Sonder Results Presentation Deck

Third Quarter 2021 Summary Results

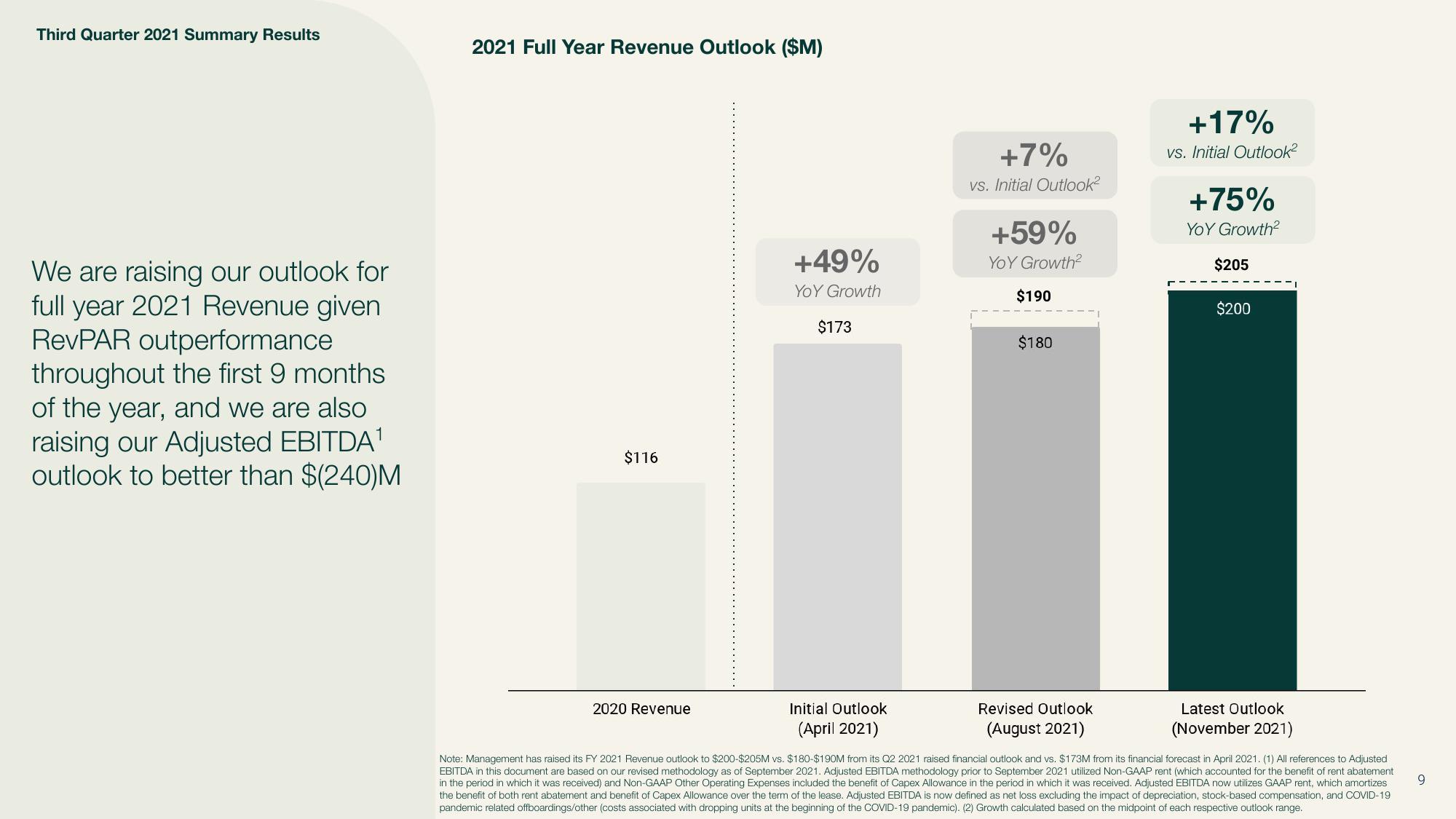

We are raising our outlook for

full year 2021 Revenue given

RevPAR outperformance

throughout the first 9 months

of the year, and we are also

raising our Adjusted EBITDA¹

outlook to better than $(240)M

2021 Full Year Revenue Outlook ($M)

$116

2020 Revenue

+49%

YOY Growth

$173

Initial Outlook

(April 2021)

+7%

vs. Initial Outlook²

+59%

YOY Growth²

$190

$180

Revised Outlook

(August 2021)

+17%

vs. Initial Outlook²

+75%

YOY Growth²

$205

$200

Latest Outlook

(November 2021)

Note: Management has raised its FY 2021 Revenue outlook to $200-$205M vs. $180-$190M from its Q2 2021 raised financial outlook and vs. $173M from its financial forecast in April 2021. (1) All references to Adjusted

EBITDA in this document are based on our revised methodology as of September 2021. Adjusted EBITDA methodology prior to September 2021 utilized Non-GAAP rent (which accounted for the benefit of rent abatement

in the period in which it was received) and Non-GAAP Other Operating Expenses included the benefit of Capex Allowance in the period in which it was received. Adjusted EBITDA now utilizes GAAP rent, which amortizes

the benefit of both rent abatement and benefit of Capex Allowance over the term of the lease. Adjusted EBITDA is now defined as net loss excluding the impact of depreciation, stock-based compensation, and COVID-19

pandemic related offboardings/other (costs associated with dropping units at the beginning of the COVID-19 pandemic). (2) Growth calculated based on the midpoint of each respective outlook range.

9View entire presentation