OpenText Investor Presentation Deck

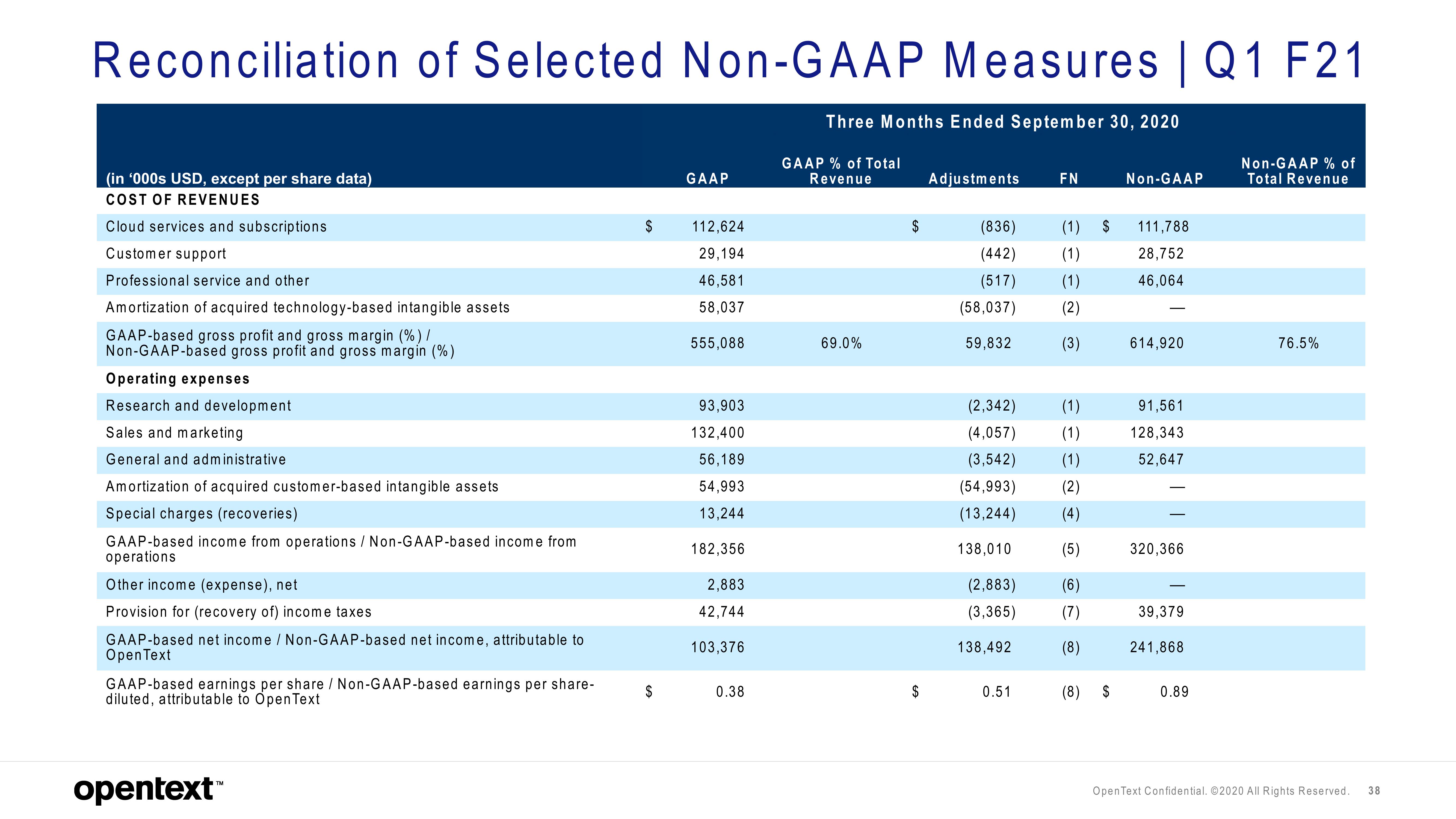

Reconciliation of Selected Non-GAAP Measures | Q1 F21

Three Months Ended September 30, 2020

(in '000s USD, except per share data)

COST OF REVENUES

Cloud services and subscriptions

Customer support

Professional service and other

Amortization of acquired technology-based intangible assets

GAAP-based gross profit and gross margin (%)/

Non-GAAP-based gross profit and gross margin (%)

Operating expenses

Research and development

Sales and marketing

General and administrative

Amortization of acquired customer-based intangible assets

Special charges (recoveries)

GAAP-based income from operations / Non-GAAP-based income from

operations

Other income (expense), net

Provision for (recovery of) income taxes

GAAP-based net income / Non-GAAP-based net income, attributable to

Open Text

GAAP-based earnings per share / Non-GAAP-based earnings per share-

diluted, attributable to Open Text

opentext™

$

$

GAAP

112,624

29,194

46,581

58,037

555,088

93,903

132,400

56,189

54,993

13,244

182,356

2,883

42,744

103,376

0.38

GAAP % of Total

Revenue

69.0%

$

$

Adjustments

(836)

(442)

(517)

(58,037)

59,832

(2,342)

(4,057)

(3,542)

(54,993)

(13,244)

138,010

(2,883)

(3,365)

138,492

0.51

FN

(1)

(1)

(1)

(2)

(3)

(1)

(1)

(1)

(2)

(4)

(5)

(6)

(7)

(8)

$

(8) $

Non-GAAP

111,788

28,752

46,064

614,920

91,561

128,343

52,647

320,366

39,379

241,868

0.89

Non-GAAP % of

Total Revenue

76.5%

Open Text Confidential. ©2020 All Rights Reserved. 38View entire presentation