Comcast Results Presentation Deck

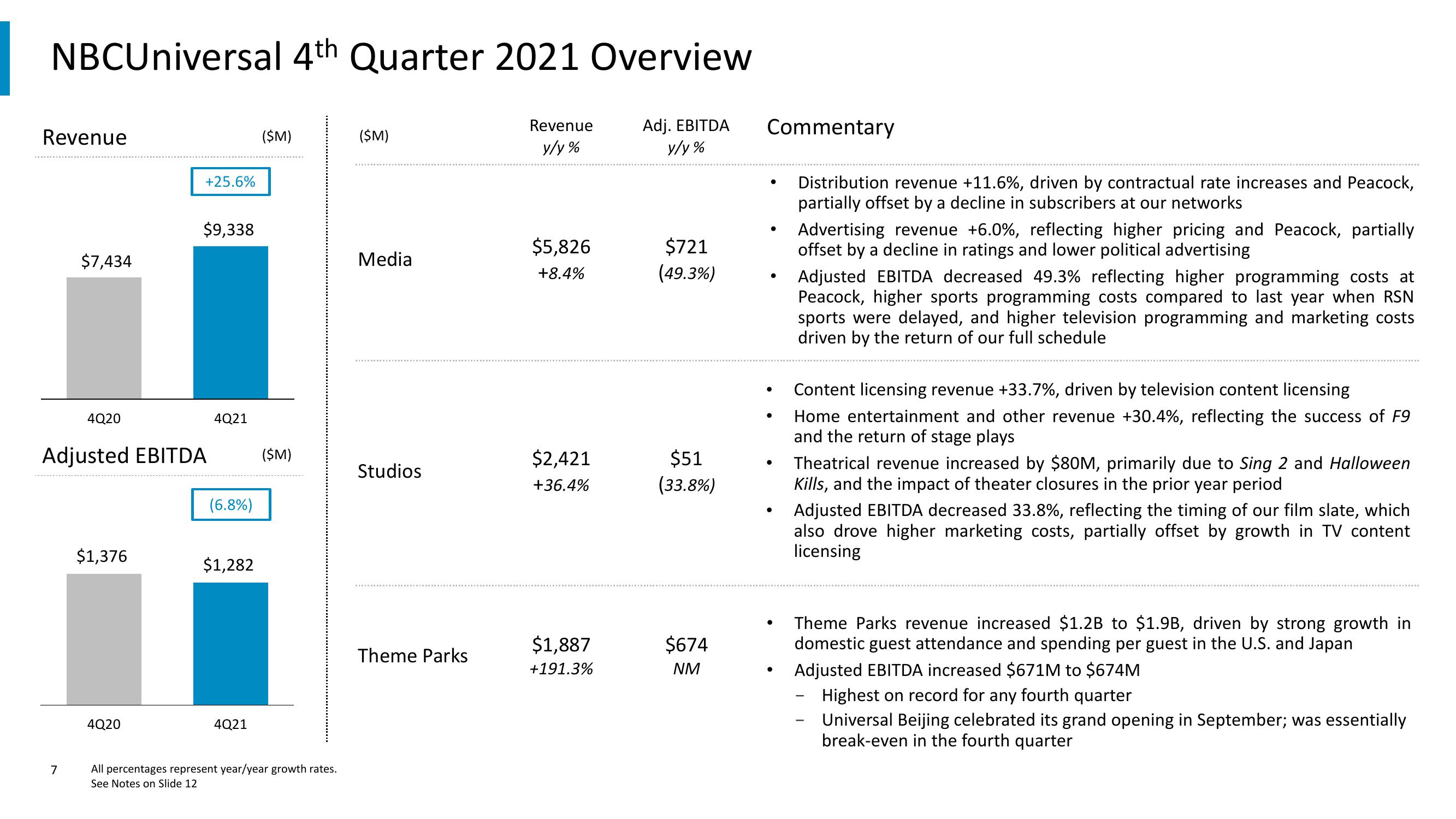

NBCUniversal 4th Quarter 2021 Overview

Revenue

y/y%

Adj. EBITDA

y/y%

Revenue

$7,434

7

4Q20

$1,376

+25.6%

4Q20

$9,338

Adjusted EBITDA ($M)

4Q21

(6.8%)

$1,282

($M)

4Q21

All percentages represent year/year growth rates.

See Notes on Slide 12

($M)

Media

Studios

Theme Parks

$5,826

+8.4%

$2,421

+36.4%

$1,887

+191.3%

$721

(49.3%)

$51

(33.8%)

$674

NM

Commentary

●

●

●

●

●

●

Distribution revenue +11.6%, driven by contractual rate increases and Peacock,

partially offset by a decline in subscribers at our networks

Advertising revenue +6.0%, reflecting higher pricing and Peacock, partially

offset by a decline in ratings and lower political advertising

Adjusted EBITDA decreased 49.3% reflecting higher programming costs at

Peacock, higher sports programming costs compared to last year when RSN

sports were delayed, and higher television programming and marketing costs

driven by the return of our full schedule

Content licensing revenue +33.7%, driven by television content licensing

Home entertainment and other revenue +30.4%, reflecting the success of F9

and the return of stage plays

Theatrical revenue increased by $80M, primarily due to Sing 2 and Halloween

Kills, and the impact of theater closures in the prior year period

Adjusted EBITDA decreased 33.8%, reflecting the timing of our film slate, which

also drove higher marketing costs, partially offset by growth in TV content

licensing

Theme Parks revenue increased $1.2B to $1.9B, driven by strong growth in

domestic guest attendance and spending per guest in the U.S. and Japan

Adjusted EBITDA increased $671M to $674M

Highest on record for any fourth quarter

Universal Beijing celebrated its grand opening in September; was essentially

break-even in the fourth quarter

-View entire presentation