Liberty Global Results Presentation Deck

RECONCILIATIONS

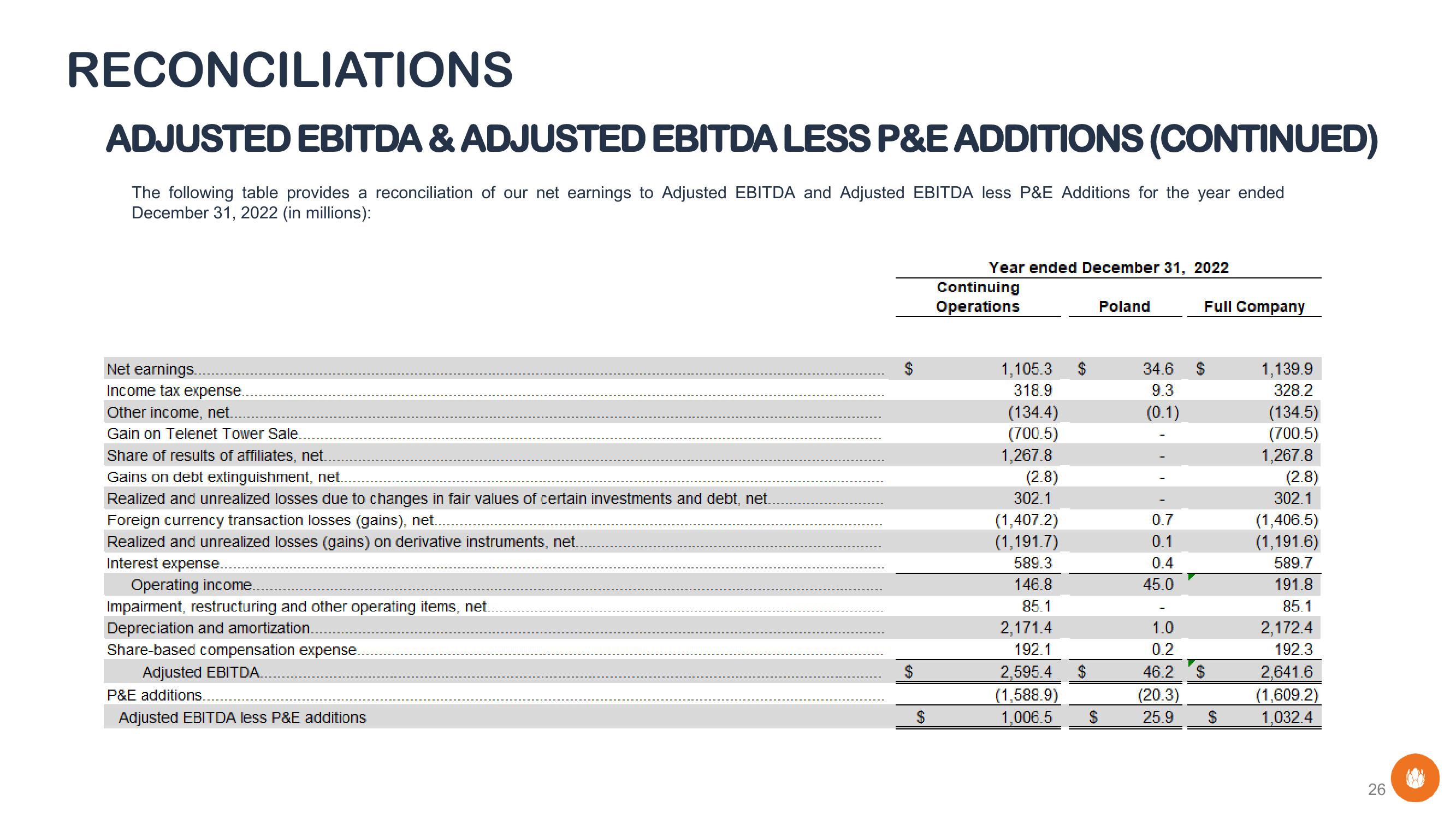

ADJUSTED EBITDA & ADJUSTED EBITDA LESS P&E ADDITIONS (CONTINUED)

The following table provides a reconciliation of our net earnings to Adjusted EBITDA and Adjusted EBITDA less P&E Additions for the year ended

December 31, 2022 (in millions):

Net earnings..

Income tax expense..

Other income, net.

Gain on Telenet Tower Sale.

Share of results of affiliates, net.

Gains on debt extinguishment, net..

Realized and unrealized losses due to changes in fair values of certain investments and debt, net.

Foreign currency transaction losses (gains), net..

Realized and unrealized losses (gains) on derivative instruments, net..

Interest expense..

Operating income.

Impairment, restructuring and other operating items, net.

Depreciation and amortization.

Share-based compensation expense.

Adjusted EBITDA..

P&E additions.

Adjusted EBITDA less P&E additions

$

$

69

Year ended December 31, 2022

Continuing

Operations

1,105.3

318.9

(134.4)

(700.5)

1,267.8

(2.8)

302.1

(1,407.2)

(1,191.7)

589.3

146.8

85.1

2,171.4

192.1

2,595.4

(1,588.9)

1,006.5

$

$

$

Poland

34.6

9.3

(0.1)

0.7

0.1

0.4

45.0

1.0

0.2

Full Company

$

46.2

(20.3)

25.9 $

1,139.9

328.2

(134.5)

(700.5)

1,267.8

(2.8)

302.1

(1,406.5)

(1,191.6)

589.7

191.8

85.1

2,172.4

192.3

2,641.6

(1,609.2)

1,032.4

26View entire presentation