Second Quarter 2023 Earnings

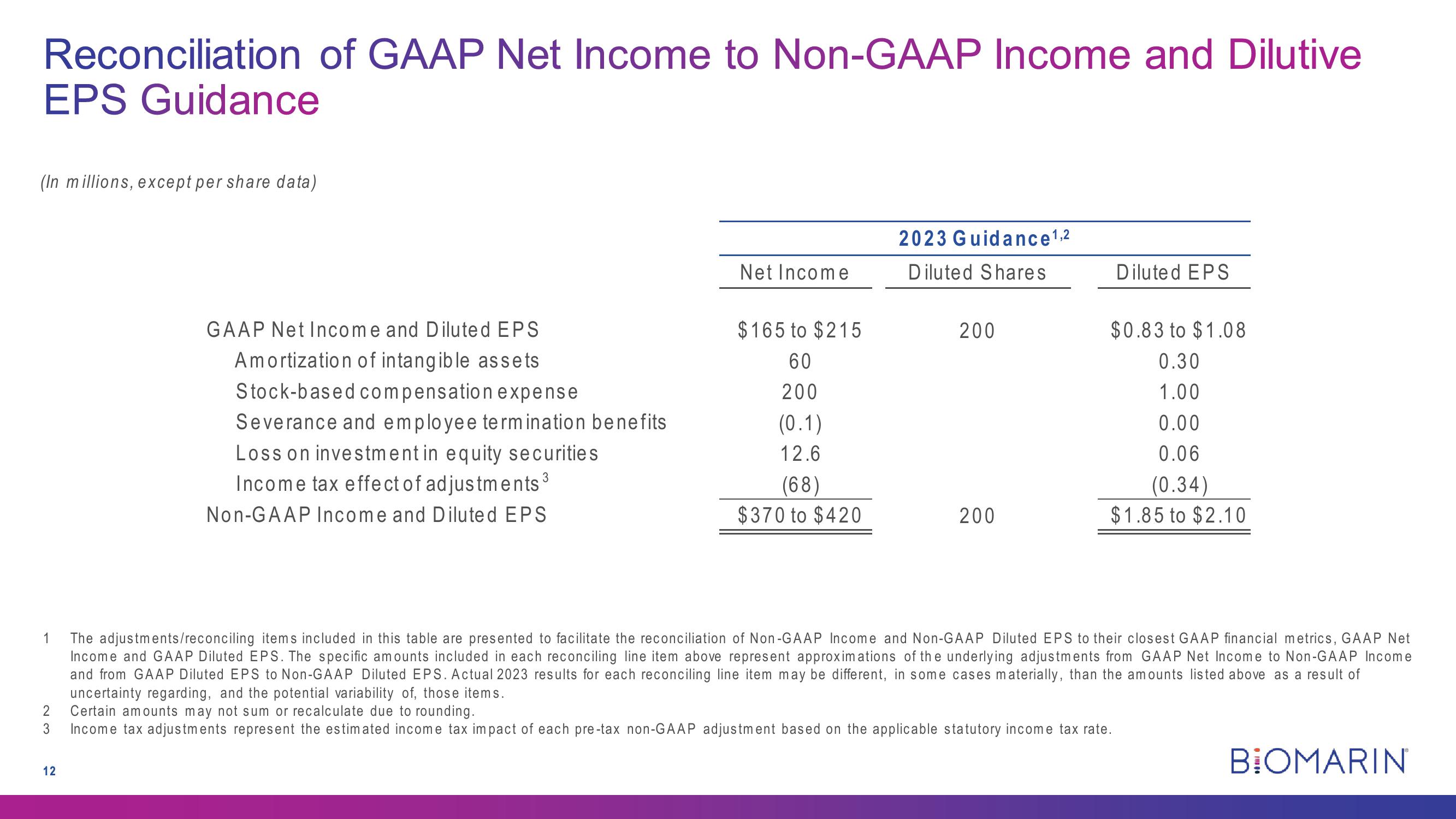

Reconciliation of GAAP Net Income to Non-GAAP Income and Dilutive

EPS Guidance

(In millions, except per share data)

Net Income

2023 Guidance 1,2

Diluted Shares

Diluted EPS

GAAP Net Income and Diluted EPS

$165 to $215

200

$0.83 to $1.08

Amortization of intangible assets

60

0.30

Stock-based compensation expense

Severance and employee termination benefits

Loss on investment in equity securities

200

1.00

(0.1)

0.00

12.6

0.06

Income tax effect of adjustments 3

(68)

(0.34)

Non-GAAP Income and Diluted EPS

$370 to $420

200

$1.85 to $2.10

1

23

The adjustments/reconciling items included in this table are presented to facilitate the reconciliation of Non-GAAP Income and Non-GAAP Diluted EPS to their closest GAAP financial metrics, GAAP Net

Income and GAAP Diluted EPS. The specific amounts included in each reconciling line item above represent approximations of the underlying adjustments from GAAP Net Income to Non-GAAP Income

and from GAAP Diluted EPS to Non-GAAP Diluted EPS. Actual 2023 results for each reconciling line item may be different, in some cases materially, than the amounts listed above as a result of

uncertainty regarding, and the potential variability of, those items.

Certain amounts may not sum or recalculate due to rounding.

Income tax adjustments represent the estimated income tax impact of each pre-tax non-GAAP adjustment based on the applicable statutory income tax rate.

12

BIOMARINView entire presentation