Genelux Investor Presentation Deck

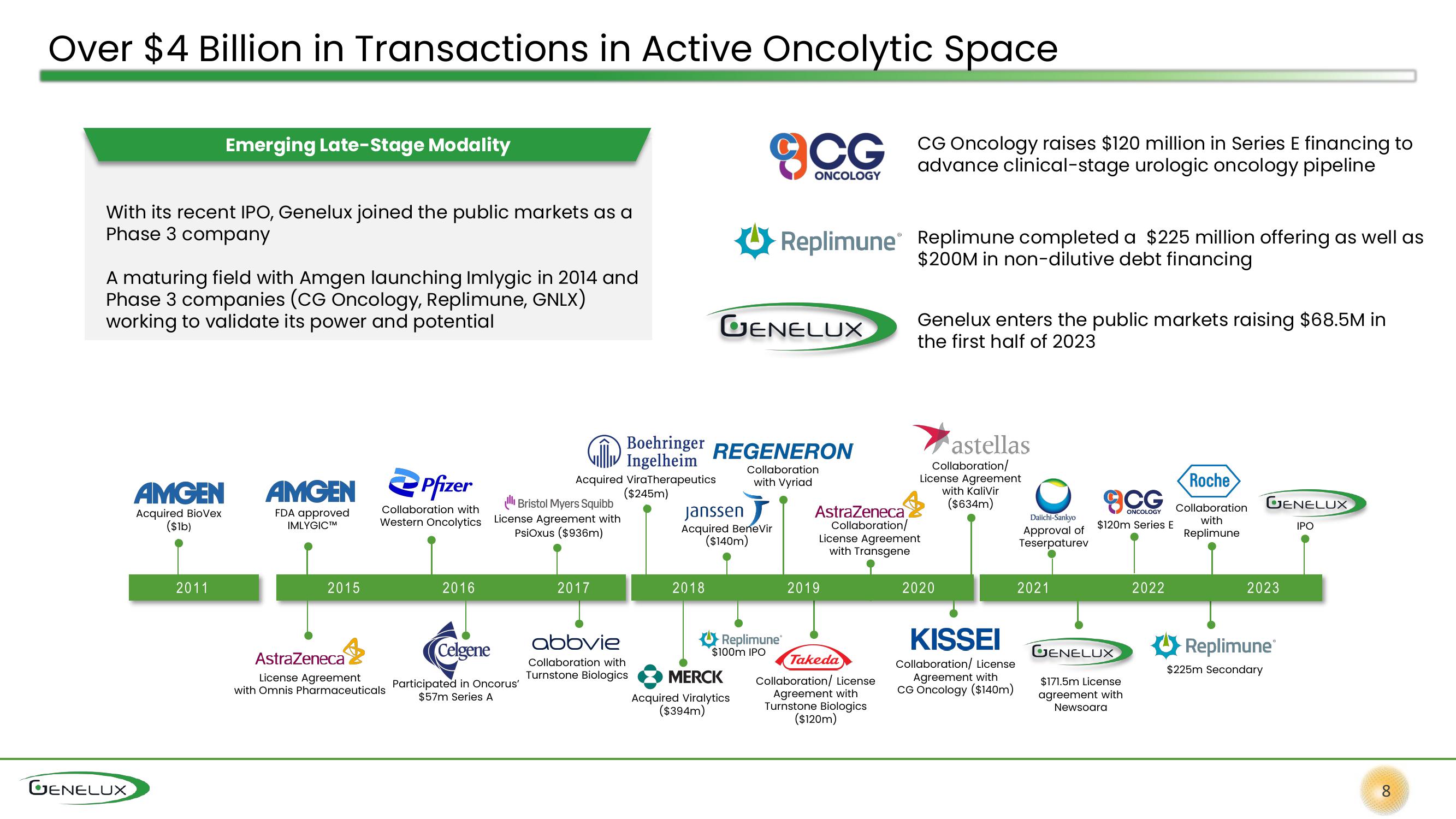

Over $4 Billion in Transactions in Active Oncolytic Space

CG

ONCOLOGY

With its recent IPO, Genelux joined the public markets as a

Phase 3 company

A maturing field with Amgen launching Imlygic in 2014 and

Phase 3 companies (CG Oncology, Replimune, GNLX)

working to validate its power and potential

GENELUX

Emerging Late-Stage Modality

AMGEN

Acquired BioVex

($1b)

2011

AMGEN

FDA approved

IMLYGICTM

2015

Pfizer

Collaboration with

Ill Bristol Myers Squibb

Western Oncolytics License Agreement with

PsiOxus ($936m)

2016

Boehringer

Ingelheim

Acquired ViraTherapeutics

($245m)

Celgene

AstraZeneca

License Agreement

with Omnis Pharmaceuticals Participated in Oncorus'

$57m Series A

2017

abbvie

Collaboration with

Turnstone Biologics

2018

GENELUX

Janssen

Acquired Benevir

($140m)

REGENERON

Collaboration

with Vyriad

Replimune® Replimune completed a $225 million offering as well as

$200M in non-dilutive debt financing

Replimune®

$100m IPO

MERCK

Acquired Viralytics

($394m)

CG Oncology raises $120 million in Series E financing to

advance clinical-stage urologic oncology pipeline

2019

Takeda

Collaboration/ License

Agreement with

Turnstone Biologics

($120m)

Genelux enters the public markets raising $68.5M in

the first half of 2023

AstraZeneca

Collaboration/

License Agreement

with Transgene

astellas

Collaboration/

License Agreement

with KaliVir

($634m)

2020

KISSEI

Collaboration/ License

Agreement with

CG Oncology ($140m)

Daiichi-Sankyo

Approval of

Teserpaturev

2021

ONCOLOGY

$120m Series E

GENELUX

$171.5m License

agreement with

Newsoara

2022

Roche

Collaboration

with

Replimune

GENELUX

IPO

2023

Replimune

$225m Secondary

8View entire presentation