Maersk Investor Presentation Deck

Logistics & Services - highlights Q3 2020

Significant growth and profitability improvement

●

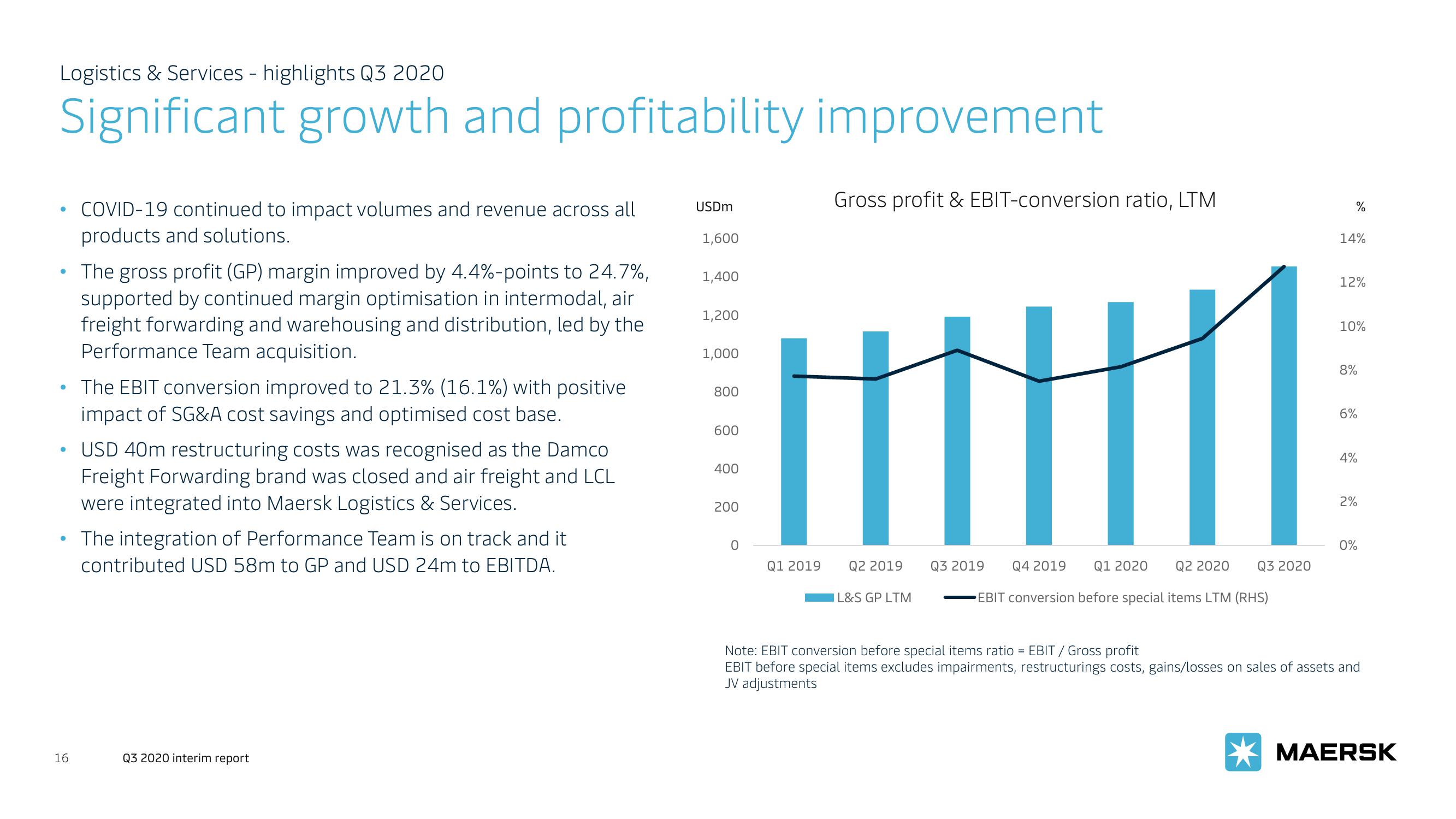

• The gross profit (GP) margin improved by 4.4%-points to 24.7%,

supported by continued margin optimisation in intermodal, air

freight forwarding and warehousing and distribution, led by the

Performance Team acquisition.

• The EBIT conversion improved to 21.3% (16.1%) with positive

impact of SG&A cost savings and optimised cost base.

●

COVID-19 continued to impact volumes and revenue across all

products and solutions.

●

16

USD 40m restructuring costs was recognised as the Damco

Freight Forwarding brand was closed and air freight and LCL

were integrated into Maersk Logistics & Services.

The integration of Performance Team is on track and it

contributed USD 58m to GP and USD 24m to EBITDA.

Q3 2020 interim report

USDm

1,600

1,400

1,200

1,000

800

600

400

200

0

Q1 2019

Gross profit & EBIT-conversion ratio, LTM

Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020

EBIT conversion before special items LTM (RHS)

IL&S GP LTM

%

14%

12%

10%

8%

6%

4%

2%

0%

Note: EBIT conversion before special items ratio = EBIT / Gross profit

EBIT before special items excludes impairments, restructurings costs, gains/losses on sales of assets and

JV adjustments

MAERSKView entire presentation