Baird Investment Banking Pitch Book

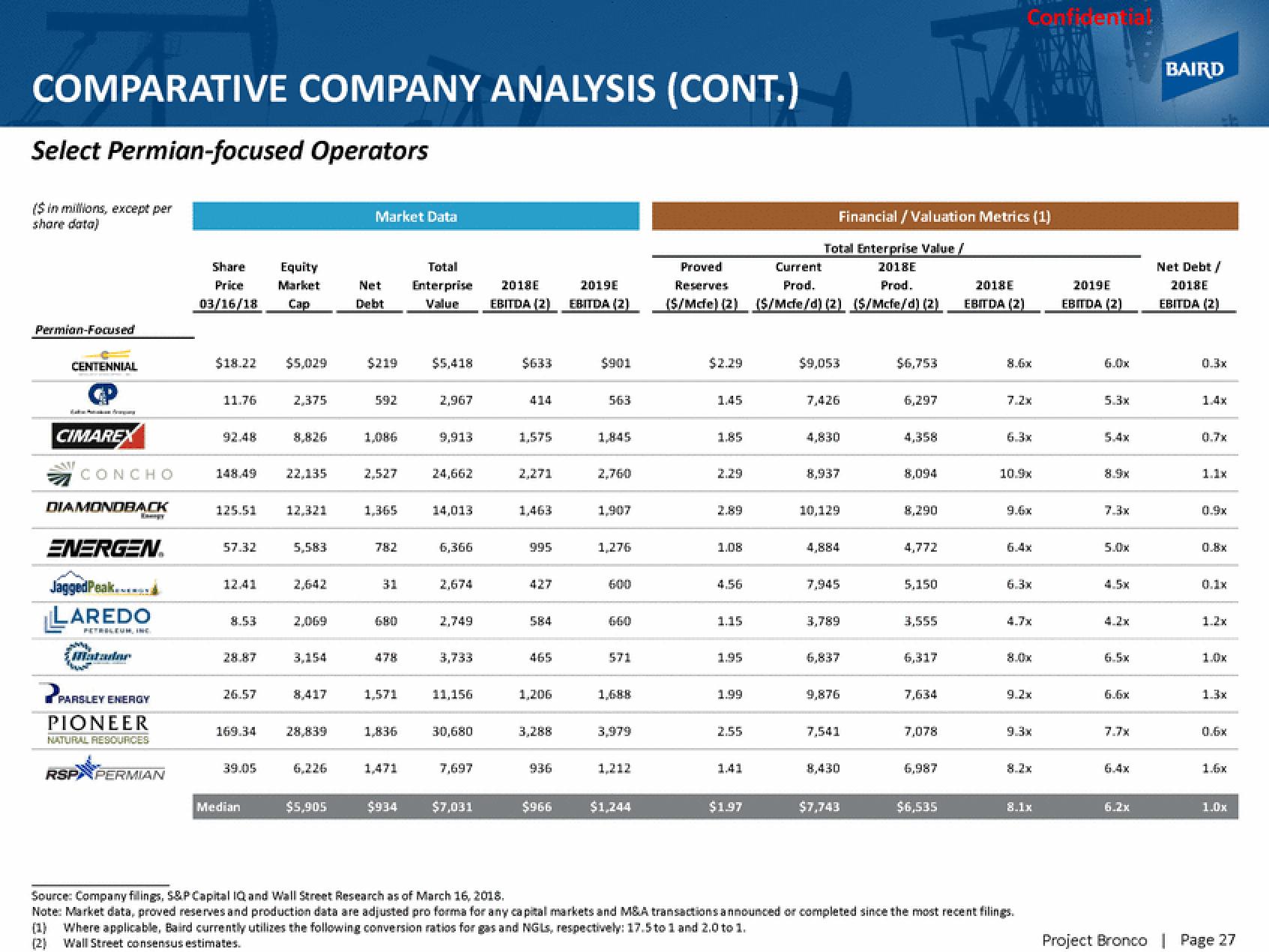

COMPARATIVE COMPANY ANALYSIS (CONT.)

Select Permian-focused Operators

($ in millions, except per

share data)

Permion-Focused

CENTENNIAL

Haku: Ponakan sema

CIMAREX

CONCHO

DIAMONDBACK

ENERGEN.

JaggedPeak....nd

LAREDO

PETROLEUM, INC

Makadan

"Ben

PARSLEY ENERGY

PIONEER

NATURAL RESOURCES

RSPAPERMIAN

Share

Price

03/16/18

$18.22 $5,029

11.76

92.48

148.49

125.51

57.32

12.41

8.53

28.87

26.57

Equity

Market

Cap

39.05

Median

2,375

8,826

22.135

12,321

5,583

2,069

3.154

169.34 28,839

8,417

6,226

$5,905

Market Data

Total

Net Enterprise 2018E

Debt

Value

EBITDA (2)

$219

592

1,086

2.527

1,365

782

31

680

478

1,571

1,836

1,471

$934

$5,418

2,967

9,913

24,662

14,013

6,366

2,674

2,749

3,733

11,156

30,680

7,697

$7,031

$633

1.575

2,271

1,463

995

584

465

1,206

3,288

936

$966

2019E

EBITDA (2)

$901

563

1,845

2,760

1,907

1,276

600

571

1,688

3,979

1,212

$1,244

Financial / Valuation Metrics (1)

Total Enterprise Value /

Proved

Current

2018E

Prod.

Reserves

Prod.

(S/Mcfe) (2) (S/Mcfe/d) (2) (S/Mcfe/d) (2)

$2.29

1.45

2.89

1.08

4.56

1.15

1.95

1.99

2.55

1.41

$1.97

$9,053

7,426

4,830

8.937

10,129

4,884

7,945

3,789

6,837

9,876

7,541

8,430

$7,743

$6,753

6,297

4,358

8,094

4,772

5,150

3,555

6,317

7,634

7,078

6,987

$6,535

2018E

EBITDA (2)

Confidential

6.3x

10.9x

6.4x

6.3x

4.7x

8.0x

9.2x

9.3x

8.1x

Source: Company fillings, S&P Capital IQ and Wall Street Research as of March 16, 2018.

Note: Market data, proved reserves and production data are adjusted pro forma for any capital markets and M&A transactions announced or completed since the most recent filings.

(1) Where applicable, Baird currently utilizes the following conversion ratios for gas and NGLs, respectively: 17.5 to 1 and 2.0 to 1.

(2) Wall Street consensus estimates.

2019E

EBITDA (2)

6.0x

5.3x

5.4x

7.3x

5.0x

4.5x

6.5x

6.6x

7.7x

6.2x

BAIRD

Net Debt/

2018E

EBITDA (2)

0.3x

1.1x

1.2x

1.0x

1.3x

0.6x

1.6x

1.0x

Project Bronco | Page 27View entire presentation