Imara M&A

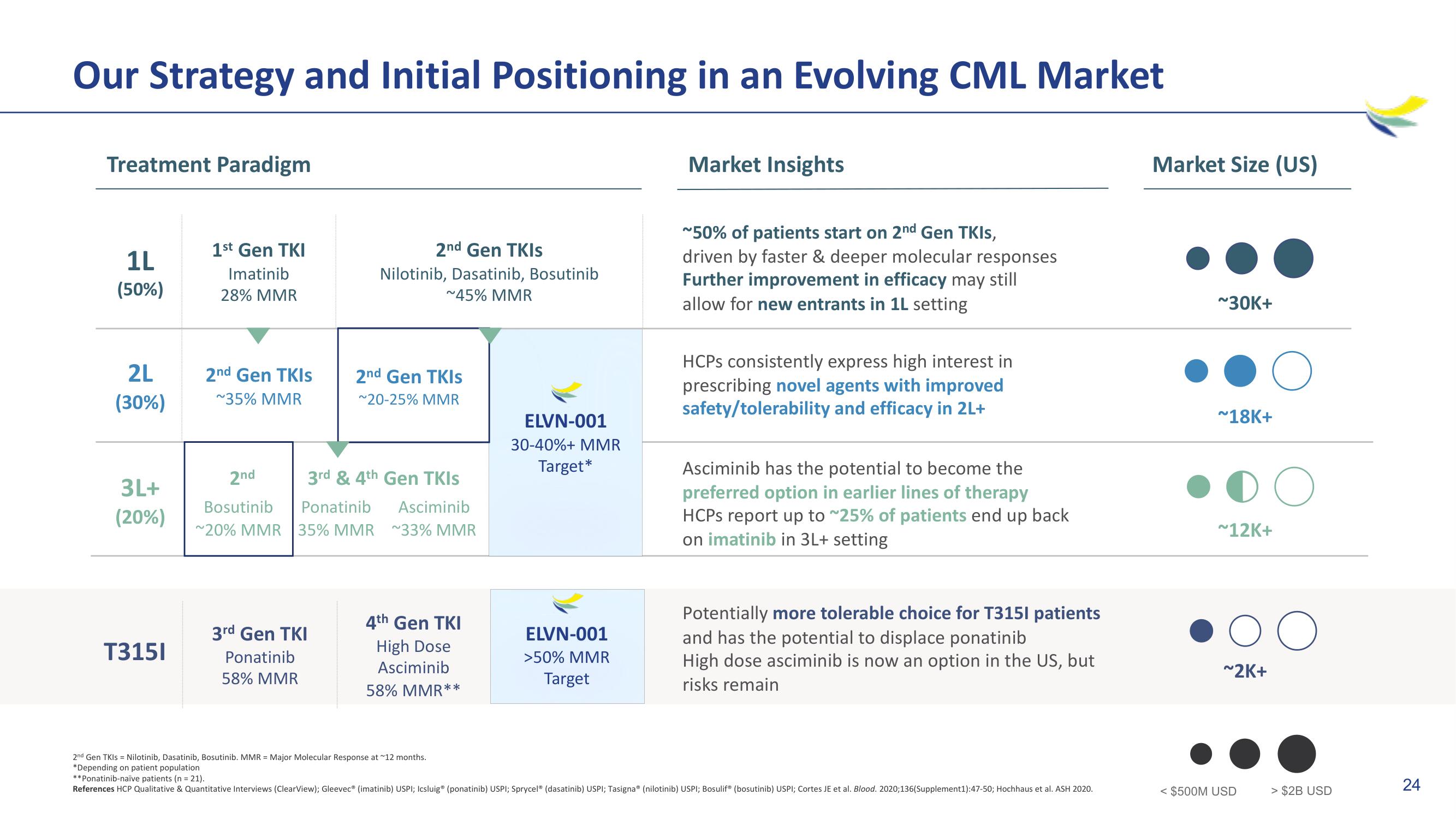

Our Strategy and Initial Positioning in an Evolving CML Market

Treatment Paradigm

1L

(50%)

2L

(30%)

3L+

(20%)

T3151

1st Gen TKI

Imatinib

28% MMR

2nd Gen TKIS

~35% MMR

2nd Gen TKIS

Nilotinib, Dasatinib, Bosutinib

~45% MMR

3rd Gen TKI

Ponatinib

58% MMR

2nd Gen TKIs

~20-25% MMR

2nd

3rd & 4th Gen TKIs

Bosutinib Ponatinib Asciminib

~20% MMR 35% MMR ~33% MMR

4th Gen TKI

High Dose

Asciminib

58% MMR**

2nd Gen TKIs = Nilotinib, Dasatinib, Bosutinib. MMR = Major Molecular Response at ~12 months.

*Depending on patient population

ELVN-001

30-40%+ MMR

Target*

ELVN-001

>50% MMR

Target

Market Insights

~50% of patients start on 2nd Gen TKIS,

driven by faster & deeper molecular responses

Further improvement in efficacy may still

allow for new entrants in 1L setting

HCPs consistently express high interest in

prescribing novel agents with improved

safety/tolerability and efficacy in 2L+

Asciminib has the potential to become the

preferred option in earlier lines of therapy

HCPs report up to ~25% of patients end up back

on imatinib in 3L+ setting

Potentially more tolerable choice for T3151 patients

and has the potential to displace ponatinib

High dose asciminib is now an option in the US, but

risks remain

**Ponatinib-naïve patients (n = 21).

References HCP Qualitative & Quantitative Interviews (ClearView); Gleevec® (imatinib) USPI; Icsluig (ponatinib) USPI; Sprycel® (dasatinib) USPI; Tasigna® (nilotinib) USPI; Bosulif® (bosutinib) USPI; Cortes JE et al. Blood. 2020;136(Supplement1):47-50; Hochhaus et al. ASH 2020.

Market Size (US)

~30K+

O

~18K+

O

~12K+

< $500M USD

оо

~2K+

> $2B USD

24View entire presentation