PJT Partners Investment Banking Pitch Book

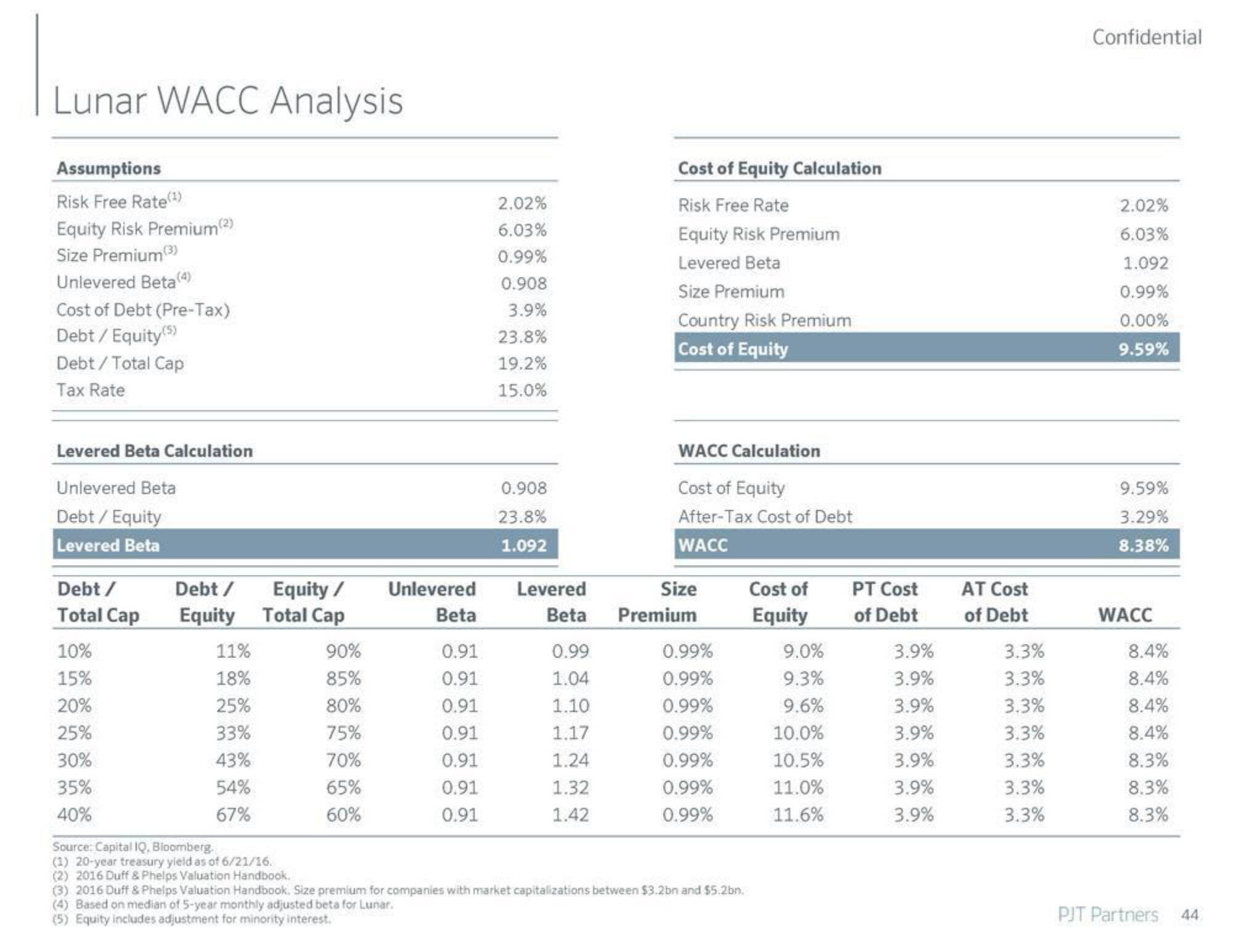

Lunar WACC Analysis

Assumptions

Risk Free Rate (¹)

Equity Risk Premium (²)

Size Premium (3)

Unlevered Beta(4)

Cost of Debt (Pre-Tax)

Debt / Equity (5)

Debt / Total Cap

Tax Rate

Levered Beta Calculation

Unlevered Beta

Debt / Equity

Levered Beta

Debt /

Total Cap

10%

15%

20%

25%

30%

35%

40%

Debt /

Equity

11%

18%

25%

33%

43%

54%

67%

Equity /

Total Cap

90%

85%

80%

75%

70%

65%

60%

Unlevered

Beta

0.91

0.91

0.91

0.91

0.91

0.91

0.91

2.02%

6.03%

0.99%

0.908

3.9%

23.8%

19.2%

15.0%

0.908

23.8%

1.092

Levered

Cost of Equity Calculation

Risk Free Rate

Equity Risk Premium

Levered Beta

Size Premium

Country Risk Premium

Cost of Equity

0.99

1.04

1.10

1.17

1.24

1.32

1.42

WACC Calculation

Cost of Equity

After-Tax Cost of Debt

WACC

Size

Beta Premium

0.99%

0.99%

0.99%

0.99%

0.99%

0.99%

0.99%

Source: Capital IQ. Bloomberg.

(1) 20-year treasury yield as of 6/21/16.

(2) 2016 Duff & Phelps Valuation Handbook.

(3) 2016 Duff & Phelps Valuation Handbook. Size premium for companies with market capitalizations between $3.2bn and $5.2bn.

(4) Based on median of 5-year monthly adjusted beta for Lunar.

(5) Equity includes adjustment for minority interest.

Cost of

Equity

9.0%

9.3%

9.6%

10.0%

10.5%

11.0%

11.6%

PT Cost

of Debt

3.9%

3.9%

3.9%

3.9%

3.9%

3.9%

3.9%

AT Cost

of Debt

3.3%

3.3%

3.3%

3.3%

3.3%

3.3%

3.3%

Confidential

2.02%

6.03%

1.092

0.99%

0.00%

9.59%

9.59%

3.29%

8.38%

WACC

8.4%

8.4%

8.4%

8.4%

8.3%

8.3%

8.3%

PJT Partners

44View entire presentation