Grove Results Presentation Deck

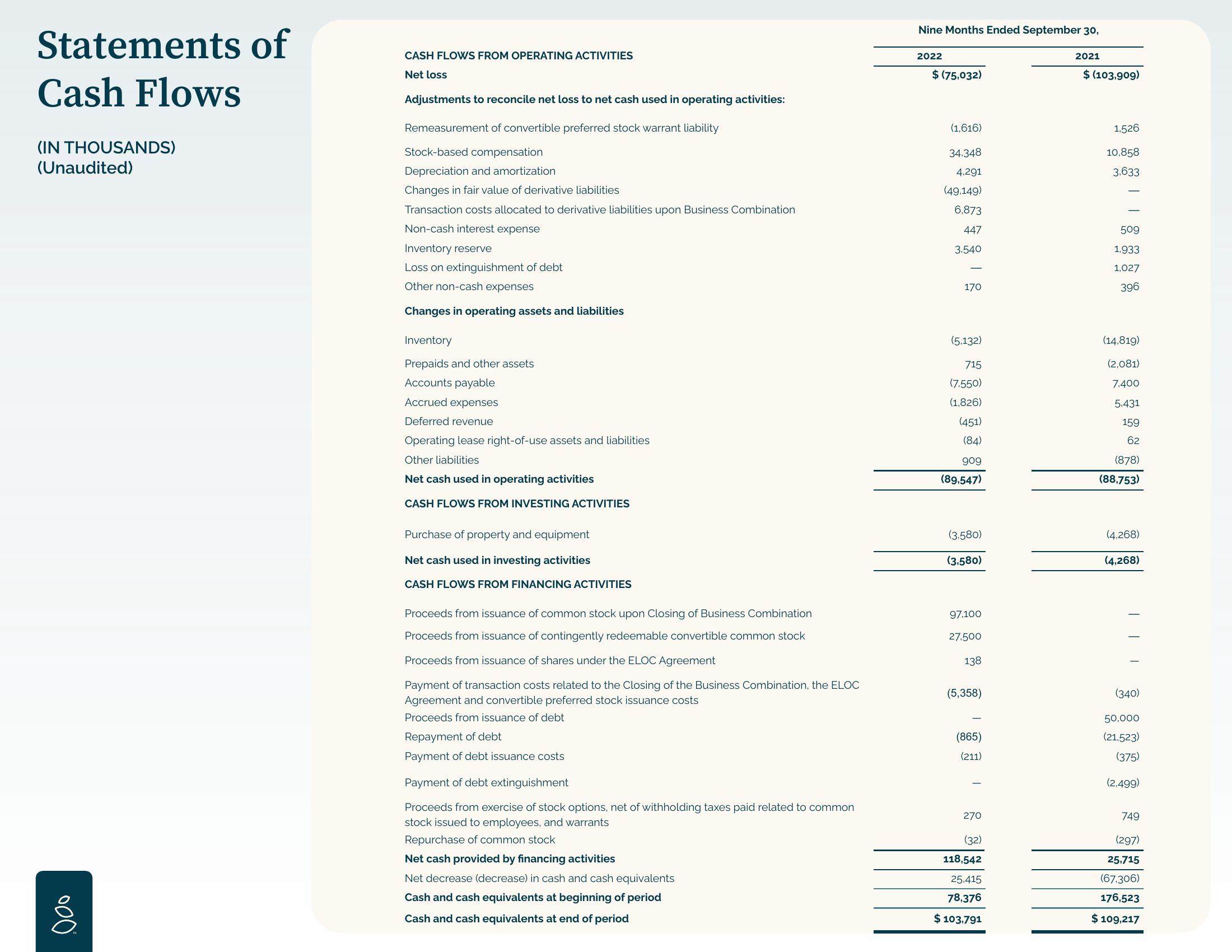

Statements of

Cash Flows

(IN THOUSANDS)

(Unaudited)

000

CASH FLOWS FROM OPERATING ACTIVITIES

Net loss

Adjustments to reconcile net loss to net cash used in operating activities:

Remeasurement of convertible preferred stock warrant liability

Stock-based compensation

Depreciation and amortization

Changes in fair value of derivative liabilities

Transaction costs allocated to derivative liabilities upon Business Combination

Non-cash interest expense

Inventory reserve

Loss on extinguishment of debt

Other non-cash expenses

Changes in operating assets and liabilities

Inventory

Prepaids and other assets

Accounts payable

Accrued expenses

Deferred revenue

Operating lease right-of-use assets and liabilities

Other liabilities

Net cash used in operating activities

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of property and equipment

Net cash used in investing activities

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from issuance of common stock upon Closing of Business Combination

Proceeds from issuance of contingently redeemable convertible common stock

Proceeds from issuance of shares under the ELOC Agreement

Payment of transaction costs related to the Closing of the Business Combination, the ELOC

Agreement and convertible preferred stock issuance costs

Proceeds from issuance of debt

Repayment of debt

Payment of debt issuance costs

Payment of debt extinguishment

Proceeds from exercise of stock options, net of withholding taxes paid related to common

stock issued to employees, and warrants

Repurchase of common stock

Net cash provided by financing activities

Net decrease (decrease) in cash and cash equivalents

Cash and cash equivalents at beginning of period

Cash and cash equivalents at end of period

Nine Months Ended September 30,

2022

$ (75,032)

(1,616)

34.348

4,291

(49.149)

6,873

447

3.540

170

(5,132)

715

(7.550)

(1,826)

(451)

(84)

909

(89,547)

(3,580)

(3,580)

97,100

27.500

138

(5,358)

(865)

(211)

270

(32)

118,542

25.415

78,376

$ 103,791

2021

$ (103,909)

1,526

10,858

3,633

509

1,933

1,027

396

(14,819)

(2,081)

7.400

5,431

159

62

(878)

(88,753)

(4,268)

(4,268)

(340)

50,000

(21,523)

(375)

(2,499)

749

(297)

25,715

(67,306)

176,523

$ 109,217View entire presentation