PJT Partners Investment Banking Pitch Book

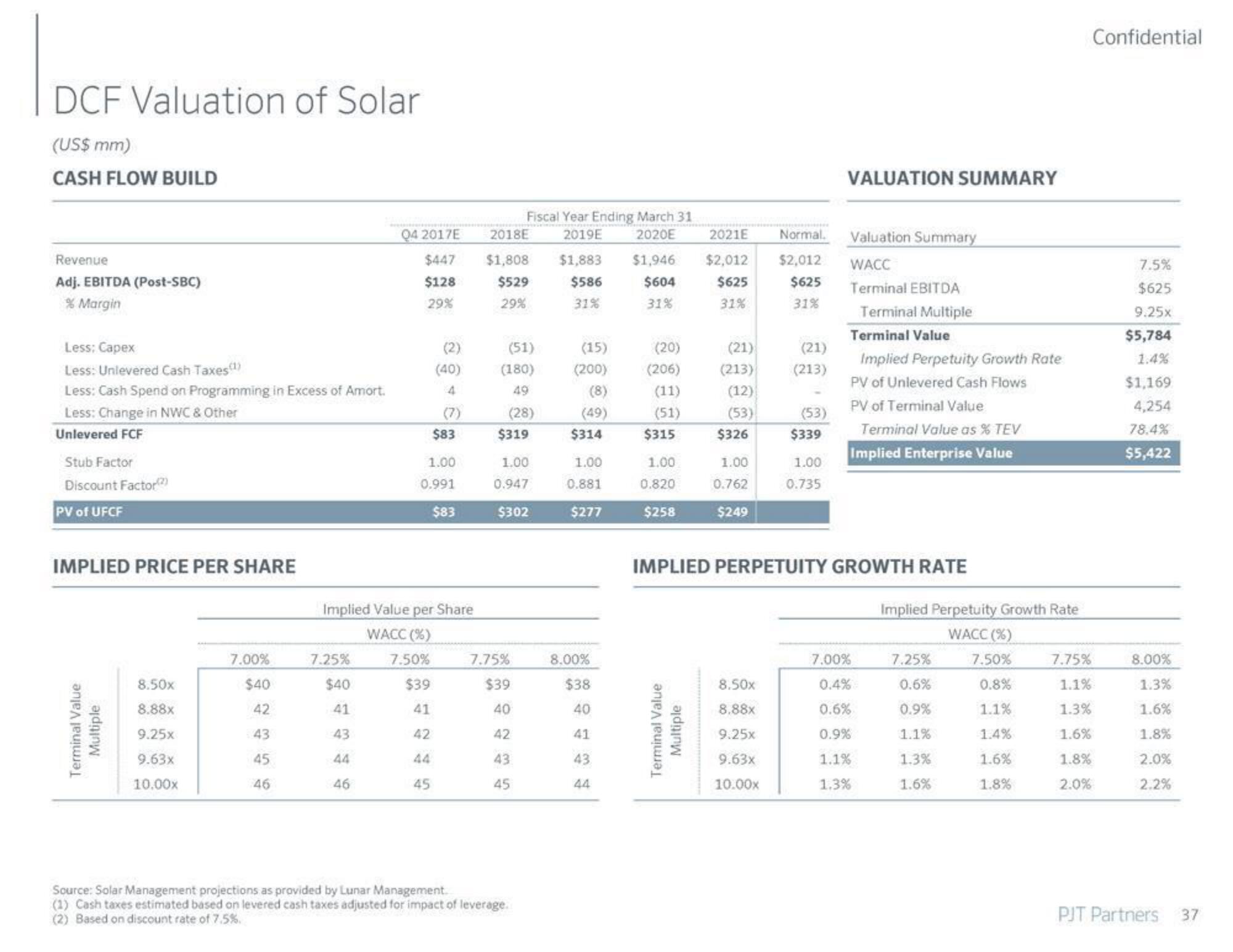

DCF Valuation of Solar

(US$ mm)

CASH FLOW BUILD

Revenue

Adj. EBITDA (Post-SBC)

% Margin

Less: Capex

Less: Unlevered Cash Taxes(¹)

Less: Cash Spend on Programming in Excess of Amort.

Less: Change in NWC & Other

Unlevered FCF

Stub Factor

Discount Factor(2)

PV of UFCF

IMPLIED PRICE PER SHARE

Terminal Value

Multiple

8.50x

8.88x

9.25x

9.63x

10.00x

7.00%

$40

42

43

45

46

04 2017E

$447

$128

29%

7.25%

$40

41

43

44

46

(2)

(40)

4

(7)

45

$83

1.00

0.991

$83

Implied Value per Share

WACC (%)

7.50%

$39

41

42

2018E

$1,808

$529

29%

Fiscal Year Ending March 31

2019E

2020E

$1,883 $1,946

$586

$604

31%

31%

(51)

(180)

49

(28)

$319

1.00

0.947

$302

7.75%

$39

40

42

43

45

Source: Solar Management projections as provided by Lunar Management.

(1) Cash taxes estimated based on levered cash taxes adjusted for impact of leverage.

(2) Based on discount rate of 7.5%.

(15)

(200)

(8)

(49)

$314

1.00

0.881

$277

8.00%

$38

40

41

43

44

(20)

(206)

(11)

(51)

$315

1.00

0.820

$258

2021E

$2,012

$625

31%

Terminal Value

Multiple

(21)

(213)

(12)

(53)

$326

1.00

0.762

$249

Normal.

$2,012

$625

31%

8.50x

8.88x

9.25x

9.63x

10.00x

(21)

(213)

(53)

$339

1.00

0.735

VALUATION SUMMARY

IMPLIED PERPETUITY GROWTH RATE

Valuation Summary

WACC

Terminal EBITDA

Terminal Multiple

Terminal Value

Implied Perpetuity Growth Rate

PV of Unlevered Cash Flows

PV of Terminal Value

Terminal Value as % TEV

Implied Enterprise Value

7.00%

0.4%

0.5%

0.9%

1.1%

1.3%

Implied Perpetuity Growth Rate

WACC (%)

7.50%

0.8%

1.1%

1.4%

1.6%

1.8%

7.25%

0.6%

0.9%

1.1%

1.3%

1.6%

7.75%

1.1%

1.3%

1.6%

1.8%

2.0%

Confidential

7.5%

$625

9.25x

$5,784

1.4%

$1,169

4,254

78.4%

$5,422

8.00%

1.3%

1.6%

1.8%

2.0%

2.2%

PJT Partners

37View entire presentation