Credit Suisse Investor Event Presentation Deck

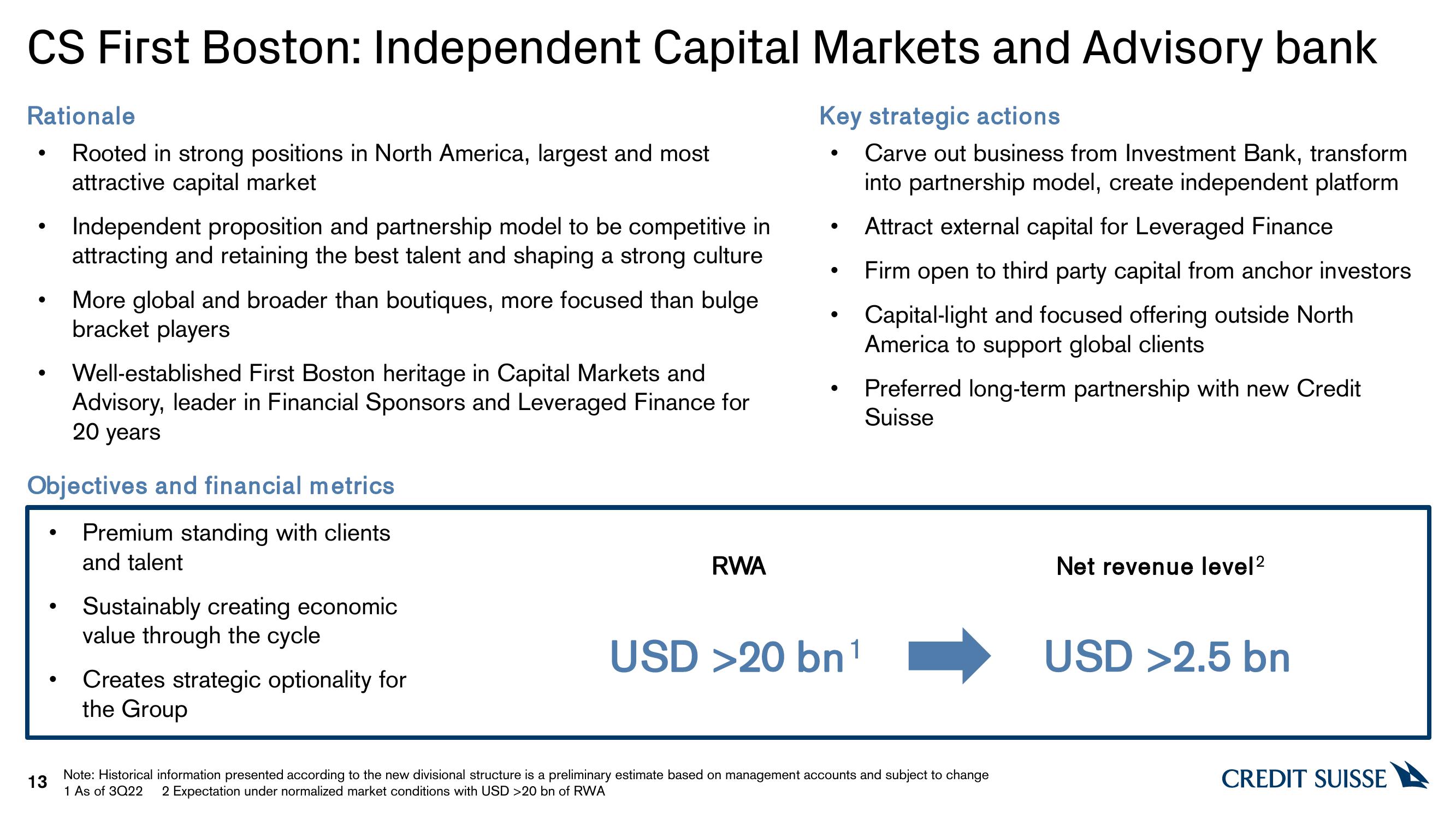

CS First Boston: Independent Capital Markets and Advisory bank

Key strategic actions

Carve out business from Investment Bank, transform

into partnership model, create independent platform

Attract external capital for Leveraged Finance

Firm open to third party capital from anchor investors

Capital-light and focused offering outside North

America to support global clients

Rationale

Rooted in strong positions in North America, largest and most

attractive capital market

●

Independent proposition and partnership model to be competitive in

attracting and retaining the best talent and shaping a strong culture

More global and broader than boutiques, more focused than bulge

bracket players

Well-established First Boston heritage in Capital Markets and

Advisory, leader in Financial Sponsors and Leveraged Finance for

20 years

Objectives and financial metrics

Premium standing with clients

and talent

Sustainably creating economic

value through the cycle

Creates strategic optionality for

the Group

RWA

●

●

●

●

USD >20 bn¹

Preferred long-term partnership with new Credit

Suisse

13

Note: Historical information presented according to the new divisional structure is a preliminary estimate based on management accounts and subject to change

1 As of 3Q22 2 Expectation under normalized market conditions with USD >20 bn of RWA

Net revenue level²

USD >2.5 bn

CREDIT SUISSEView entire presentation