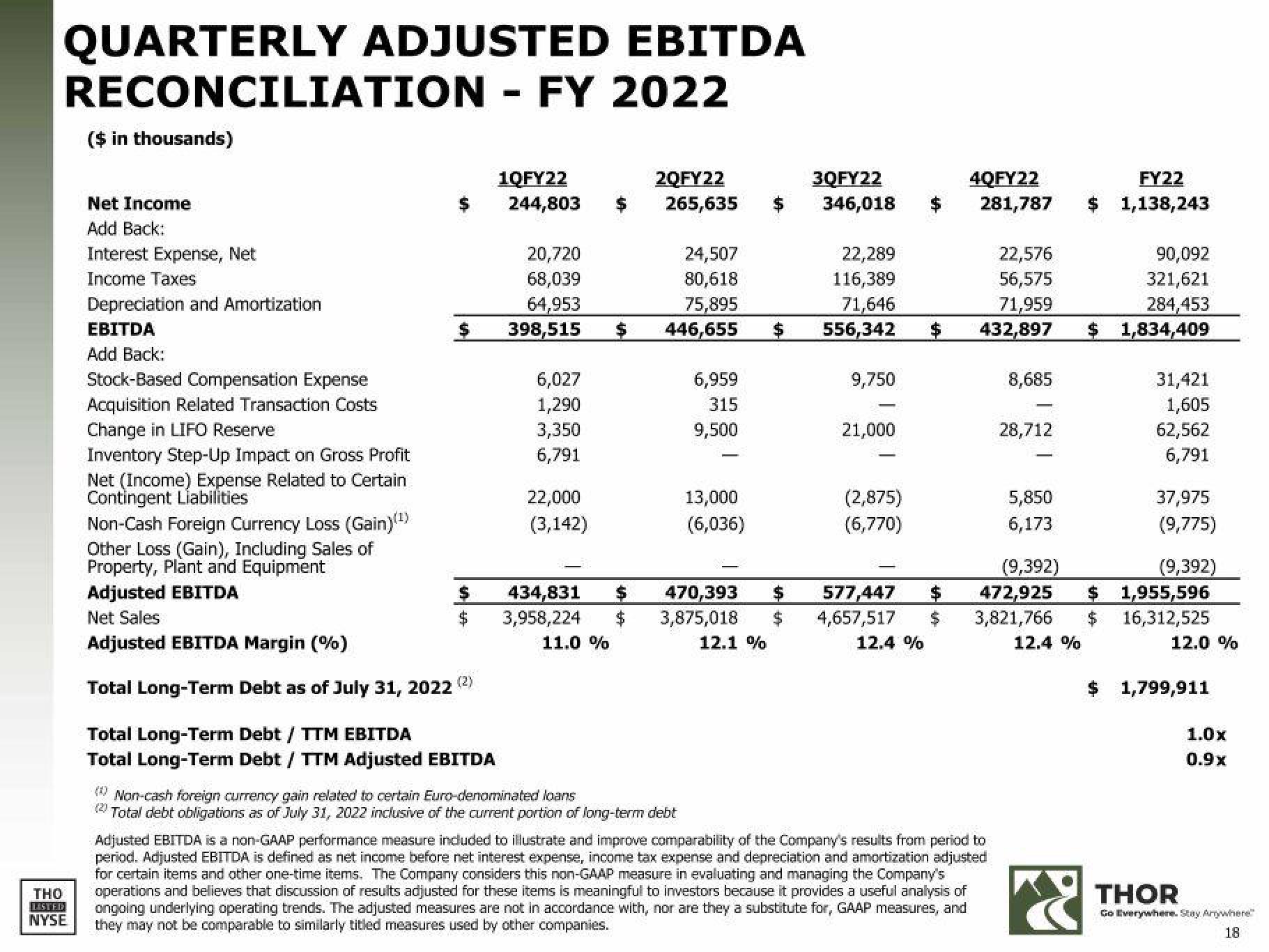

THOR Industries Results Presentation Deck

QUARTERLY ADJUSTED EBITDA

RECONCILIATION FY 2022

THO

LISTED

NYSE

($ in thousands)

Net Income

Add Back:

Interest Expense, Net

Income Taxes

Depreciation and Amortization

EBITDA

Add Back:

Stock-Based Compensation Expense

Acquisition Related Transaction Costs

Change in LIFO Reserve

Inventory Step-Up Impact on Gross Profit

Net (Income) Expense Related to Certain

Contingent Liabilities

Non-Cash Foreign Currency Loss (Gain)(¹)

$

Other Loss (Gain), Including Sales of

Property, Plant and Equipment

Adjusted EBITDA

Net Sales

Adjusted EBITDA Margin (%)

Total Long-Term Debt as of July 31, 2022 (2)

$

$

Total Long-Term Debt / TTM EBITDA

Total Long-Term Debt / TTM Adjusted EBITDA

1QFY22

244,803

20,720

68,039

64,953

398,515

6,027

1,290

3,350

6,791

22,000

(3,142)

434,831

3,958,224

11.0%

2QFY22

265,635

24,507

80,618

75,895

$ 446,655

$

6,959

315

9,500

(1) Non-cash foreign currency gain related to certain Euro-denominated loans

(2) Total debt obligations as of July 31, 2022 inclusive of the current portion of long-term debt

13,000

(6,036)

$

470,393 $

3,875,018 $

12.1 %

3QFY22

346,018

22,289

116,389

71,646

556,342

9,750

21,000

(2,875)

(6,770)

577,447

4,657,517

12.4 %

4QFY22

FY22

281,787 $ 1,138,243

22,576

90,092

56,575

321,621

71,959

284,453

$ 432,897 $ 1,834,409

8,685

Adjusted EBITDA is a non-GAAP performance measure included to illustrate and improve comparability of the Company's results from period to

period. Adjusted EBITDA is defined as net income before net interest expense, income tax expense and depreciation and amortization adjusted

for certain items and other one-time items. The Company considers this non-GAAP measure in evaluating and managing the Company's

operations and believes that discussion of results adjusted for these items is meaningful to investors because it provides a useful analysis of

ongoing underlying operating trends. The adjusted measures are not in accordance with, nor are they a substitute for, GAAP measures, and

they may not be comparable to similarly titled measures used by other companies.

28,712

5,850

6,173

31,421

1,605

62,562

6,791

(9,392)

(9,392)

472,925 $ 1,955,596

3,821,766 $ 16,312,525

12.4 %

12.0 %

X

37,975

(9,775)

$ 1,799,911

1.0x

0.9x

THOR

Go Everywhere. Stay Anywhere

18View entire presentation