Maersk Investor Presentation Deck

Key statements

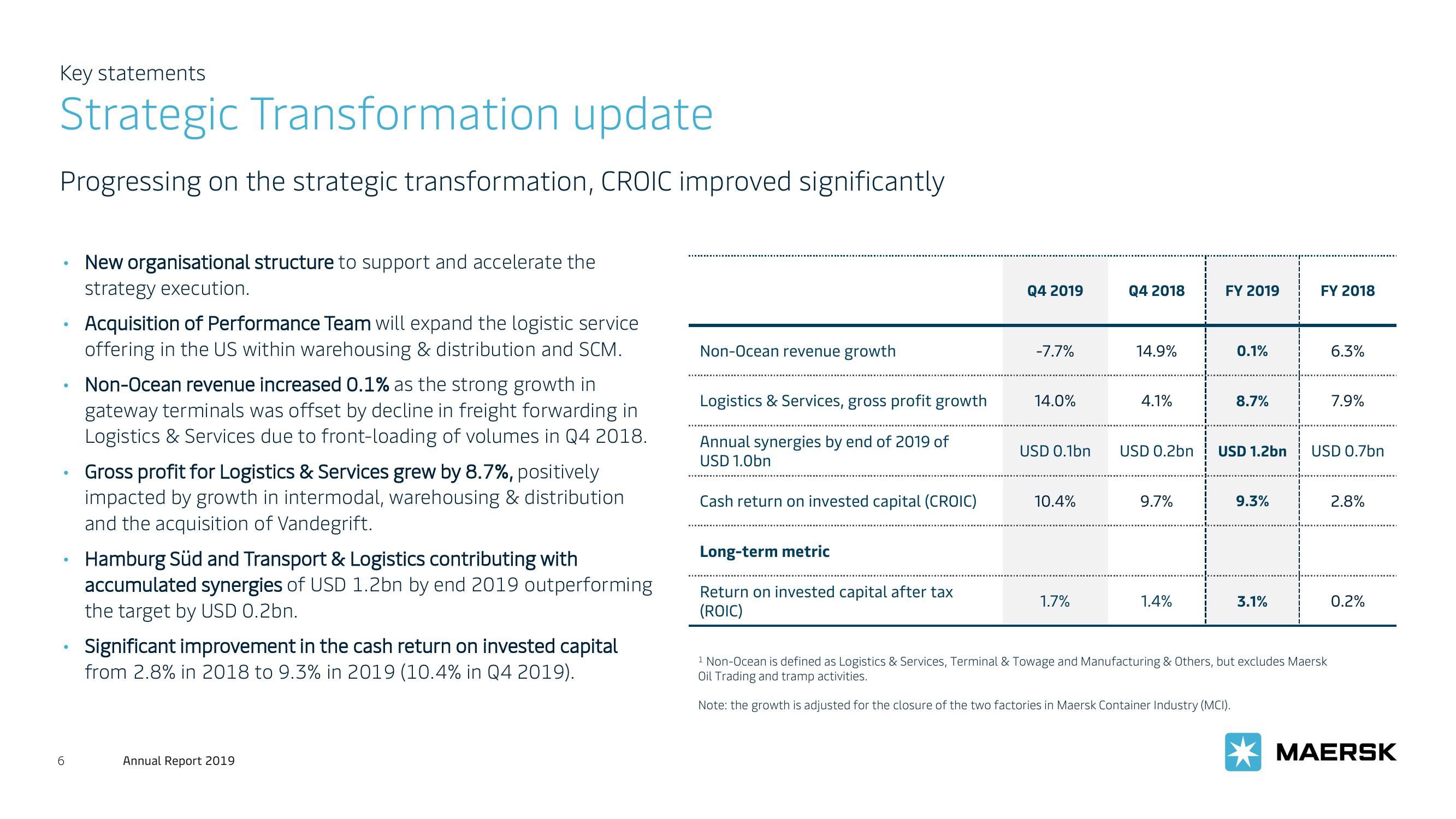

Strategic Transformation update

Progressing on the strategic transformation, CROIC improved significantly

●

●

●

●

6

New organisational structure to support and accelerate the

strategy execution.

Acquisition of Performance Team will expand the logistic service

offering in the US within warehousing & distribution and SCM.

Non-Ocean revenue increased 0.1% as the strong growth in

gateway terminals was offset by decline in freight forwarding in

Logistics & Services due to front-loading of volumes in Q4 2018.

Gross profit for Logistics & Services grew by 8.7%, positively

impacted by growth in intermodal, warehousing & distribution

and the acquisition of Vandegrift.

Hamburg Süd and Transport & Logistics contributing with

accumulated synergies of USD 1.2bn by end 2019 outperforming

the target by USD 0.2bn.

Significant improvement in the cash return on invested capital

from 2.8% in 2018 to 9.3% in 2019 (10.4% in Q4 2019).

Annual Report 2019

Non-Ocean revenue growth

Logistics & Services, gross profit growth

Annual synergies by end of 2019 of

USD 1.0bn

Cash return on invested capital (CROIC)

Long-term metric

Return on invested capital after tax

(ROIC)

Q4 2019

-7.7%

14.0%

USD 0.1bn

10.4%

1.7%

Q4 2018

14.9%

4.1%

USD 0.2bn

9.7%

1.4%

FY 2019

0.1%

8.7%

USD 1.2bn

9.3%

3.1%

FY 2018

6.3%

¹ Non-Ocean is defined as Logistics & Services, Terminal & Towage and Manufacturing & Others, but excludes Maersk

Oil Trading and tramp activities.

Note: the growth is adjusted for the closure of the two factories in Maersk Container Industry (MCI).

7.9%

USD 0.7bn

2.8%

0.2%

MAERSKView entire presentation