Bed Bath & Beyond Results Presentation Deck

FISCAL 2022

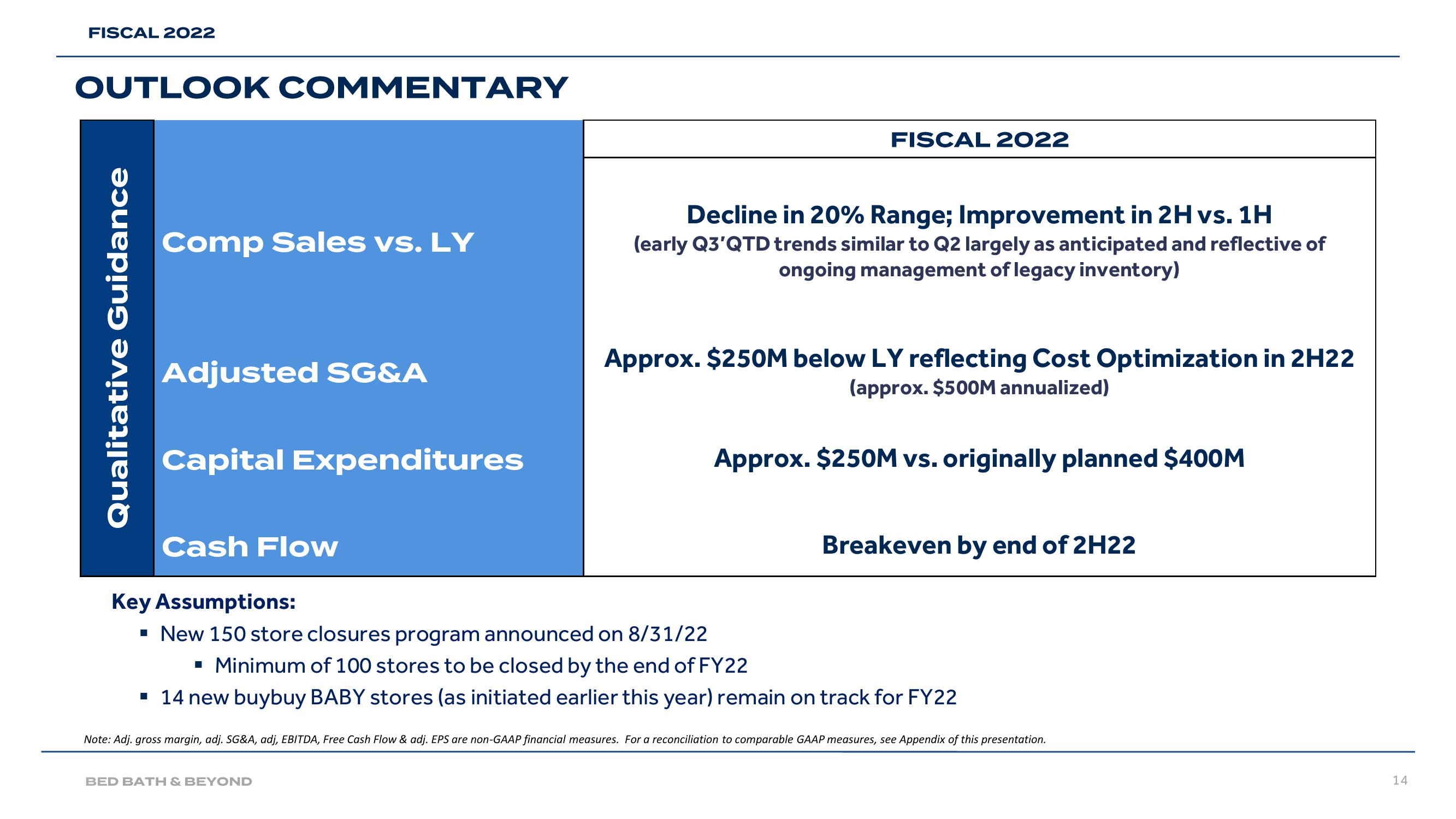

OUTLOOK COMMENTARY

Qualitative Guidance

Comp Sales vs. LY

Adjusted SG&A

Capital Expenditures

Cash Flow

FISCAL 2022

Decline in 20% Range; Improvement in 2H vs. 1H

(early Q3'QTD trends similar to Q2 largely as anticipated and reflective of

ongoing management of legacy inventory)

BED BATH & BEYOND

Approx. $250M below LY reflecting Cost Optimization in 2H22

(approx. $500M annualized)

Approx. $250M vs. originally planned $400M

Breakeven by end of 2H22

Key Assumptions:

▪ New 150 store closures program announced on 8/31/22

▪ Minimum of 100 stores to be closed by the end of FY22

▪ 14 new buybuy BABY stores (as initiated earlier this year) remain on track for FY22

Note: Adj. gross margin, adj. SG&A, adj, EBITDA, Free Cash Flow & adj. EPS are non-GAAP financial measures. For a reconciliation to comparable GAAP measures, see Appendix of this presentation.

14View entire presentation