SPAC Presentation

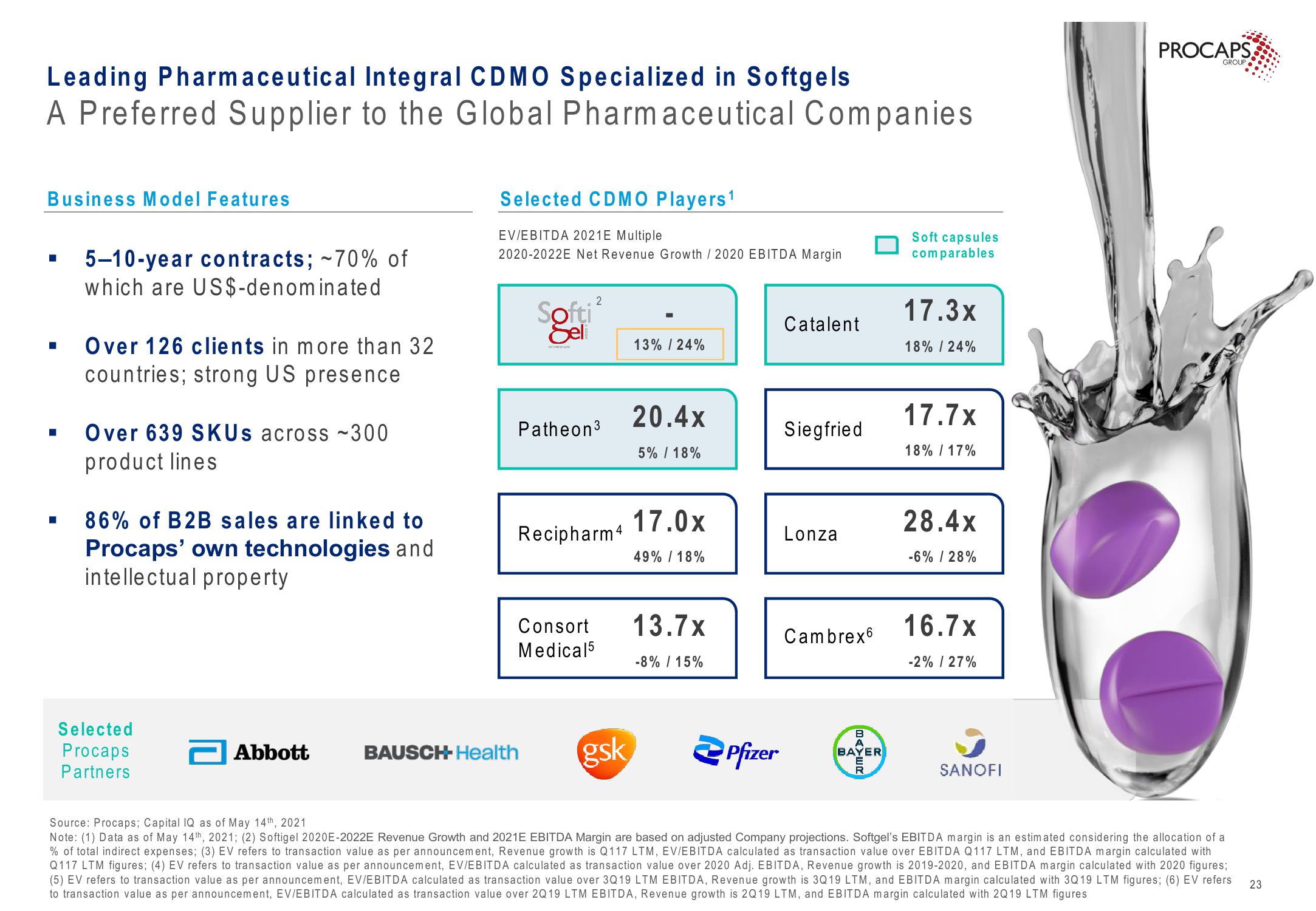

Leading Pharmaceutical Integral CDMO Specialized in Softgels

A Preferred Supplier to the Global Pharmaceutical Companies

Business Model Features

■

■

■

5-10-year contracts; -70% of

which are US$-denominated

Over 126 clients in more than 32

countries; strong US presence

Over 639 SKUs across ~300

product lines

86% of B2B sales are linked to

Procaps' own technologies and

intellectual property

Selected

Procaps

Partners

Abbott

Selected CDMO Players¹

EV/EBITDA 2021E Multiple

2020-2022E Net Revenue Growth / 2020 EBITDA Margin

Softi

Sel

inca

BAUSCH- Health

2

Patheon ³

Recipharm4

13% / 24%

gsk

20.4x

5% / 18%

17.0x

49% / 18%

Consort 13.7x

Medical5

-8% / 15%

Pfizer

Catalent

Siegfried

Lonza

Cambrex6

BAYER

BAYER

Soft capsules

comparables

17.3x

18% / 24%

17.7x

18% / 17%

28.4x

-6% / 28%

16.7x

-2% / 27%

SANOFI

PROCAPS

GROUP

Source: Procaps; Capital IQ as of May 14th, 2021

Note: (1) Data as of May 14th, 2021; (2) Softigel 2020E-2022E Revenue Growth and 2021E EBITDA Margin are based on adjusted Company projections. Softgel's EBITDA margin is an estimated considering the allocation of a

% of total indirect expenses; (3) EV refers to transaction value as per announcement, Revenue growth is Q117 LTM, EV/EBITDA calculated as transaction value over EBITDA Q117 LTM, and EBITDA margin calculated with

Q117 LTM figures; (4) EV refers to transaction value as per announcement, EV/EBITDA calculated as transaction value over 2020 Adj. EBITDA, Revenue growth is 2019-2020, and EBITDA margin calculated with 2020 figures;

(5) EV refers to transaction value as per announcement, EV/EBITDA calculated as transaction value over 3Q19 LTM EBITDA, Revenue growth is 3Q19 LTM, and EBITDA margin calculated with 3Q19 LTM figures; (6) EV refers

to transaction value as per announcement, EV/EBITDA calculated as transaction value over 2Q19 LTM EBITDA, Revenue growth is 2Q19 LTM, and EBITDA margin calculated with 2Q19 LTM figures

..::

23View entire presentation