TPG Results Presentation Deck

Fund Performance Metrics Notes

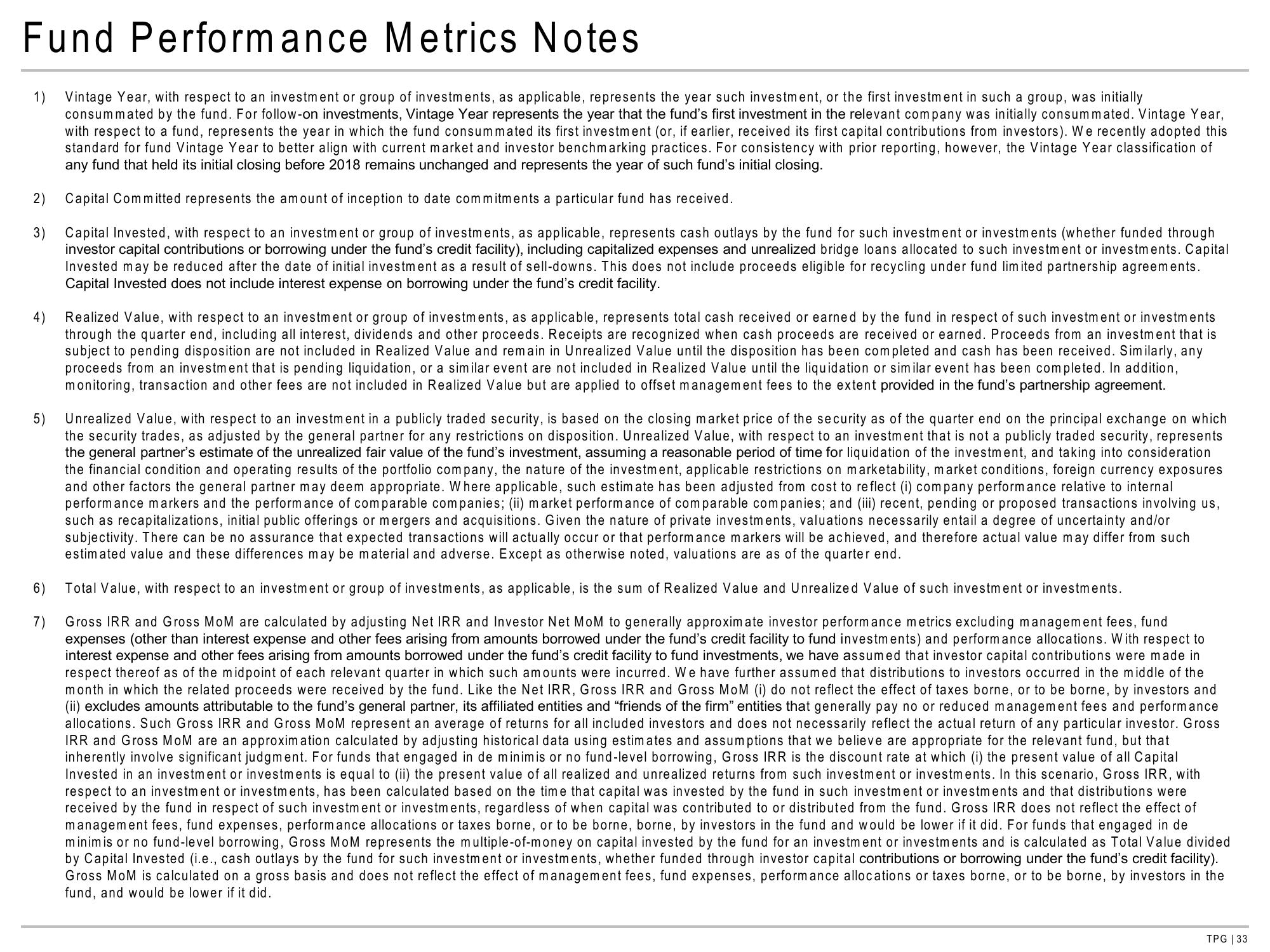

Vintage Year, with respect to an investment or group of investments, as applicable, represents the year such investment, or the first investment in such a group, was initially

consummated by the fund. For follow-on investments, Vintage Year represents the year that the fund's first investment in the relevant company was initially consummated. Vintage Year,

with respect to a fund, represents the year in which the fund consummated its first investment (or, if earlier, received its first capital contributions from investors). We recently adopted this

standard for fund Vintage Year to better align with current market and investor benchmarking practices. For consistency with prior reporting, however, the Vintage Year classification of

any fund that held its initial closing before 2018 remains unchanged and represents the year of such fund's initial closing.

2)

Capital Committed represents the amount of inception to date commitments a particular fund has received.

3) Capital Invested, with respect to an investment or group of investments, as applicable, represents cash outlays by the fund for such investment or investments (whether funded through

investor capital contributions or borrowing under the fund's credit facility), including capitalized expenses and unrealized bridge loans allocated to such investment or investments. Capital

Invested may be reduced after the date of initial investment as a result of sell-downs. This does not include proceeds eligible for recycling under fund limited partnership agreements.

Capital Invested does not include interest expense on borrowing under the fund's credit facility.

1)

4)

6)

7)

Realized Value, with respect to an investment or group of investments, as applicable, represents total cash received or earned by the fund in respect of such investment or investments

through the quarter end, including all interest, dividends and other proceeds. Receipts are recognized when cash proceeds are received or earned. Proceeds from an investment that is

subject to pending disposition are not included in Realized Value and remain in Unrealized Value until the disposition has been completed and cash has been received. Similarly, any

proceeds from an investment that is pending liquidation, or a similar event are not included in Realized Value until the liquidation or similar event has been completed. In addition,

monitoring, transaction and other fees are not included in Realized Value but are applied to offset management fees to the extent provided in the fund's partnership agreement.

Unrealized Value, with respect to an investment in a publicly traded security, is based on the closing market price of the security as of the quarter end on the principal exchange on which

the security trades, as adjusted by the general partner for any restrictions on disposition. Unrealized Value, with respect to an investment that is not a publicly traded security, represents

the general partner's estimate of the unrealized fair value of the fund's investment, assuming a reasonable period of time for liquidation of the investment, and taking into consideration

the financial condition and operating results of the portfolio company, the nature of the investment, applicable restrictions on marketability, market conditions, foreign currency exposures

and other factors the general partner may deem appropriate. Where applicable, such estimate has been adjusted from cost to reflect (i) company performance relative to internal

performance markers and the performance of comparable companies; (ii) market performance of comparable companies; and (iii) recent, pending or proposed transactions involving us,

such as recapitalizations, initial public offerings or mergers and acquisitions. Given the nature of private investments, valuations necessarily entail a degree of uncertainty and/or

subjectivity. There can be no assurance that expected transactions will actually occur or that performance markers will be achieved, and therefore actual value may differ from such

estimated value and these differences may be material and adverse. Except as otherwise noted, valuations are as of the quarte end.

Total Value, with respect to an investment or group of investments, as applicable, is the sum of Realized Value and Unrealized Value of such investment or investments.

Gross IRR and Gross MoM are calculated by adjusting Net IRR and Investor Net MoM to generally approximate investor performance metrics excluding management fees, fund

expenses (other than interest expense and other fees arising from amounts borrowed under the fund's credit facility to fund investments) and performance allocations. With respect to

interest expense and other fees arising from amounts borrowed under the fund's credit facility to fund investments, we have assumed that investor capital contributions were made in

respect thereof as of the midpoint of each relevant quarter in which such amounts were incurred. We have further assumed that distributions to investors occurred in the middle of the

month in which the related proceeds were received by the fund. Like the Net IRR, Gross IRR and Gross MoM (i) do not reflect the effect of taxes borne, or to be borne, by investors and

(ii) excludes amounts attributable to the fund's general partner, its affiliated entities and "friends of the firm" entities that generally pay no or reduced management fees and performance

allocations. Such Gross IRR and Gross MoM represent an average of returns for all included investors and does not necessarily reflect the actual return of any particular investor. Gross

IRR and Gross MoM are an approximation calculated by adjusting historical data using estimates and assumptions that we believe are appropriate for the relevant fund, but that

inherently involve significant judgment. For funds that engaged in de minimis or no fund-level borrowing, Gross IRR is the discount rate at which (i) the present value of all Capital

Invested in an investment or investments is equal to (ii) the present value of all realized and unrealized returns from such investment or investments. In this scenario, Gross IRR, with

respect to an investment or investments, has been calculated based on the time that capital was invested by the fund in such investment or investments and that distributions were

received by the fund in respect of such investment or investments, regardless of when capital was contributed to or distributed from the fund. Gross IRR does not reflect the effect of

management fees, fund expenses, performance allocations or taxes borne, or to be borne, borne, by investors in the fund and would be lower if it did. For funds that engaged in de

minimis or no fund-level borrowing, Gross MoM represents the multiple-of-money on capital invested by the fund for an investment or investments and is calculated as Total Value divided

by Capital Invested (i.e., cash outlays by the fund for such investment or investments, whether funded through investor capital contributions or borrowing under the fund's credit facility).

Gross MoM is calculated on a gross basis and does not reflect the effect of management fees, fund expenses, performance allocations or taxes borne, or to be borne, by investors in the

fund, and would be lower if it did.

TPG | 33View entire presentation