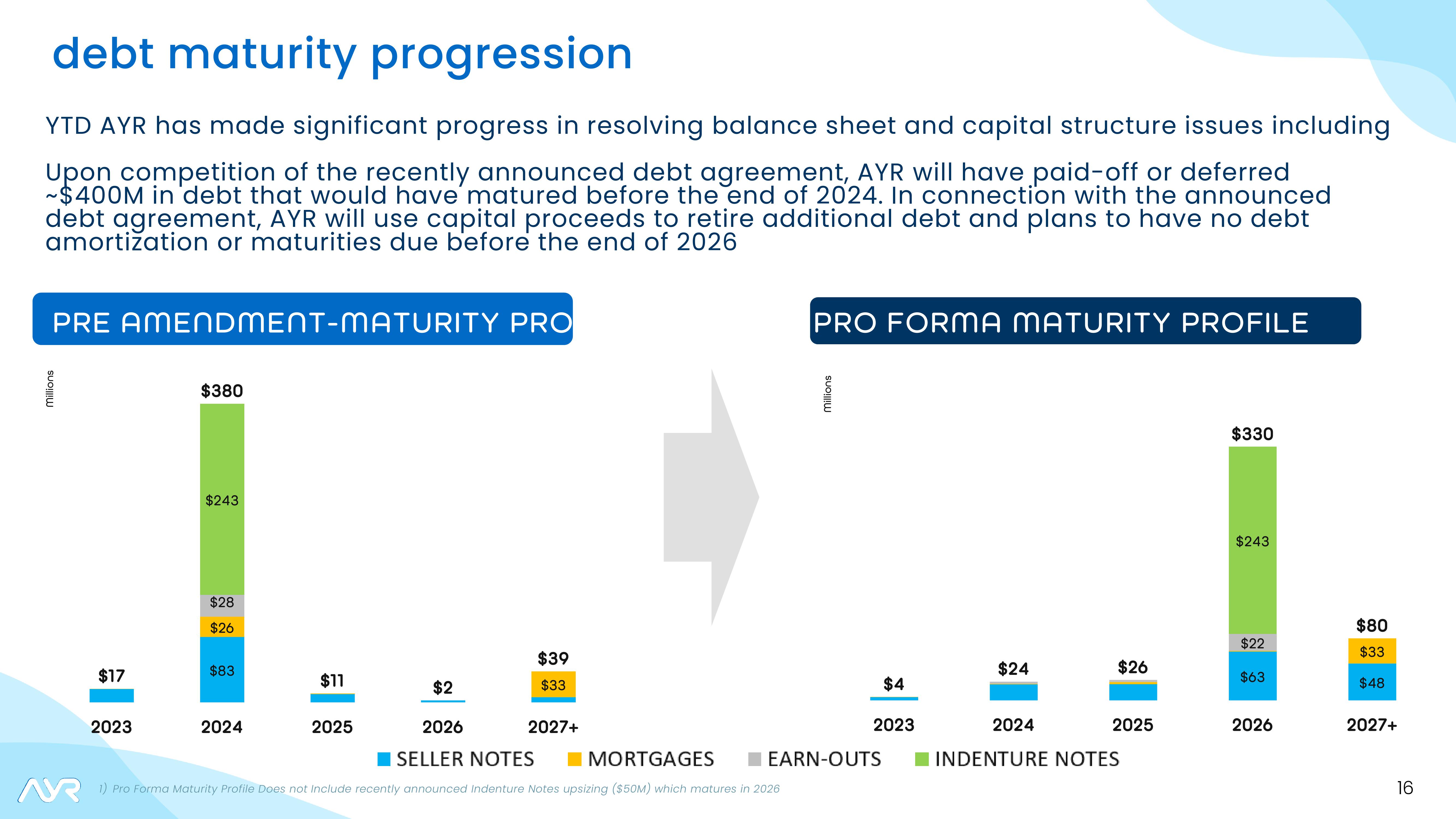

YTD AYR has made significant progress in resolving balance sheet and capital structure issues including

Upon competition of the recently announced debt agreement, AYR will have paid-off or deferred

~$400M in debt that would have matured before the end of 2024. In connection with the announced

debt agreement, AYR will use capital proceeds to retire additional debt and plans to have no debt

amortization or maturities due before the end of 2026

PRE AMENDMENT-MATURITY PRO

millions

$17

2023

$380

$243

$28

$26

$83

2024

$11

2025

$2

$39

$33

2027+

2026

SELLER NOTES

MORTGAGES

1) Pro Forma Maturity Profile Does not Include recently announced Indenture Notes upsizing ($50M) which matures in 2026

PRO FORMA MATURITY PROFILE

millions

$4

2023

EARN-OUTS

$24

2024

$26

2025

INDENTURE NOTES

$330

$243

$22

$63

2026

$80

$33

$48

2027+

16View entire presentation