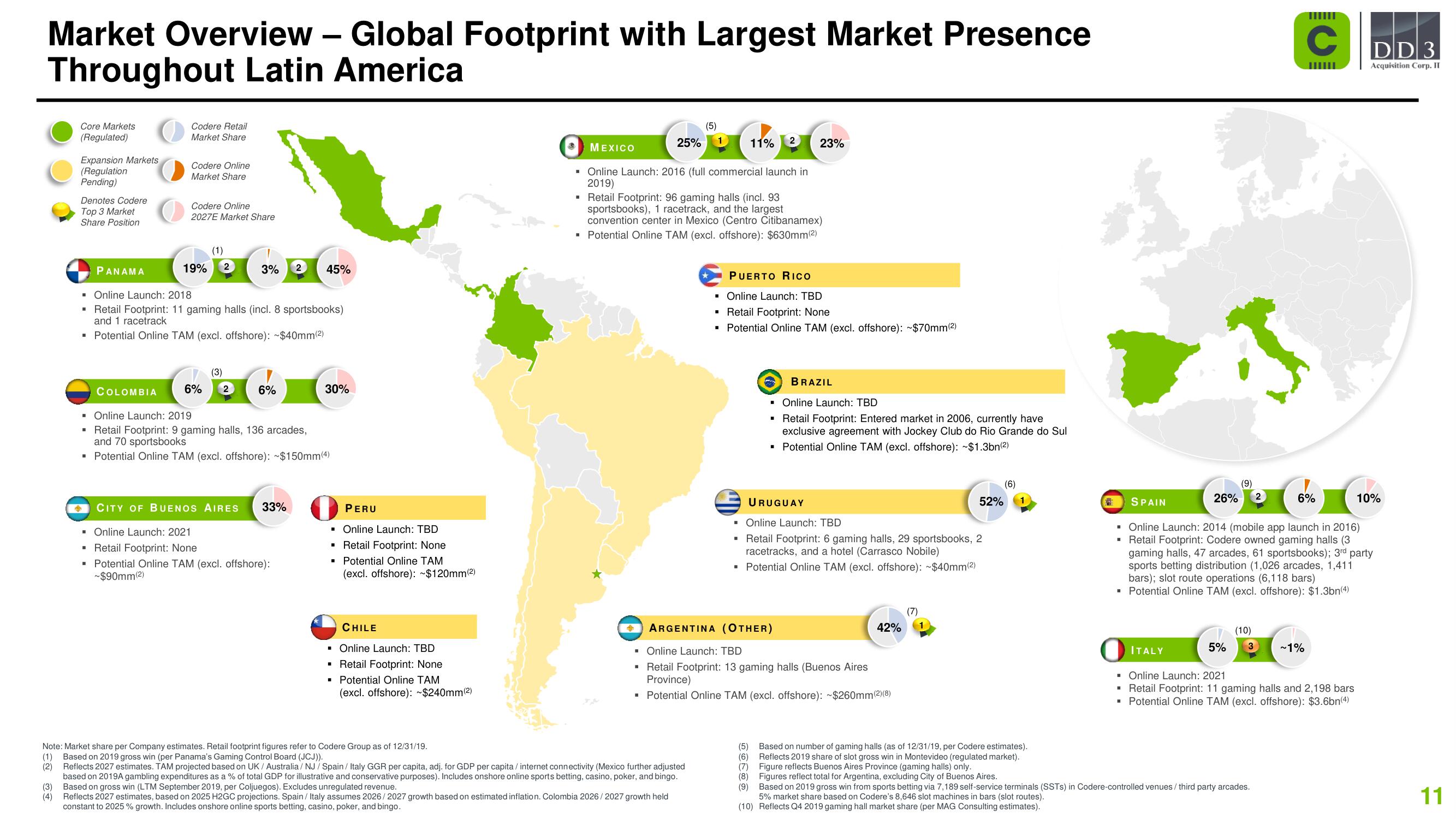

Codere SPAC Presentation Deck

Market Overview - Global Footprint with Largest Market Presence

Throughout Latin America

Core Markets

(Regulated)

(3)

(4)

Expansion Markets

(Regulation

Pending)

Denotes Codere

Top 3 Market

Share Position

ΡΑΝΑΜΑ

■

Codere Retail

Market Share

COLOMBIA

Codere Online

Market Share

Codere Online

2027E Market Share

(1)

19% 2

▪ Online Launch: 2018

▪ Retail Footprint: 11 gaming halls (incl. 8 sportsbooks)

and 1 racetrack

▪ Potential Online TAM (excl. offshore): ~$40mm(²)

3% 2

(3)

6% 2

6%

45%

Online Launch: 2019

▪ Retail Footprint: 9 gaming halls, 136 arcades,

and 70 sportsbooks

Potential Online TAM (excl. offshore): ~$150mm (4)

CITY OF BUENOS AIRES 33%

▪ Online Launch: 2021

▪ Retail Footprint: None

■ Potential Online TAM (excl. offshore):

~$90mm (2)

30%

.

-

■

PERU

Online Launch: TBD

Retail Footprint: None

Potential Online TAM

(excl. offshore): ~$120mm(2)

CHILE

▪ Online Launch: TBD

Retail Footprint: None

▪ Potential Online TAM

(excl. offshore): ~$240mm(2)

■

■

(5)

25% 1

W

MEXICO

Online Launch: 2016 (full commercial launch in

2019)

▪ Retail Footprint: 96 gaming halls (incl. 93

sportsbooks), 1 racetrack, and the largest

convention center in Mexico (Centro Citibanamex)

Potential Online TAM (excl. offshore): $630mm(2)

Note: Market share per Company estimates. Retail footprint figures refer to Codere Group as of 12/31/19.

(1) Based on 2019 gross win (per Panama's Gaming Control Board (JCJ)).

(2)

Reflects 2027 estimates. TAM projected based on UK/Australia/ NJ / Spain /Italy GGR per capita, adj. for GDP per capita / internet connectivity (Mexico further adjusted

based on 2019A gambling expenditures as a % of total GDP for illustrative and conservative purposes). Includes onshore online sports betting, casino, poker, and bingo.

Based on gross win (LTM September 2019, per Coljuegos). Excludes unregulated revenue.

Reflects 2027 estimates, based on 2025 H2GC projections. Spain/ Italy assumes 2026/2027 growth based on estimated inflation. Colombia 2026/2027 growth held

constant to 2025% growth. Includes onshore online sports betting, casino, poker, and bingo.

PUERTO RICO

▪ Online Launch: TBD

Retail Footprint: None

Potential Online TAM (excl. offshore): ~$70mm(²)

■

11% 2 23%

■

"

■ Online Launch: TBD

Retail Footprint: Entered market in 2006, currently have

exclusive agreement with Jockey Club do Rio Grande do Sul

Potential Online TAM (excl. offshore): ~$1.3bn(2)

■

(6)

(7)

(8)

■

ARGENTINA (OTHER)

BRAZIL

URUGUAY

▪ Online Launch: TBD

▪ Retail Footprint: 6 gaming halls, 29 sportsbooks, 2

racetracks, and a hotel (Carrasco Nobile)

Potential Online TAM (excl. offshore): ~$40mm(²)

Online Launch: TBD

▪ Retail Footprint: 13 gaming halls (Buenos Aires

Province)

▪ Potential Online TAM (excl. offshore): ~$260mm (2)(8)

°

42%

(6)

52%

(7)

(5) Based on number of gaming halls (as of 12/31/19, per Codere estimates).

Reflects 2019 share of slot gross win in Montevideo (regulated market).

Figure reflects Buenos Aires Province (gaming halls) only.

Figures reflect total for Argentina, excluding City of Buenos Aires.

SPAIN

26%

ITALY

(9)

5%

(10)

3

2

(9) Based on 2019 gross win from sports betting via 7,189 self-service terminals (SSTs) in Codere-controlled venues / third party arcades.

5% market share based on Codere's 8,646 slot machines in bars (slot routes).

(10) Reflects Q4 2019 gaming hall market share (per MAG Consulting estimates).

C

▪ Online Launch: 2014 (mobile app launch in 2016)

▪ Retail Footprint: Codere owned gaming halls (3

gaming halls, 47 arcades, 61 sportsbooks); 3rd party

sports betting distribution (1,026 arcades, 1,411

bars); slot route operations (6,118 bars)

▪ Potential Online TAM (excl. offshore): $1.3bn(4)

6%

~1%

▪ Online Launch: 2021

▪ Retail Footprint: 11 gaming halls and 2,198 bars

▪ Potential Online TAM (excl. offshore): $3.6bn(4)

DD 3

Acquisition Corp. II

10%

11View entire presentation