Bird Investor Presentation Deck

Strong Q2 financial results

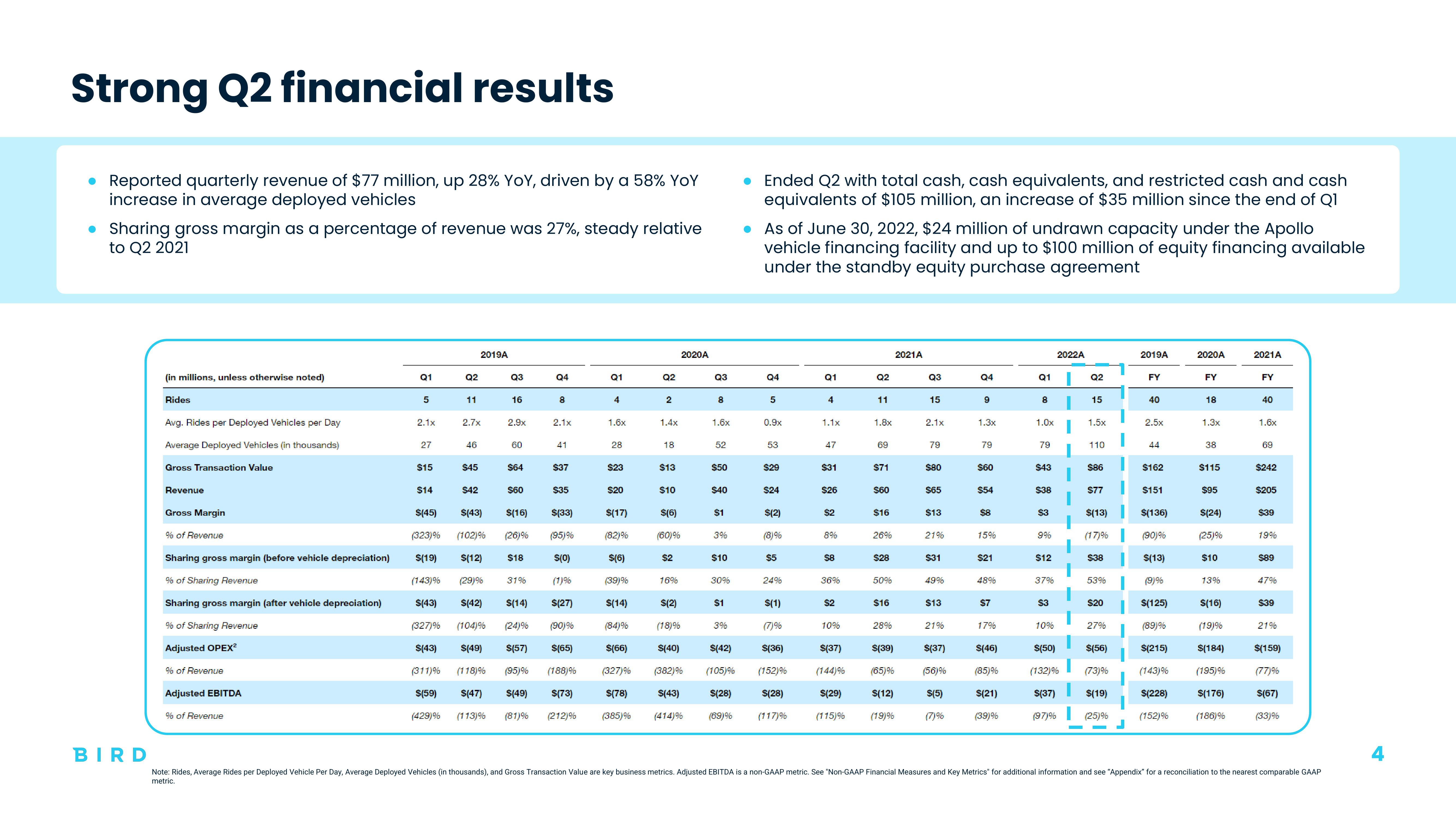

• Reported quarterly revenue of $77 million, up 28% YOY, driven by a 58% YoY

increase in average deployed vehicles

• Sharing gross margin as a percentage of revenue was 27%, steady relative

to Q2 2021

BIRD

(in millions, unless otherwise noted)

Rides

Avg. Rides per Deployed Vehicles per Day

Average Deployed Vehicles (in thousands)

Gross Transaction Value

Revenue

Gross Margin

% of Revenue

Sharing gross margin (before vehicle depreciation)

% of Sharing Revenue

Sharing gross margin (after vehicle depreciation)

% of Sharing Revenue

Adjusted OPEX²

% of Revenue

Adjusted EBITDA

% of Revenue

Q1

5

2.1x

27

$15

$14

Q2

11

2.7x

46

$45

2019A

$42

Q3

16

2.9x

60

$64

$60

$(45) $(43)

(323)%

S(19) $(12)

(143)%

(29)%

S(43) $(42) $(14)

(327)%

(104)% (24)%

S(43) $(49) $(57)

(311)% (118)% (95)%

$(59)

S(47) $(49)

(429)% (113)% (81)%

$(16)

(102)% (26)%

$18

31%

04

8

2.1x

41

$37

$35

$(33)

(95)%

$(0)

(1)%

$(27)

(90)%

$(65)

(188)%

$(73)

(212)%

Q1

4

1.6x

28

$23

$20

92

2

1.4x

18

$13

$10

$(6)

(60)%

$(17)

(82)%

$(6)

(39)%

$(14)

$(2)

(84)%

(18)%

$(66)

$(40)

(327)%

(382)%

$(78) $(43)

(385)% (414)%

$2

2020A

16%

Q3

8

1.6x

52

$50

$40

$1

3%

$10

30%

$1

3%

$(42)

(105)%

$(28)

(69)%

● Ended Q2 with total cash, cash equivalents, and restricted cash and cash

equivalents of $105 million, an increase of $35 million since the end of Q1

● As of June 30, 2022, $24 million of undrawn capacity under the Apollo

vehicle financing facility and up to $100 million of equity financing available

under the standby equity purchase agreement

Q4

5

0.9x

53

$29

$24

$(2)

(8)%

$5

24%

$(1)

(7)%

S(36)

(152)%

$(28)

(117)%

Q1

4

1.1x

47

$31

$26

$2

8%

S8

36%

$2

10%

$(37)

(144)%

$(29)

(115)%

Q2

11

1.8x

69

$71

$60

$16

26%

$28

50%

$16

28%

$(39)

(65)%

S(12)

(19)%

2021A

Q3

15

2.1x

79

$80

$65

$13

21%

$31

49%

$13

21%

$(37)

(56)%

S(5)

(7)%

Q4

9

1.3x

79

$60

$54

$8

15%

$21

%687

$7

17%

$(46)

(85)%

$(21)

(39)%

Q1

8

1.0x

79

$43

$38

$3

9%

$12

37%

$3

10%

2022A

Q2

15

1.5x

110

$86

$77

$(13)

(17)%

$38

53%

$20

27%

$(50)

$(56)

(132)% (73)%

$(19)

$(37)

(97)%

(25)%

2019A

FY

40

2.5x

44

$162

$151

$(136)

(90)%

$(13)

(9)%

$(125)

(89)%

$(215)

(143)%

$(228)

(152)%

2020A

FY

18

1.3x

38

$115

$95

$(24)

(25)%

$10

13%

S(16)

(19)%

$(184)

(195)%

$(176)

(186)%

2021A

FY

40

1.6x

69

$242

$205

$39

19%

$89

47%

$39

21%

$(159)

(77)%

S(67)

(33)%

Note: Rides, Average Rides per Deployed Vehicle Per Day, Average Deployed Vehicles (in thousands), and Gross Transaction Value are key business metrics. Adjusted EBITDA is a non-GAAP metric. See "Non-GAAP Financial Measures and Key Metrics" for additional information and see "Appendix" for a reconciliation to the nearest comparable GAAP

metric.View entire presentation