jetBlue Mergers and Acquisitions Presentation Deck

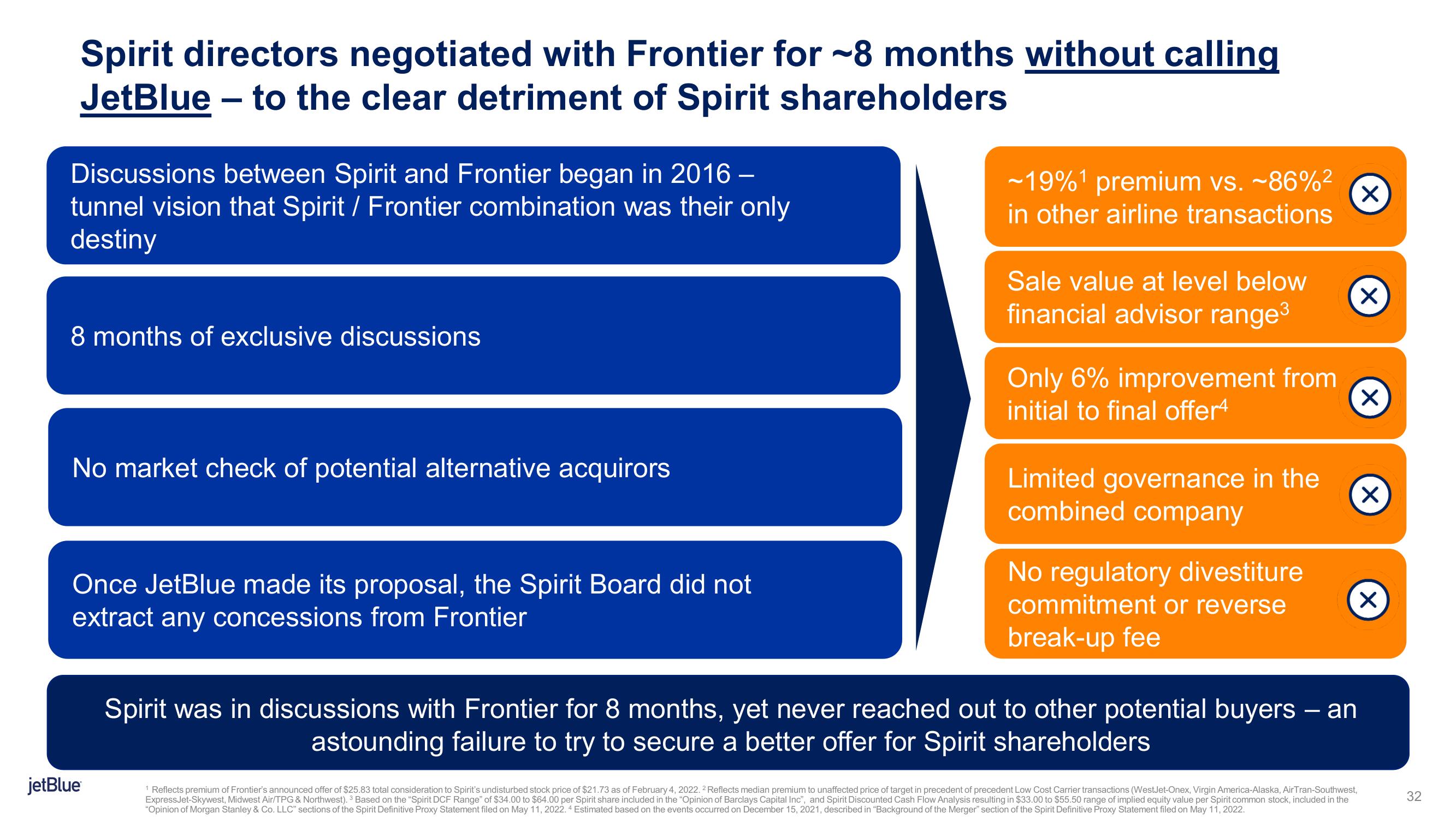

Spirit directors negotiated with Frontier for ~8 months without calling

JetBlue - to the clear detriment of Spirit shareholders

Discussions between Spirit and Frontier began in 2016 -

tunnel vision that Spirit/ Frontier combination was their only

destiny

8 months of exclusive discussions

No market check of potential alternative acquirors

Once JetBlue made its proposal, the Spirit Board did not

extract any concessions from Frontier

jetBlue

~19%¹ premium vs. ~86%² X

in other airline transactions

Sale value at level below

financial advisor range³

Only 6% improvement from

initial to final offer4

Limited governance in the

combined company

No regulatory divestiture

commitment or reverse

break-up fee

Spirit was in discussions with Frontier for 8 months, yet never reached out to other potential buyers - an

astounding failure to try to secure a better offer for Spirit shareholders

1 Reflects premium of Frontier's announced offer of $25.83 total consideration to Spirit's undisturbed stock price of $21.73 as of February 4, 2022. 2 Reflects median premium to unaffected price of target in precedent of precedent Low Cost Carrier transactions (WestJet-Onex, Virgin America-Alaska, AirTran-Southwest,

ExpressJet-Skywest, Midwest Air/TPG & Northwest). ³ Based on the "Spirit DCF Range" of $34.00 to $64.00 per Spirit share included in the "Opinion of Barclays Capital Inc", and Spirit Discounted Cash Flow Analysis resulting in $33.00 to $55.50 range of implied equity value per Spirit common stock, included in the

"Opinion of Morgan Stanley & Co. LLC" sections of the Spirit Definitive Proxy Statement filed on May 11, 2022. 4 Estimated based on the events occurred on December 15, 2021, described in "Background of the Merger" section of the Spirit Definitive Proxy Statement filed on May 11, 2022.

X

X

X

X

32View entire presentation