Tempo SPAC Presentation Deck

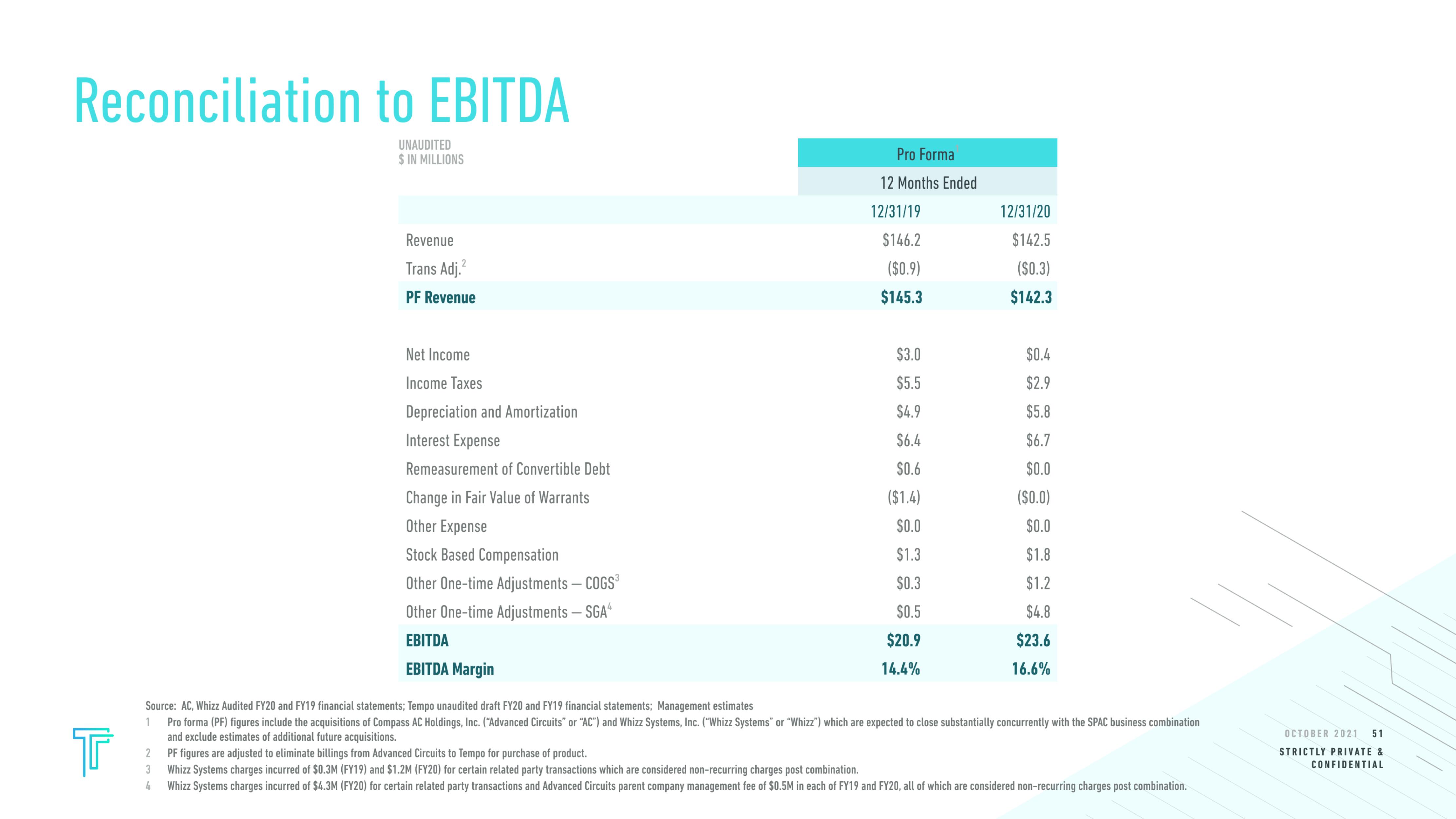

Reconciliation to EBITDA

UNAUDITED

$ IN MILLIONS

T

Revenue

Trans Adj.²

PF Revenue

2

3

4

Net Income

Income Taxes

Depreciation and Amortization

Interest Expense

Remeasurement of Convertible Debt

Change in Fair Value of Warrants

Other Expense

Stock Based Compensation

Other One-time Adjustments - COGS³

Other One-time Adjustments - SGA4

EBITDA

EBITDA Margin

Pro Forma

12 Months Ended

12/31/19

$146.2

($0.9)

$145.3

$3.0

$5.5

$4.9

$6.4

$0.6

($1.4)

$0.0

$1.3

$0.3

$0.5

$20.9

14.4%

12/31/20

$142.5

($0.3)

$142.3

$0.4

$2.9

$5.8

$6.7

$0.0

($0.0)

$0.0

$1.8

$1.2

$4.8

$23.6

16.6%

Source: AC, Whizz Audited FY20 and FY19 financial statements; Tempo unaudited draft FY20 and FY19 financial statements; Management estimates

1

Pro forma (PF) figures include the acquisitions of Compass AC Holdings, Inc. ("Advanced Circuits" or "AC") and Whizz Systems, Inc. ("Whizz Systems" or "Whizz") which are expected to close substantially concurrently with the SPAC business combination

and exclude estimates of additional future acquisitions.

PF figures are adjusted to eliminate billings from Advanced Circuits to Tempo for purchase of product.

Whizz Systems charges incurred of $0.3M (FY19) and $1.2M (FY20) for certain related party transactions which are considered non-recurring charges post combination.

Whizz Systems charges incurred of $4.3M (FY20) for certain related party transactions and Advanced Circuits parent company management fee of $0.5M in each of FY19 and FY20, all of which are considered non-recurring charges post combination.

OCTOBER 2021 51

STRICTLY PRIVATE &

CONFIDENTIALView entire presentation