Credit Suisse Results Presentation Deck

CET1 ratio of 14.1%

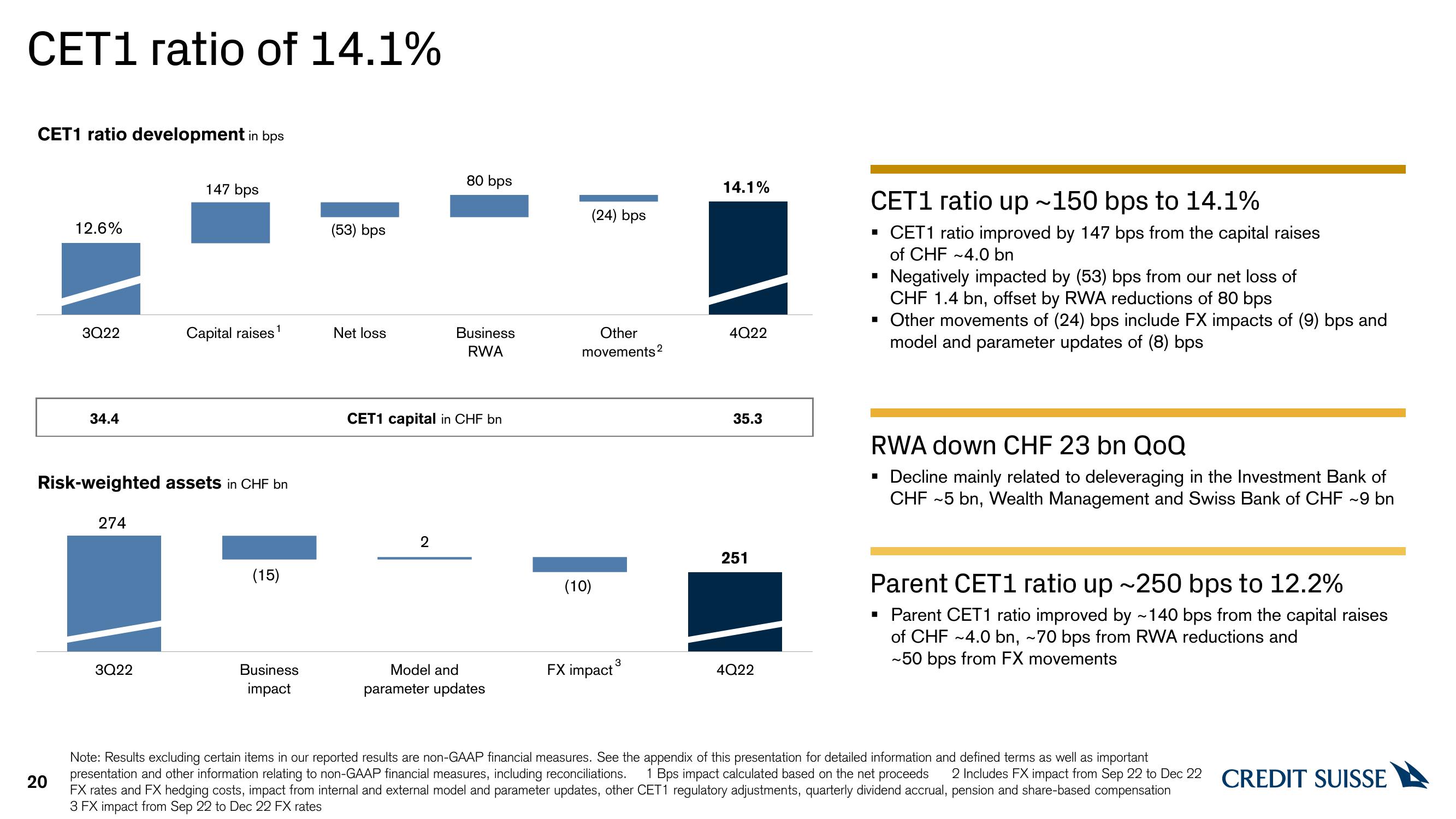

CET1 ratio development in bps

12.6%

20

3Q22

34.4

Risk-weighted assets in CHF bn

274

147 bps

3Q22

Capital raises ¹

1

(15)

Business

impact

(53) bps

Net loss

80 bps

2

Business

RWA

CET1 capital in CHF bn

Model and

parameter updates

(24) bps

Other

movements ²

(10)

FX impact ³

14.1%

4Q22

35.3

251

4Q22

CET1 ratio up ~150 bps to 14.1%

▪ CET1 ratio improved by 147 bps from the capital raises

of CHF -4.0 bn

Negatively impacted by (53) bps from our net loss of

CHF 1.4 bn, offset by RWA reductions of 80 bps

▪ Other movements of (24) bps include FX impacts of (9) bps and

model and parameter updates of (8) bps

RWA down CHF 23 bn QoQ

▪ Decline mainly related to deleveraging in the Investment Bank of

CHF -5 bn, Wealth Management and Swiss Bank of CHF ~9 bn

Parent CET1 ratio up ~250 bps to 12.2%

▪ Parent CET1 ratio improved by ~140 bps from the capital raises

of CHF ~4.0 bn, ~70 bps from RWA reductions and

~50 bps from FX movements

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Bps impact calculated based on the net proceeds

FX rates and FX hedging costs, impact from internal and external model and parameter updates, other CET1 regulatory adjustments, quarterly dividend accrual, pension and share-based compensation

3 FX impact from Sep 22 to Dec 22 FX rates

2 Includes FX impact from Sep 22 to Dec 22 CREDIT SUISSEView entire presentation