Melrose Investor Presentation Deck

←N>

GKN AEROSPACE

£m

750

650

550

450

350

250

150

50

-50

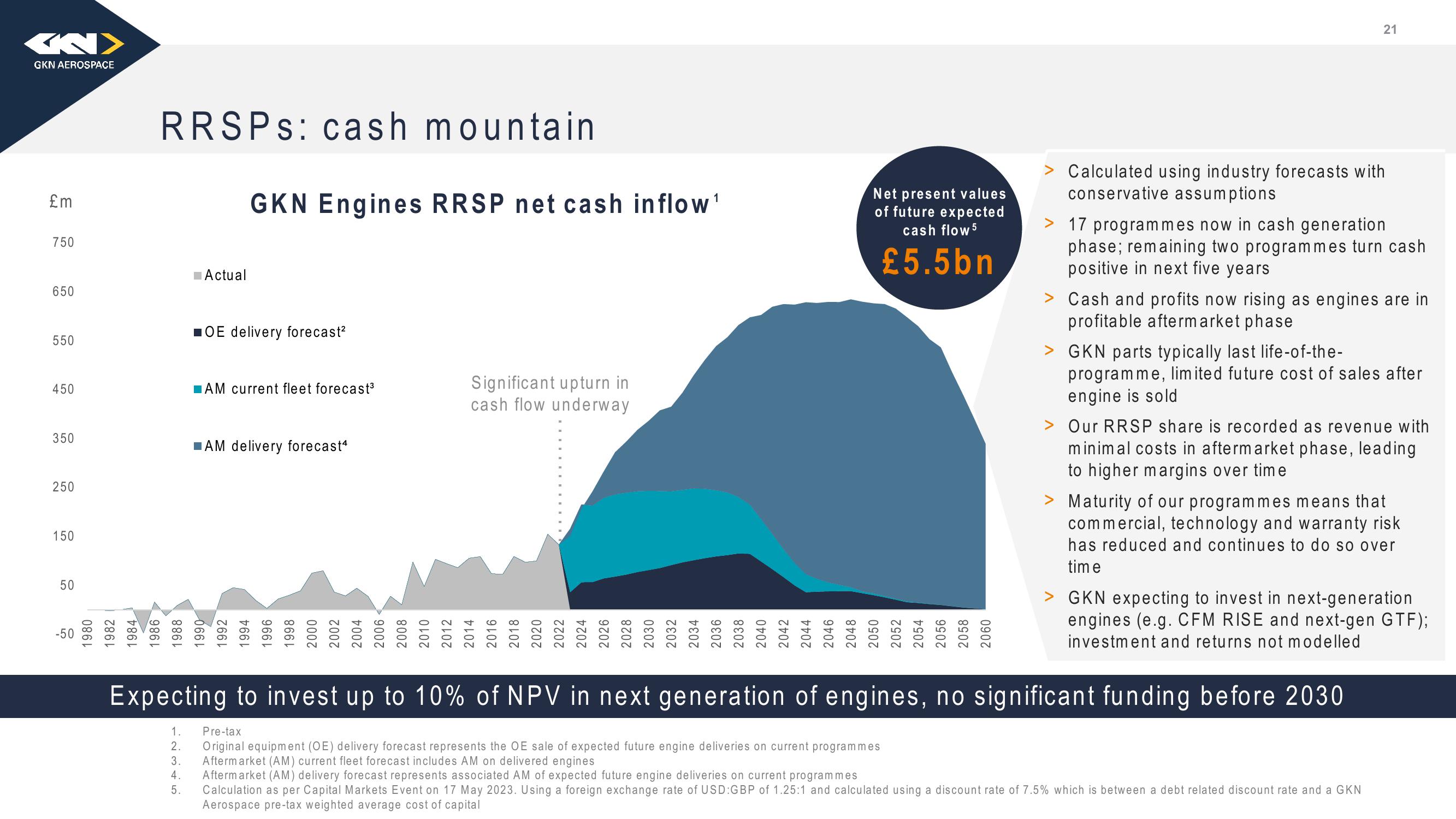

RRSPS: cash mountain

Actual

GKN Engines RRSP net cash inflow ¹

1.

2.

■OE delivery forecast²

~ 3

■AM current fleet forecast³

■AM delivery forecast4

Significant upturn in

cash flow underway

1980

1982

1984

1986

1988

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

2014

2016

2018

2020

2022

2024

2026

2028

2030

2032

2034

2036

2038

2040

2042

2044

2046

2048

2050

2052

2054

2056

2058

2060

Net present values

of future expected

cash flow 5

£5.5bn

Pre-tax

Original equipment (OE) delivery forecast represents the OE sale of expected future engine deliveries on current programmes

3. Aftermarket (AM) current fleet forecast includes AM on delivered engines

Calculated using industry forecasts with

conservative assumptions

21

> 17 programmes now in cash generation

phase; remaining two programmes turn cash

positive in next five years

> Cash and profits now rising as engines are in

profitable aftermarket phase

> GKN parts typically last life-of-the-

programme, limited future cost of sales after

engine is sold

Expecting to invest up to 10% of NPV in next generation of engines, no significant funding before 2030

> Our RRSP share is recorded as revenue with

minimal costs in aftermarket phase, leading

to higher margins over time

> Maturity of our programmes means that

commercial, technology and warranty risk

has reduced and continues to do so over

time

> GKN expecting to invest in next-generation

engines (e.g. CFM RISE and next-gen GTF);

investment and returns not modelled

4. Aftermarket (AM) delivery forecast represents associated AM of expected future engine deliveries on current programmes

5.

Calculation as per Capital Markets Event on 17 May 2023. Using a foreign exchange rate of USD GBP of 1.25:1 and calculated using a discount rate of 7.5% which is between a debt related discount rate and a GKN

Aerospace pre-tax weighted average cost of capitalView entire presentation