Bank of America Investment Banking Pitch Book

Sales

% Growth

Adjusted EBITDA

% Margin

Adjusted EBIT

% Margin

Tax-Effected Adjusted EBIT (

Plus: Depreciation & Amortization

Less: Capital Expenditures

Less: Change in Operating Assets & Liabilities

Unlevered Free Cash Flow

Discount

Rate

11.0%

12.0%

13.0%

Discount

Rate

11.0%

12.0%

13.0%

Discounted

Cash Flows

Q3-Q4 2012E

2014E

$56

55

55

Cash

$48

48

48

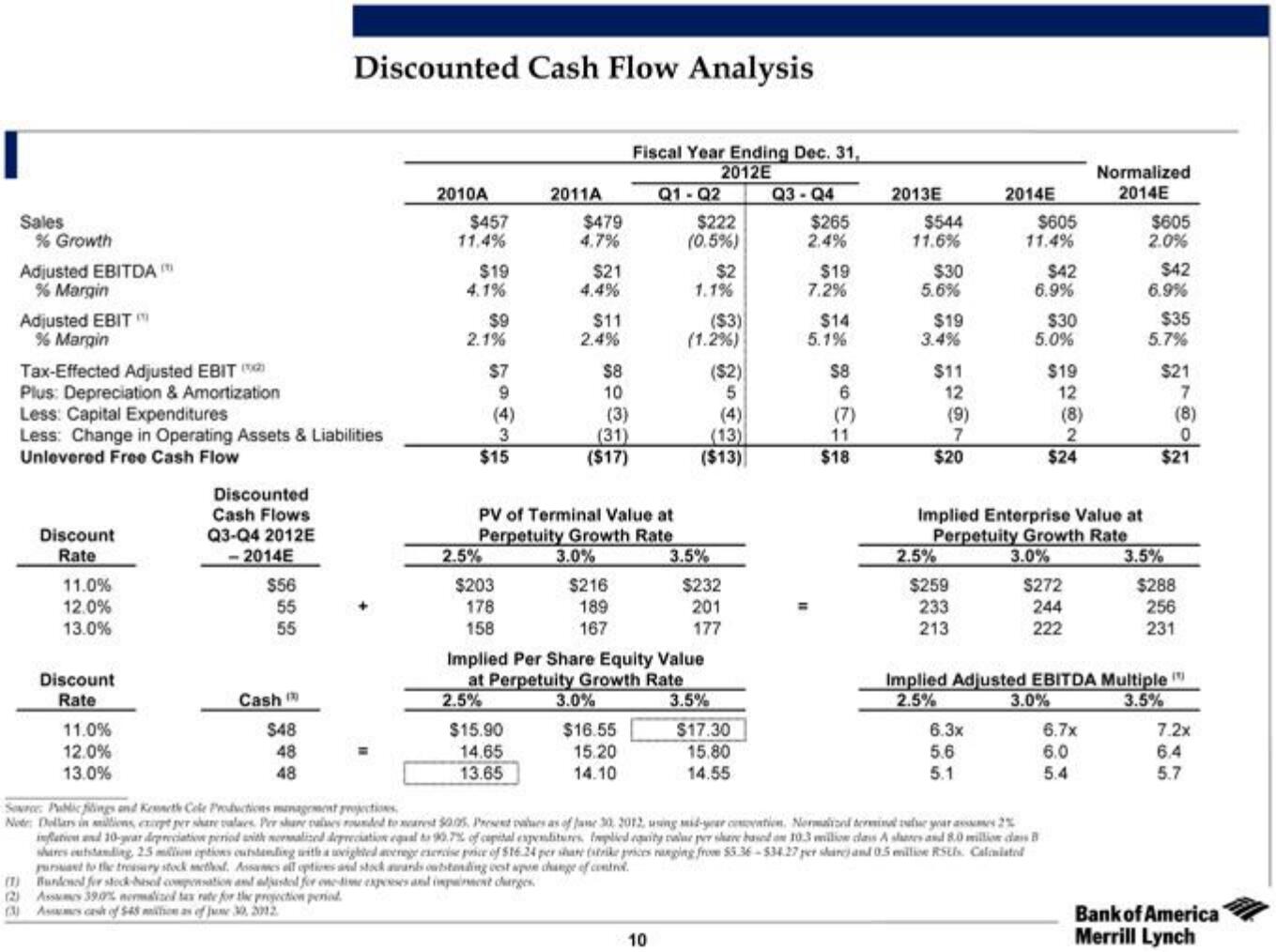

Discounted Cash Flow Analysis

39,0% nermalized tax rate for the projection period.

(3) Asses cash of $45 million as of June 30, 2012

2010A

$457

11.4%

$19

4.1%

2.1%

$9

9

(4)

3

$15

2.5%

$7

$203

178

158

2.5%

2011A

$479

4.7%

$15.90

14.65

13.65

$21

4.4%

$11

2.4%

$8

10

PV of Terminal Value at

Perpetuity Growth Rate

3.0%

(3)

(31)

($17)

Fiscal Year Ending Dec. 31,

2012E

Q3-Q4

$216

189

167

Q1-Q2

$222

(0.5%)

10

1.1%

($3)

(1.2%)

Implied Per Share Equity Value

at Perpetuity Growth Rate

3.0%

$16.55

15.20

14.10

$2

($2)

5

(4)

(13)

($13)

3.5%

$232

201

177

3.5%

$17.30

15.80

14.55

$265

2.4%

$19

7.2%

$14

5.1%

$8

6

(7)

11

$18

2013E

$544

11.6%

$30

5.6%

$19

3.4%

$11

12

(9)

7

$20

2.5%

$259

233

213

2014E

$605

11.4%

6.3x

5.6

5.1

$42

6.9%

Source: Public filings and Kenneth Cole Productions management projections

Note: Dollars in millions, exopt per share values. Per share values rounded to nearest $0.05 Presest palues as of June 30, 2012, uning mid-year contion. Normalized terminal aur year am 2%

inflation and 10-year depreciation period with normalized depreciation equal to 90.7% of capital expenditures, fplied equity value per share based on 10.3 million class A shares and 8.0 million das B

shares outstanding, 25 million options outstanding with a weighted average exercise price of $16.24 per share (strike prices ranging from $5.36-534.27 per share) and 0.5 million RSLs. Calmisted

pursuant to the treasury stock method, Assames all optices and stock awards outstanding est apue change of control.

(1) Bundened for stock-hasol compensation and adjusted for one-dime expenses and impairment charges.

(2) Ass

$30

5.0%

Implied Enterprise Value at

Perpetuity Growth Rate

3.0%

$19

12

(8)

2

$24

$272

244

222

Normalized

2014E

6.7x

6.0

5.4

$605

2.0%

$42

6.9%

$35

5.7%

$21

7

(8)

$21

Implied Adjusted EBITDA Multiple

2.5%

3.0%

3.5%

3.5%

$288

256

231

7.2x

6.4

5.7

Bank of America

Merrill LynchView entire presentation