HSBC Results Presentation Deck

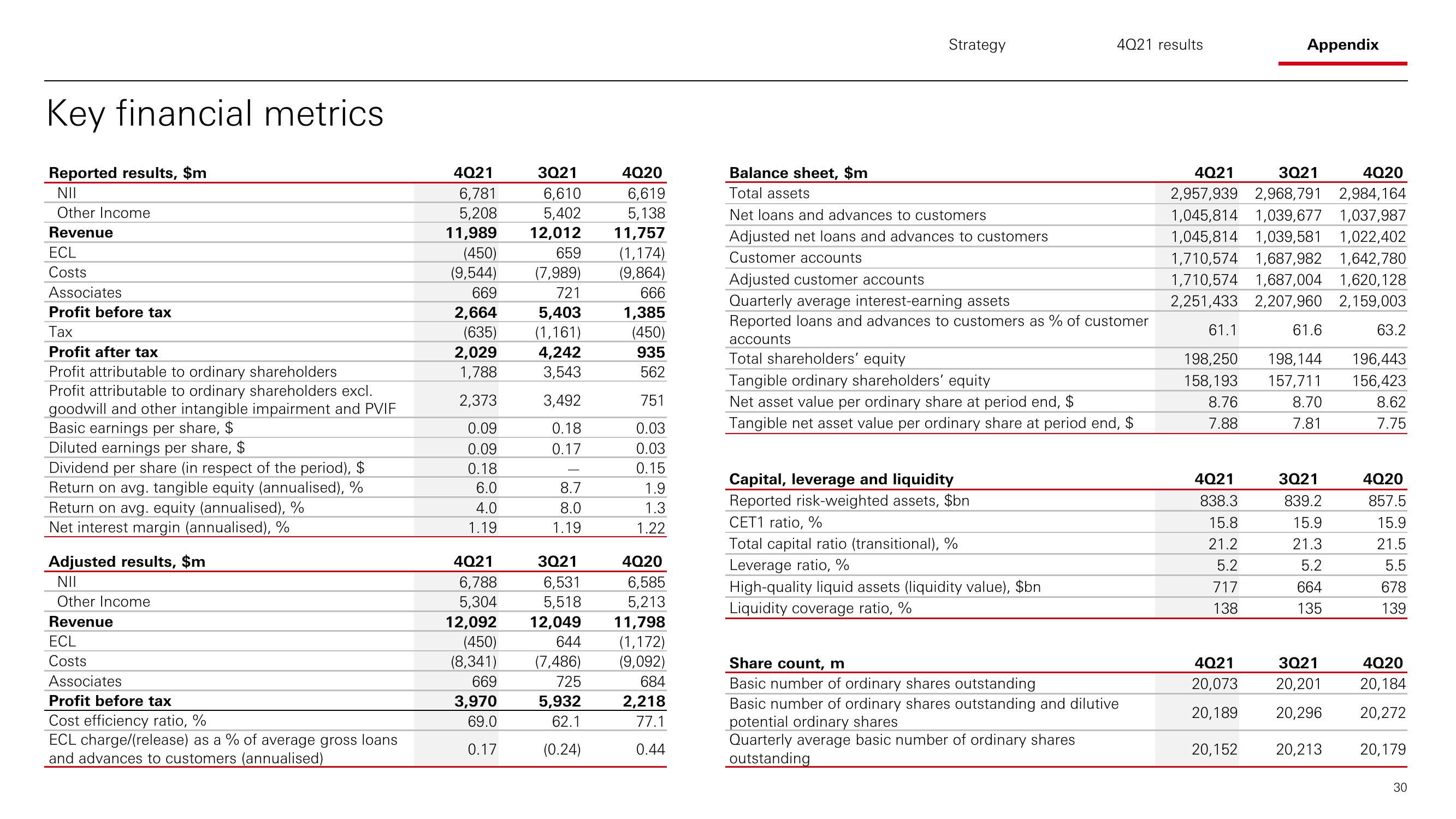

Key financial metrics

Reported results, $m

NII

Other Income

Revenue

ECL

Costs

Associates

Profit before tax

Tax

Profit after tax

Profit attributable to ordinary shareholders

Profit attributable to ordinary shareholders excl.

goodwill and other intangible impairment and PVIF

Basic earnings per share, $

Diluted earnings per share, $

Dividend per share (in respect of the period), $

Return on avg. tangible equity (annualised), %

Return on avg. equity (annualised), %

Net interest margin (annualised), %

Adjusted results, $m

NII

Other Income

Revenue

ECL

Costs

Associates

Profit before tax

Cost efficiency ratio, %

ECL charge/(release) as a % of average gross loans

and advances to customers (annualised)

4Q21

6,781

5,208

11,989

(450)

(9,544)

669

2,664

(635)

2,029

1,788

2,373

0.09

0.09

0.18

6.0

4.0

1.19

4Q21

3Q21

4Q20

6,610

6,619

5,138

5,402

12,012 11,757

659 (1,174)

(7,989) (9,864)

721

5,403

(1,161)

666

1,385

(450)

935

562

4,242

3,543

3,492

751

0.18

0.03

0.17

0.03

0.15

8.7

8.0

1.19

3Q21

6,788

6,531

5,304

5,518

12,092 12,049

(450)

(8,341)

644

(7,486)

725

5,932

669

3,970

69.0

62.1

0.17

(0.24)

1.9

1.3

1.22

4Q20

6,585

5,213

11,798

(1,172)

(9,092)

684

2,218

77.1

0.44

Strategy

Balance sheet, $m

Total assets

Net loans and advances to customers

Adjusted net loans and advances to customers

Customer accounts

Adjusted customer accounts

Quarterly average interest-earning assets

Reported loans and advances to customers as % of customer

accounts

Total shareholders' equity

Tangible ordinary shareholders' equity

Net asset value per ordinary share at period end, $

Tangible net asset value per ordinary share at period end, $

Capital, leverage and liquidity

Reported risk-weighted assets, $bn

4021 results

CET1 ratio, %

Total capital ratio (transitional), %

Leverage ratio, %

High-quality liquid assets (liquidity value), $bn

Liquidity coverage ratio, %

Share count, m

Basic number of ordinary shares outstanding

Basic number of ordinary shares outstanding and dilutive

potential ordinary shares

Quarterly average basic number of ordinary shares

outstanding

4Q20

4Q21

3Q21

2,957,939 2,968,791 2,984,164

1,045,814 1,039,677 1,037,987

1,045,814 1,039,581 1,022,402

1,710,574 1,687,982 1,642,780

1,710,574 1,687,004 1,620,128

2,251,433 2,207,960 2,159,003

61.1

198,250

158,193

8.76

7.88

4Q21

838.3

15.8

21.2

5.2

717

138

4021

20,073

20,189

Appendix

20,152

61.6

198,144

157,711

8.70

7.81

3Q21

839.2

15.9

21.3

5.2

664

135

3Q21

20,201

20,296

20,213

63.2

196,443

156,423

8.62

7.75

4Q20

857.5

15.9

21.5

5.5

678

139

4Q20

20,184

20,272

20,179

30View entire presentation