Alternus Energy SPAC Presentation Deck

1

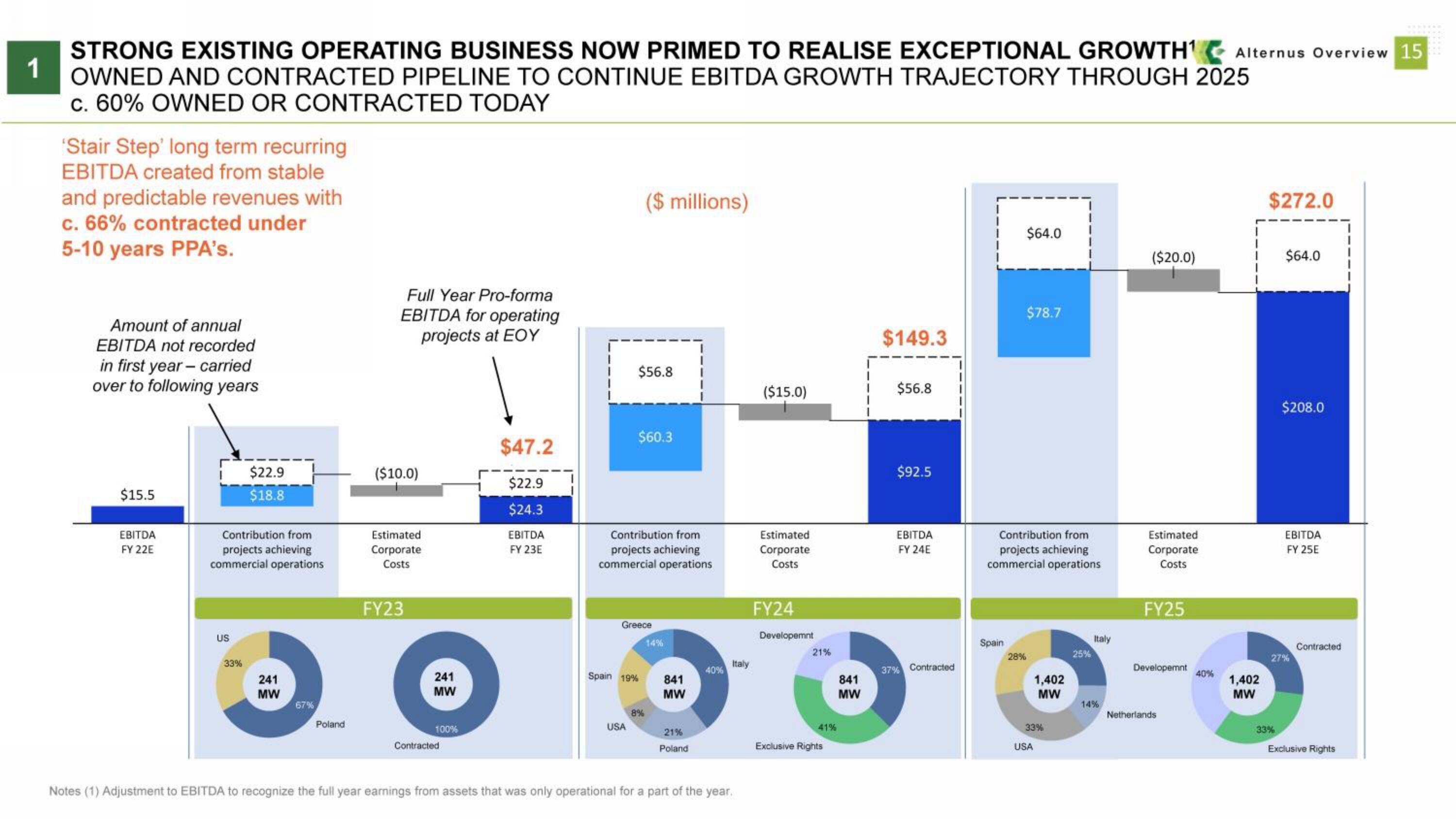

STRONG EXISTING OPERATING BUSINESS NOW PRIMED TO REALISE EXCEPTIONAL GROWTH¹ Alternus Overview 15

OWNED AND CONTRACTED PIPELINE TO CONTINUE EBITDA GROWTH TRAJECTORY THROUGH 2025

c. 60% OWNED OR CONTRACTED TODAY

'Stair Step' long term recurring

EBITDA created from stable

and predictable revenues with

c. 66% contracted under

5-10 years PPA's.

Amount of annual

EBITDA not recorded

in first year - carried

over to following years

$15.5

EBITDA

FY 22E

Contribution from

projects achieving

commercial operations

US

$22.9

$18.8

33%

241

MW

67%

Poland

Full Year Pro-forma

EBITDA for operating

projects at EOY

($10.0)

Estimated

Corporate

Costs

FY23

241

MW

100%

Contracted

$47.2

$22.9

$24.3

EBITDA

FY 23E

$56.8

($ millions)

$60.3

Contribution from

projects achieving

commercial operations

USA

Greece

Spain 19%

8%

841

MW

21%

Poland

40%

Italy

Notes (1) Adjustment to EBITDA to recognize the full year earnings from assets that was only operational for a part of the year.

($15.0)

Estimated

Corporate

Costs

FY24

Developemnt

21%

41%

Exclusive Rights

841

MW

$149.3

$56.8

$92.5

EBITDA

FY 24E

37% Contracted

Spain

$64.0

Contribution from

projects achieving

commercial operations

28%

$78.7

1,402

MW

33%

USA

25%

Italy

14%

($20.0)

Estimated

Corporate

Costs

FY25

Developemnt

Netherlands

40%

1,402

MW

$272.0

$64.0

33%

$208.0

EBITDA

FY 25E

27%

Contracted

Exclusive RightsView entire presentation