Apollo Global Management Mergers and Acquisitions Presentation Deck

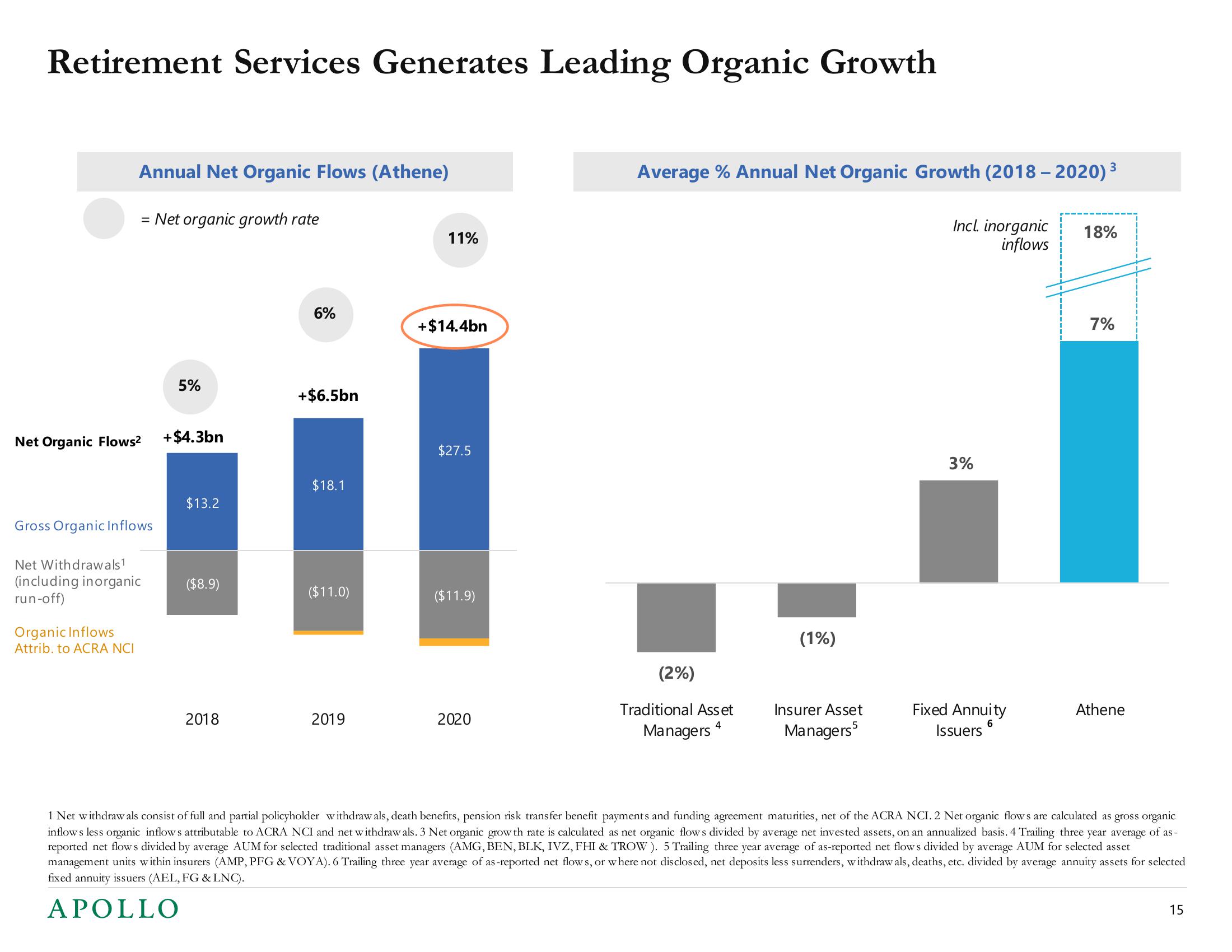

Retirement Services Generates Leading Organic Growth

Annual Net Organic Flows (Athene)

= Net organic growth rate

Net Organic Flows² +$4.3bn

Gross Organic Inflows

Organic Inflows

Attrib. to ACRA NCI

Net Withdrawals¹

(including inorganic

run-off)

5%

$13.2

($8.9)

2018

6%

+$6.5bn

$18.1

($11.0)

2019

11%

+$14.4bn

$27.5

($11.9)

2020

Average % Annual Net Organic Growth (2018 – 2020) ³

3

(2%)

Traditional Asset

Managers 4

(1%)

Insurer Asset

Managers5

Incl. inorganic

inflows

3%

Fixed Annuity

Issuers

6

18%

7%

Athene

1 Net withdraw als consist of full and partial policyholder withdraw als, death benefits, pension risk transfer benefit payments and funding agreement maturities, net of the ACRA NCI. 2 Net organic flows are calculated as gross organic

inflows less organic inflows attributable to ACRA NCI and net withdraw als. 3 Net organic grow th rate is calculated as net organic flows divided by average net invested assets, on an annualized basis. 4 Trailing three year average of as-

reported net flows divided by average AUM for selected traditional asset managers (AMG, BEN, BLK, IVZ, FHI & TROW). 5 Trailing three year average of as-reported net flows divided by average AUM for selected asset

management units within insurers (AMP, PFG & VOYA). 6 Trailing three year average of as-reported net flows, or where not disclosed, net deposits less surrenders, withdraw als, deaths, etc. divided by average annuity assets for selected

fixed annuity issuers (AEL, FG & LNC).

APOLLO

15View entire presentation