J.P.Morgan Results Presentation Deck

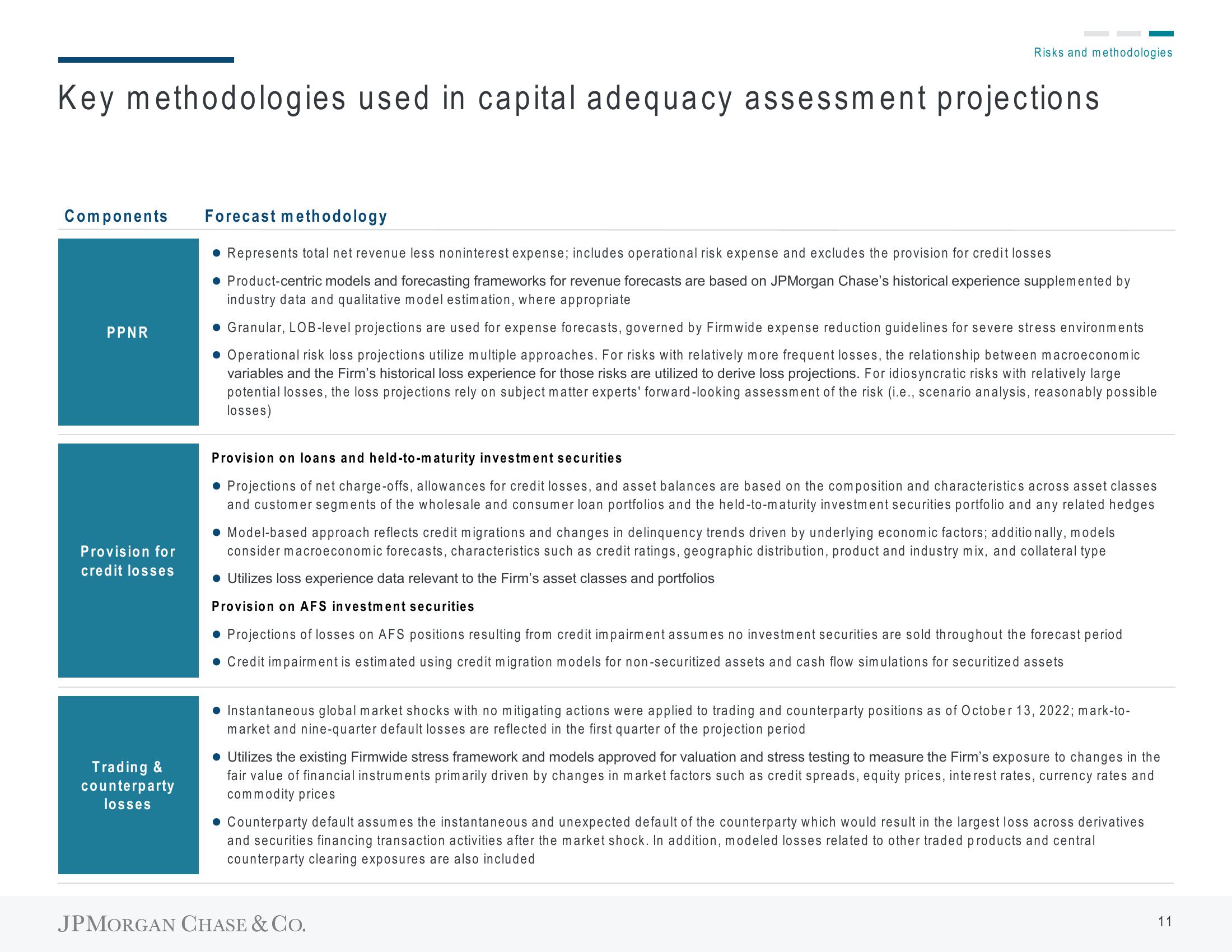

Key methodologies used in capital adequacy assessment projections

Components Forecast methodology

PPNR

Provision for

credit losses

Trading &

counterparty

losses

Risks and methodologies

• Represents total net revenue less noninterest expense; includes operational risk expense and excludes the provision for credit losses

• Product-centric models and forecasting frameworks for revenue forecasts are based on JPMorgan Chase's historical experience supplemented by

industry data and qualitative model estimation, where appropriate

Granular, LOB-level projections are used for expense forecasts, governed by Firm wide expense reduction guidelines for severe stress environments

Operational risk loss projections utilize multiple approaches. For risks with relatively more frequent losses, the relationship between macroeconomic

variables and the Firm's historical loss experience for those risks are utilized to derive loss projections. For idiosyncratic risks with relatively large

potential losses, the loss projections rely on subject matter experts' forward-looking assessment of the risk (i.e., scenario analysis, reasonably possible

losses)

Provision on loans and held-to-maturity investment securities

• Projections of net charge-offs, allowances for credit losses, and asset balances are based on the composition and characteristics across asset classes

and customer segments of the wholesale and consumer loan portfolios and the held-to-maturity investment securities portfolio and any related hedges

• Model-based approach reflects credit migrations and changes in delinquency trends driven by underlying economic factors; additionally, models

consider macroeconomic forecasts, characteristics such as credit ratings, geographic distribution, product and industry mix, and collateral type

• Utilizes loss experience data relevant to the Firm's asset classes and portfolios

Provision on AFS investment securities

● Projections of losses on AFS positions resulting from credit impairment assumes no investment securities are sold throughout the forecast period

● Credit impairment is estimated using credit migration models for non-securitized assets and cash flow simulations for securitized assets

• Instantaneous global market shocks with no mitigating actions were applied to trading and counterparty positions as of October 13, 2022; mark-to-

market and nine-quarter default losses are reflected in the first quarter of the projection period

• Utilizes the existing Firmwide stress framework and models approved for valuation and stress testing to measure the Firm's exposure to changes in the

fair value of financial instruments primarily driven by changes in market factors such as credit spreads, equity prices, interest rates, currency rates and

commodity prices

. Counterparty default assumes the instantaneous and unexpected default of the counterparty which would result in the largest loss across derivatives

and securities financing transaction activities after the market shock. In addition, modeled losses related to other traded products and central

counterparty clearing exposures are also included

JPMORGAN CHASE & CO.

11View entire presentation