AgroFresh Results Presentation Deck

(in thousands)

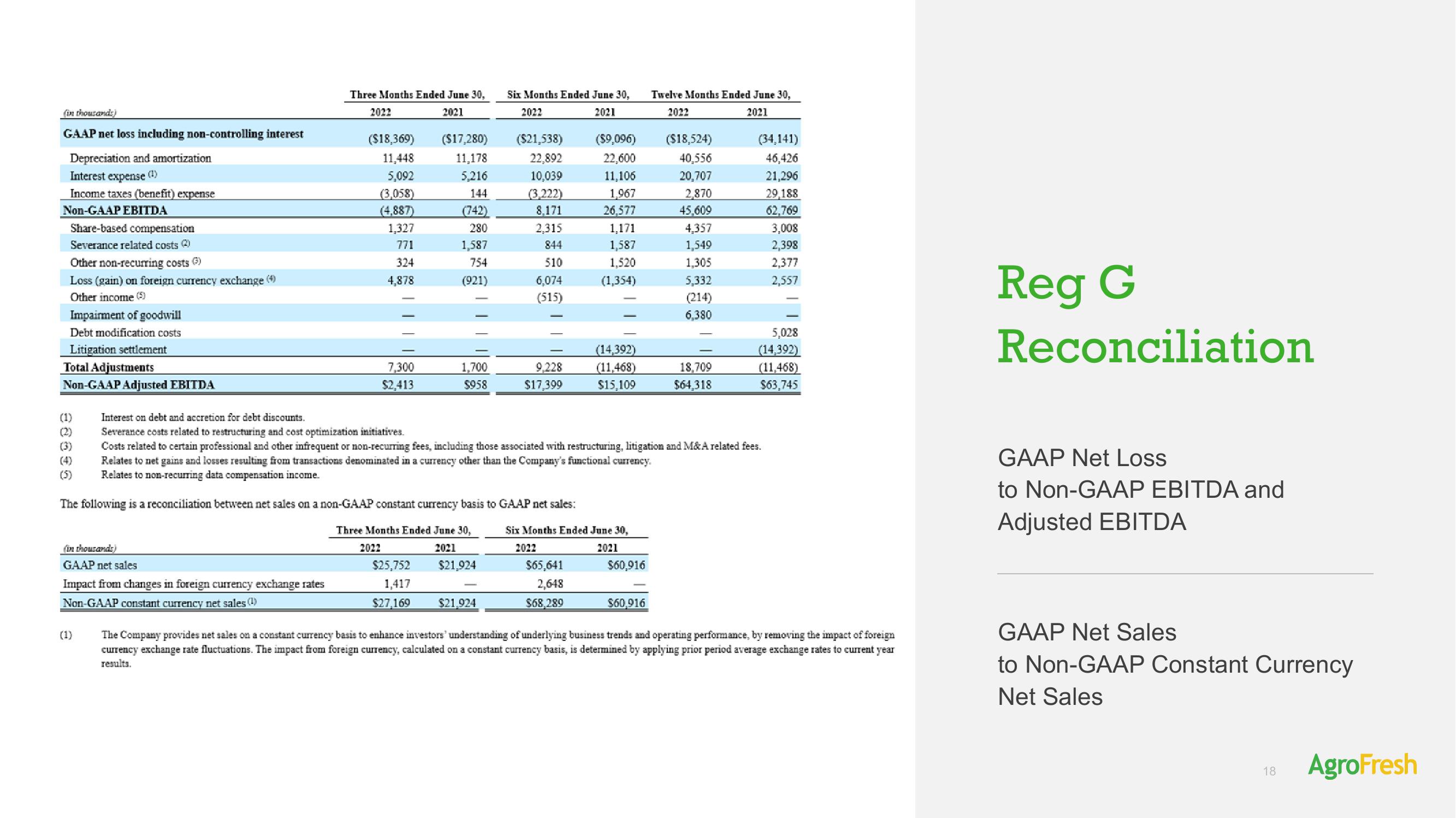

GAAP net loss including non-controlling interest

Depreciation and amortization

Interest expense

Income taxes (benefit) expense

Non-GAAP EBITDA

Share-based compensation

Severance related costs (2)

Other non-recurring costs (3)

Loss (gain) on foreign currency exchange (4)

Other income (5)

Impairment of goodwill

Debt modification costs

Litigation settlement

Total Adjustments

Non-GAAP Adjusted EBITDA

(1)

(2)

(4)

(5)

Three Months Ended June 30,

2021

2022

(in thousands)

GAAP net sales

Impact from changes in foreign currency exchange rates

Non-GAAP constant currency net sales (¹)

($18,369)

11,448

5,092

(3,058)

(4,887)

1,327

771

324

4,878

7,300

$2,413

($17,280)

11,178

5,216

144

(742)

280

1,587

754

(921)

1,700

$958

$25,752

1,417

$27,169

Six Months Ended June 30,

2022

2021

-

($21,538)

22,892

10,039

The following is a reconciliation between net sales on a non-GAAP constant currency basis to GAAP net sales:

Three Months Ended June 30,

2022

2021

$21,924

$21,924

(3,222)

8,171

2,315

844

510

6,074

(515)

9,228

$17,399

($9,096)

22,600

11,106

1,967

26,577

1,171

1,587

1,520

(1,354)

Interest on debt and accretion for debt discounts.

Severance costs related to restructuring and cost optimization initiatives.

Costs related to certain professional and other infrequent or non-recurring fees, including those associated with restructuring, litigation and M&A related fees.

Relates to net gains and losses resulting from transactions denominated in a currency other than the Company's functional currency.

Relates to non-recurring data compensation income.

2022

(14,392)

(11,468)

$15,109

Six Months Ended June 30,

2021

$65,641

2,648

$68,289

$60,916

Twelve Months Ended June 30,

2022

2021

$60,916

($18,524)

40,556

20,707

2,870

45,609

4,357

1,549

1,305

5,332

(214)

6,380

18,709

$64,318

(34,141)

46,426

21,296

29,188

62,769

3,008

2,398

2,377

2,557

5,028

(14,392)

(11,468)

$63,745

The Company provides net sales on a constant currency basis to enhance investors' understanding of underlying business trends and operating performance, by removing the impact of foreign

currency exchange rate fluctuations. The impact from foreign currency, calculated on a constant currency basis, is determined by applying prior period average exchange rates to current year

results.

Reg G

Reconciliation

GAAP Net Loss

to Non-GAAP EBITDA and

Adjusted EBITDA

GAAP Net Sales

to Non-GAAP Constant Currency

Net Sales

18

AgroFreshView entire presentation