MoneyLion Results Presentation Deck

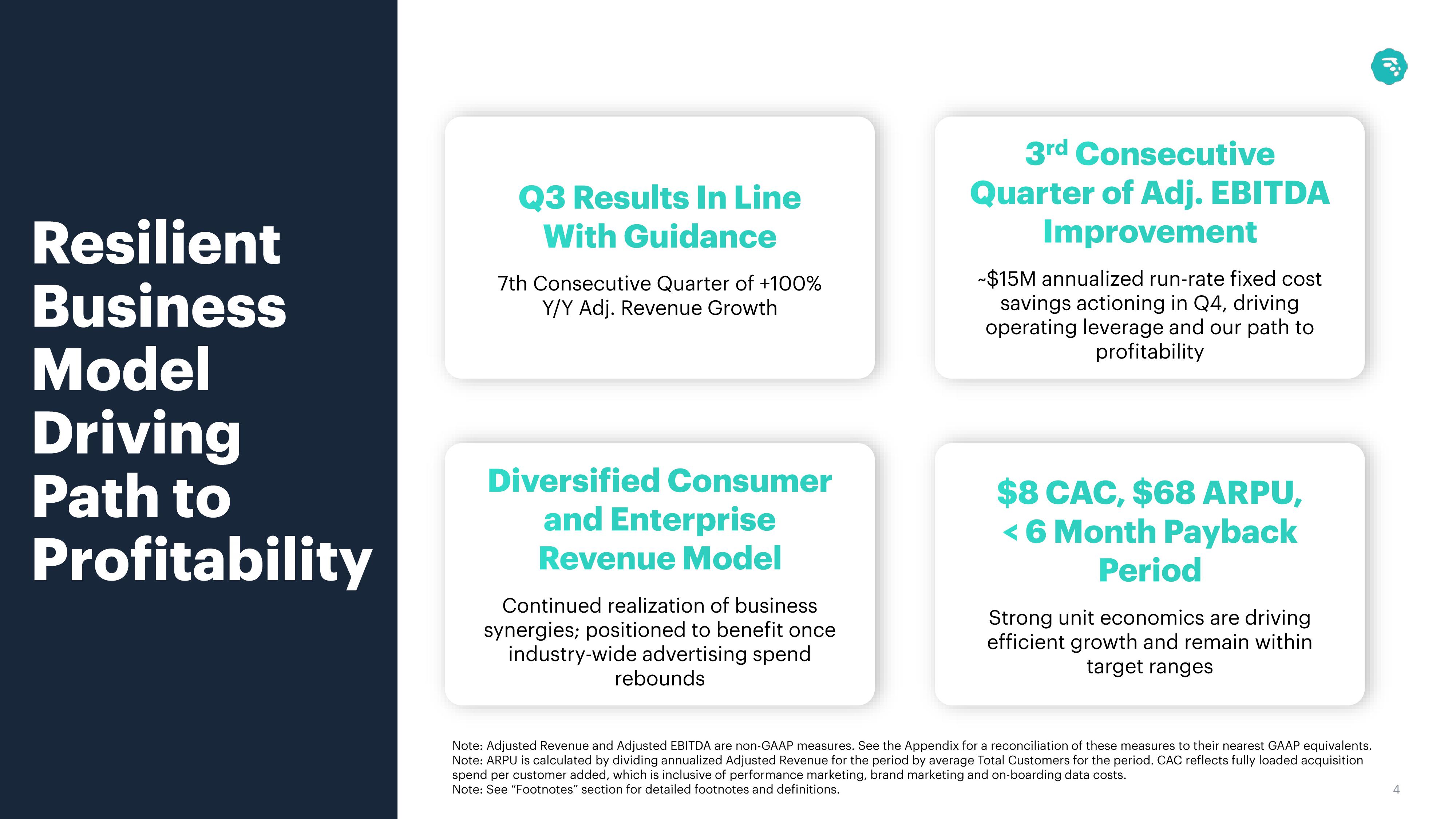

Resilient

Business

Model

Driving

Path to

Profitability

Q3 Results In Line

With Guidance

7th Consecutive Quarter of +100%

Y/Y Adj. Revenue Growth

Diversified Consumer

and Enterprise

Revenue Model

Continued realization of business

synergies; positioned to benefit once

industry-wide advertising spend

rebounds

3rd Consecutive

Quarter of Adj. EBITDA

Improvement

-$15M annualized run-rate fixed cost

savings actioning in Q4, driving

operating leverage and our path to

profitability

$8 CAC, $68 ARPU,

< 6 Month Payback

Period

Strong unit economics are driving

efficient growth and remain within

target ranges

Note: Adjusted Revenue and Adjusted EBITDA are non-GAAP measures. See the Appendix for a reconciliation of these measures to their nearest GAAP equivalents.

Note: ARPU is calculated by dividing annualized Adjusted Revenue for the period by average Total Customers for the period. CAC reflects fully loaded acquisition

spend per customer added, which is inclusive of performance marketing, brand marketing and on-boarding data costs.

Note: See "Footnotes" section for detailed footnotes and definitions.

50⁰

4View entire presentation