Near SPAC Presentation Deck

Transaction Summary

●

●

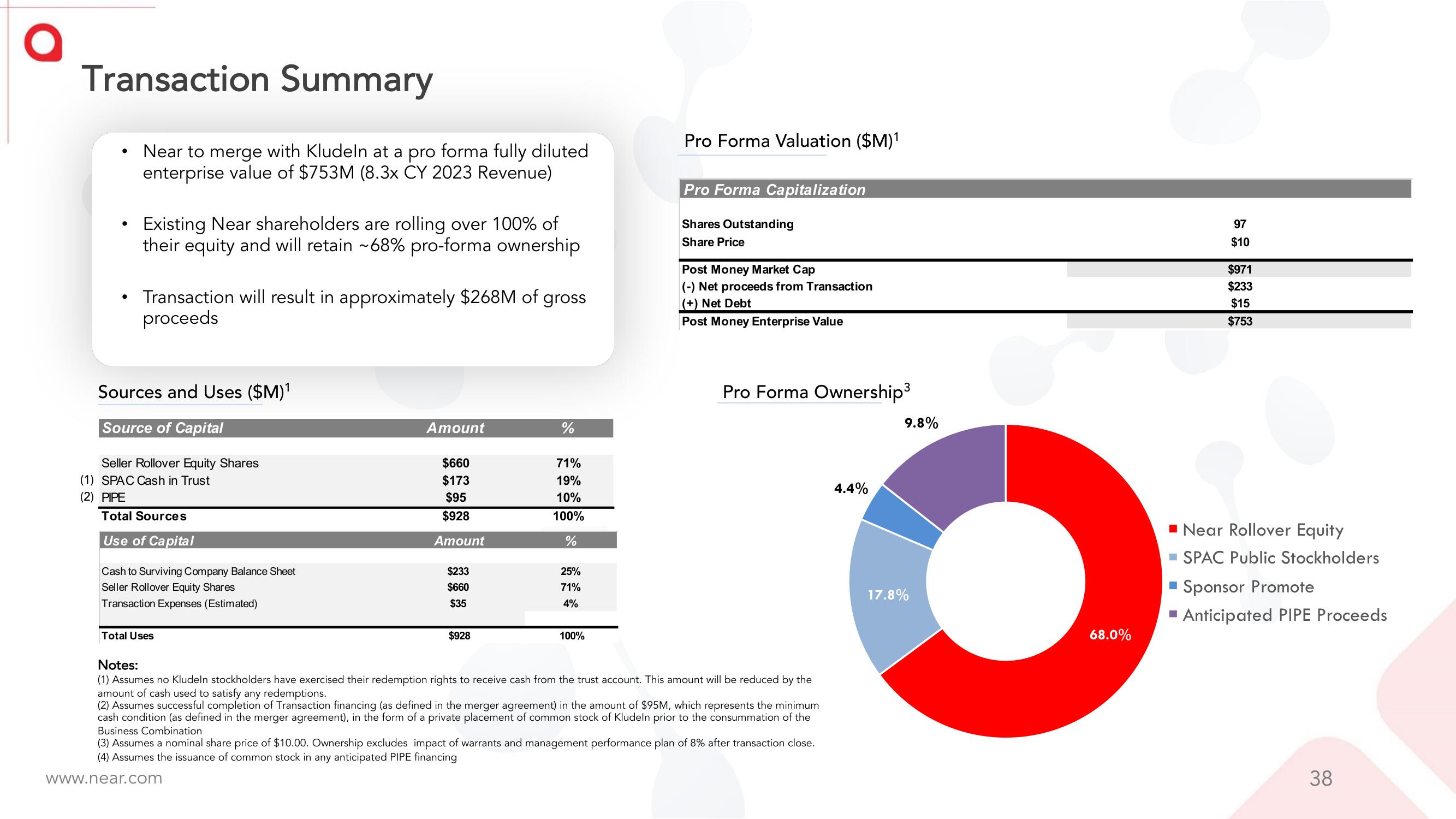

Near to merge with Kludeln at a pro forma fully diluted

enterprise value of $753M (8.3x CY 2023 Revenue)

Existing Near shareholders are rolling over 100% of

their equity and will retain ~68% pro-forma ownership

Transaction will result in approximately $268M of gross

proceeds

Sources and Uses ($M)¹

Source of Capital

Seller Rollover Equity Shares

(1) SPAC Cash in Trust

(2) PIPE

Total Sources

Use of Capital

Cash to Surviving Company Balance Sheet

Seller Rollover Equity Shares

Transaction Expenses (Estimated)

Total Uses

Amount

$660

$173

$95

$928

Amount

$233

$660

$35

$928

%

71%

19%

10%

100%

%

25%

71%

4%

100%

Pro Forma Valuation ($M)¹

Pro Forma Capitalization

Shares Outstanding

Share Price

Post Money Market Cap

(-) Net proceeds from Transaction

(+) Net Debt

Post Money Enterprise Value

Pro Forma Ownership³

Notes:

(1) Assumes no Kludeln stockholders have exercised their redemption rights to receive cash from the trust account. This amount will be reduced by the

amount of cash used to satisfy any redemptions.

(2) Assumes successful completion of Transaction financing (as defined in the merger agreement) in the amount of $95M, which represents the minimum

cash condition (as defined in the merger agreement), in the form of a private placement of common stock of Kludeln prior to the consummation of the

Business Combination

(3) Assumes a nominal share price of $10.00. Ownership excludes impact of warrants and management performance plan of 8% after transaction close.

(4) Assumes the issuance of common stock in any anticipated PIPE financing

www.near.com

4.4%

9.8%

17.8%

68.0%

97

$10

$971

$233

$15

$753

Near Rollover Equity

■ SPAC Public Stockholders

■ Sponsor Promote

▪ Anticipated PIPE Proceeds

38View entire presentation