Kinnevik Results Presentation Deck

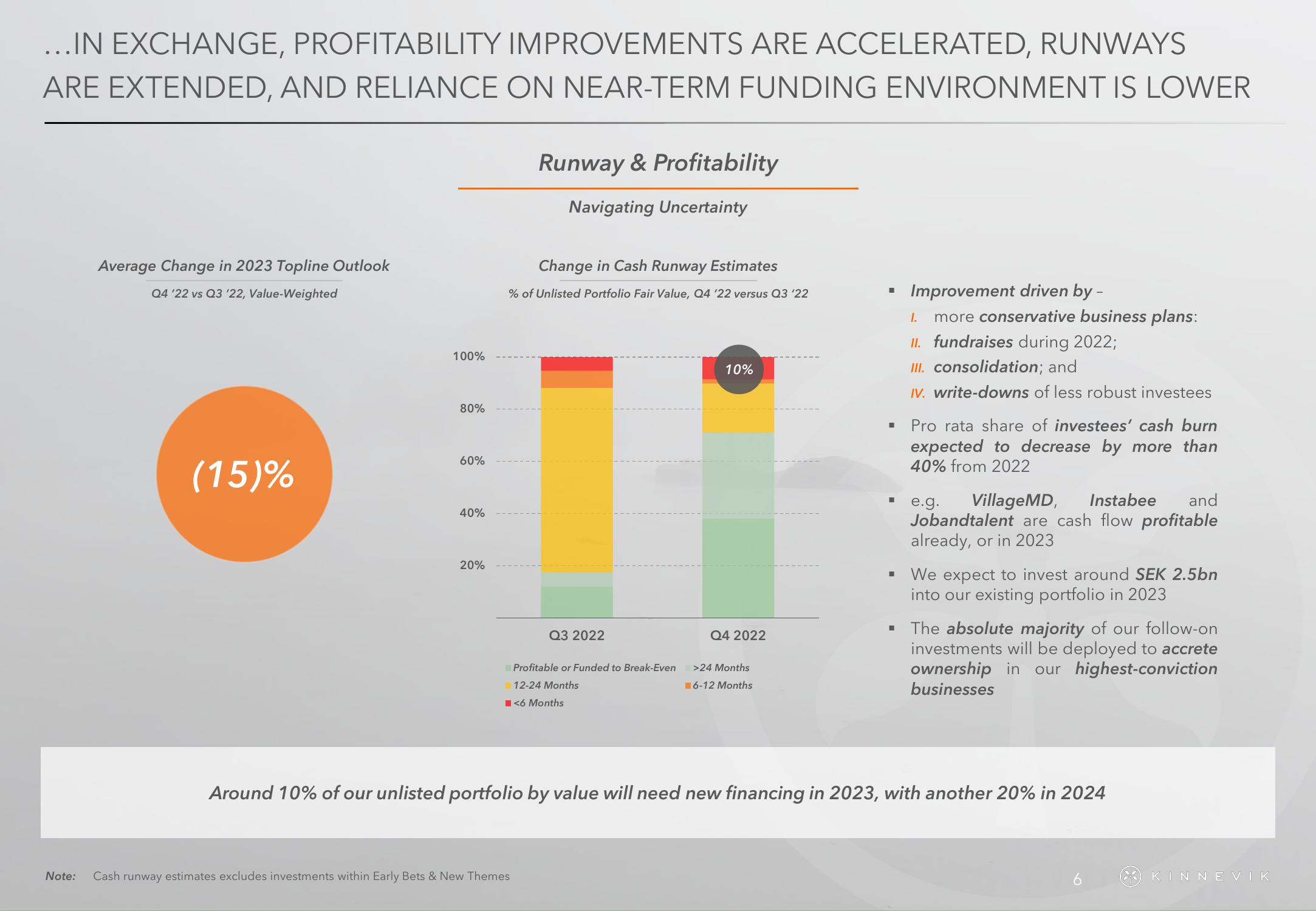

...IN EXCHANGE, PROFITABILITY IMPROVEMENTS ARE ACCELERATED, RUNWAYS

ARE EXTENDED, AND RELIANCE ON NEAR-TERM FUNDING ENVIRONMENT IS LOWER

Note:

Average Change in 2023 Topline Outlook

Q4 '22 vs Q3 '22, Value-Weighted

(15)%

100%

80%

60%

40%

20%

Runway & Profitability

Navigating Uncertainty

Change in Cash Runway Estimates

% of Unlisted Portfolio Fair Value, Q4 '22 versus Q3 '22

Q3 2022

Profitable or Funded to Break-Even

12-24 Months

■<6 Months

Cash runway estimates excludes investments within Early Bets & New Themes

10%

Q4 2022

>24 Months

6-12 Months

I

I

Improvement driven by -

1. more conservative business plans:

II. fundraises during 2022;

III. consolidation; and

IV. write-downs of less robust investees

Pro rata share of investees' cash burn

expected to decrease by more than

40% from 2022

e.g. Village MD, Instabee and

Jobandtalent are cash flow profitable

already, or in 2023

We expect to invest around SEK 2.5bn

into our existing portfolio in 2023

▪ The absolute majority of our follow-on

investments will be deployed to accrete

ownership in our highest-conviction

businesses

Around 10% of our unlisted portfolio by value will need new financing in 2023, with another 20% in 2024

6

KINNEVIKView entire presentation