Coppersmith Presentation to Alere Inc Stockholders

PAGE 22 |

COPPERSMITH

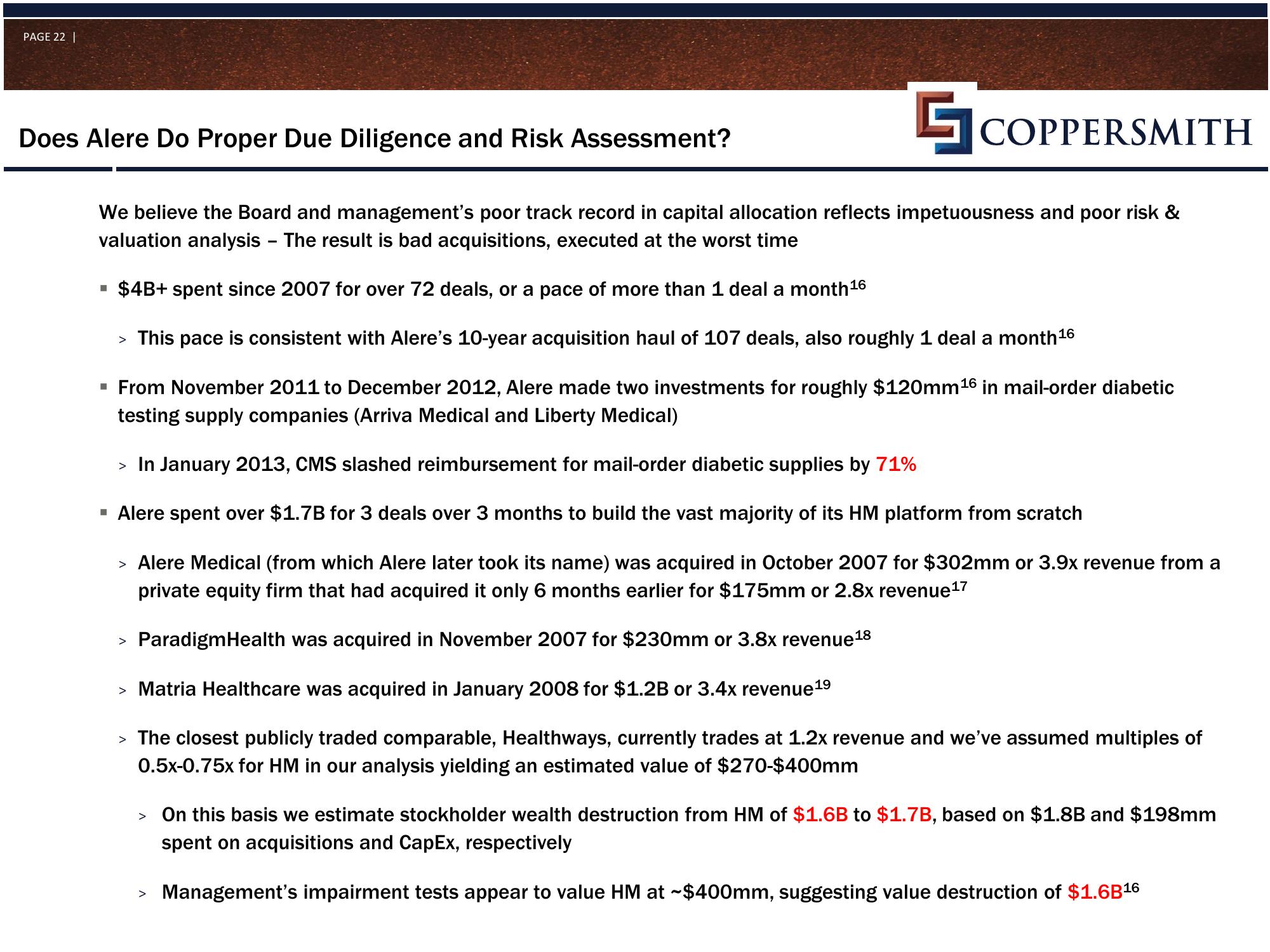

We believe the Board and management's poor track record in capital allocation reflects impetuousness and poor risk &

valuation analysis - The result is bad acquisitions, executed at the worst time

Does Alere Do Proper Due Diligence and Risk Assessment?

$4B+ spent since 2007 for over 72 deals, or a pace of more than 1 deal a month ¹6

> This pace is consistent with Alere's 10-year acquisition haul of 107 deals, also roughly 1 deal a month ¹6

▪ From November 2011 to December 2012, Alere made two investments for roughly $120mm ¹6 in mail-order diabetic

testing supply companies (Arriva Medical and Liberty Medical)

> In January 2013, CMS slashed reimbursement for mail-order diabetic supplies by 71%

▪ Alere spent over $1.7B for 3 deals over 3 months to build the vast majority of its HM platform from scratch

> Alere Medical (from which Alere later took its name) was acquired in October 2007 for $302mm or 3.9x revenue from a

private equity firm that had acquired it only 6 months earlier for $175mm or 2.8x revenue¹7

> ParadigmHealth was acquired in November 2007 for $230mm or 3.8x revenue ¹8

> Matria Healthcare was acquired in January 2008 for $1.2B or 3.4x revenue¹⁹

> The closest publicly traded comparable, Healthways, currently trades at 1.2x revenue and we've assumed multiples of

0.5x-0.75x for HM in our analysis yielding an estimated value of $270-$400mm

■

On this basis we estimate stockholder wealth destruction from HM of $1.6B to $1.7B, based on $1.8B and $198mm

spent on acquisitions and CapEx, respectively

> Management's impairment tests appear to value HM at ~$400mm, suggesting value destruction of $1.6B16View entire presentation