Uber Results Presentation Deck

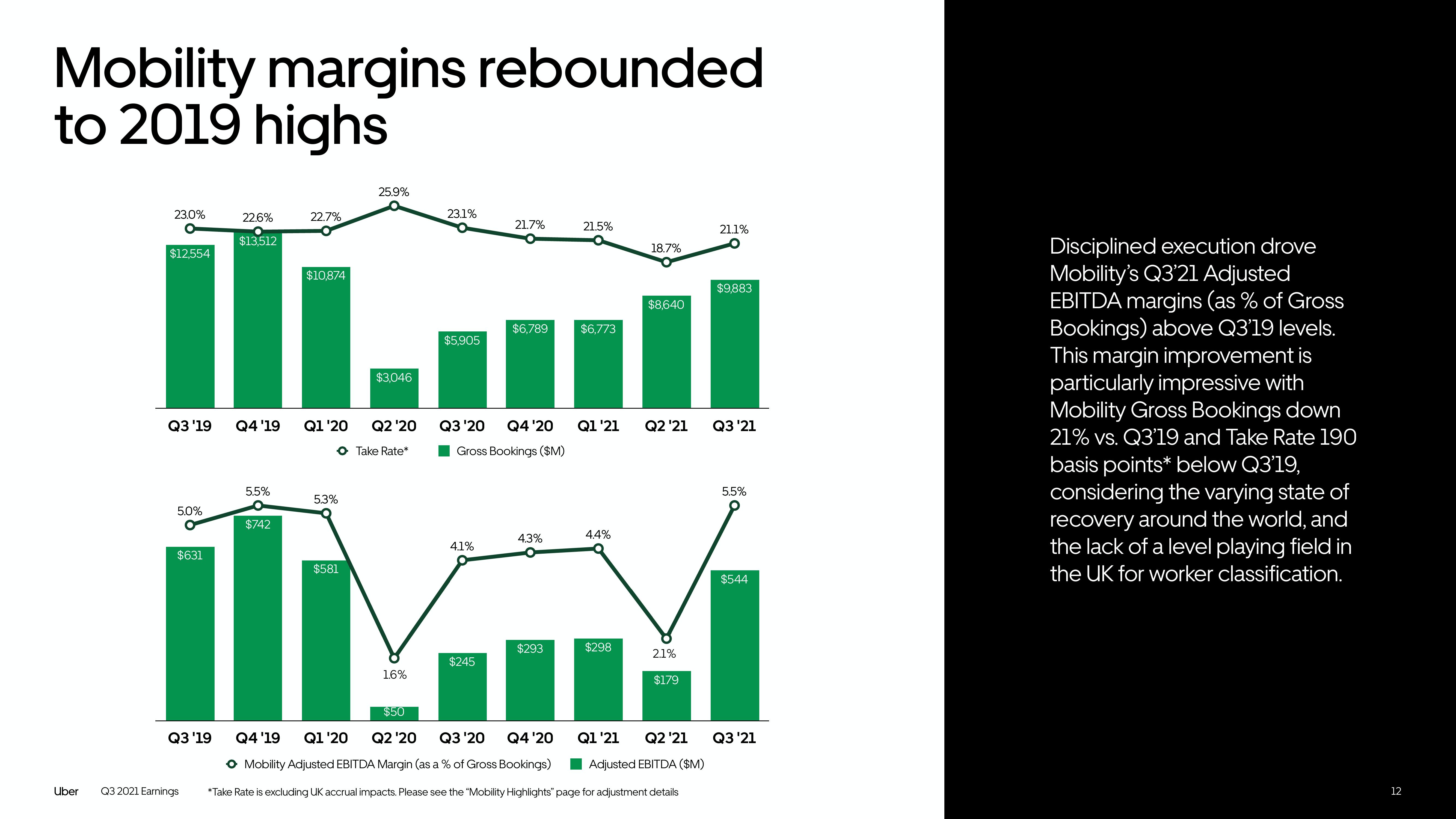

Mobility margins rebounded

to 2019 highs

Uber

23.0%

O

$12,554

Q3 '19

5.0%

$631

22.6%

$13,512

Q3 2021 Earnings

5.5%

Q4 '19 Q1 '20

$742

11

Q3 '19

22.7%

$10,874

5.3%

$581

25.9%

$3,046

Q2 '20

Take Rate*

1.6%

$50

23.1%

$5,905

21.7%

Q3 '20 Q4 '20

4.1%

$6,789

Gross Bookings ($M)

$245

4.3%

$293

21.5%

$6,773

Q1 '21

4.4%

$298

18.7%

$8,640

Q2 '21

2.1%

$179

Q4 '19 Q1 '20 Q2 '20 Q3 '20

Q4 '20

Q1 '21

O Mobility Adjusted EBITDA Margin (as a % of Gross Bookings)

Adjusted EBITDA ($M)

*Take Rate is excluding UK accrual impacts. Please see the "Mobility Highlights" page for adjustment details

21.1%

$9,883

Q3 '21

5.5%

$544

Q2 '21 Q3 '21

Disciplined execution drove

Mobility's Q3'21 Adjusted

EBITDA margins (as % of Gross

Bookings) above Q3'19 levels.

This margin improvement is

particularly impressive with

Mobility Gross Bookings down

21% vs. Q3'19 and Take Rate 190

basis points* below Q3'19,

considering the varying state of

recovery around the world, and

the lack of a level playing field in

the UK for worker classification.

12View entire presentation