Credit Suisse Investment Banking Pitch Book

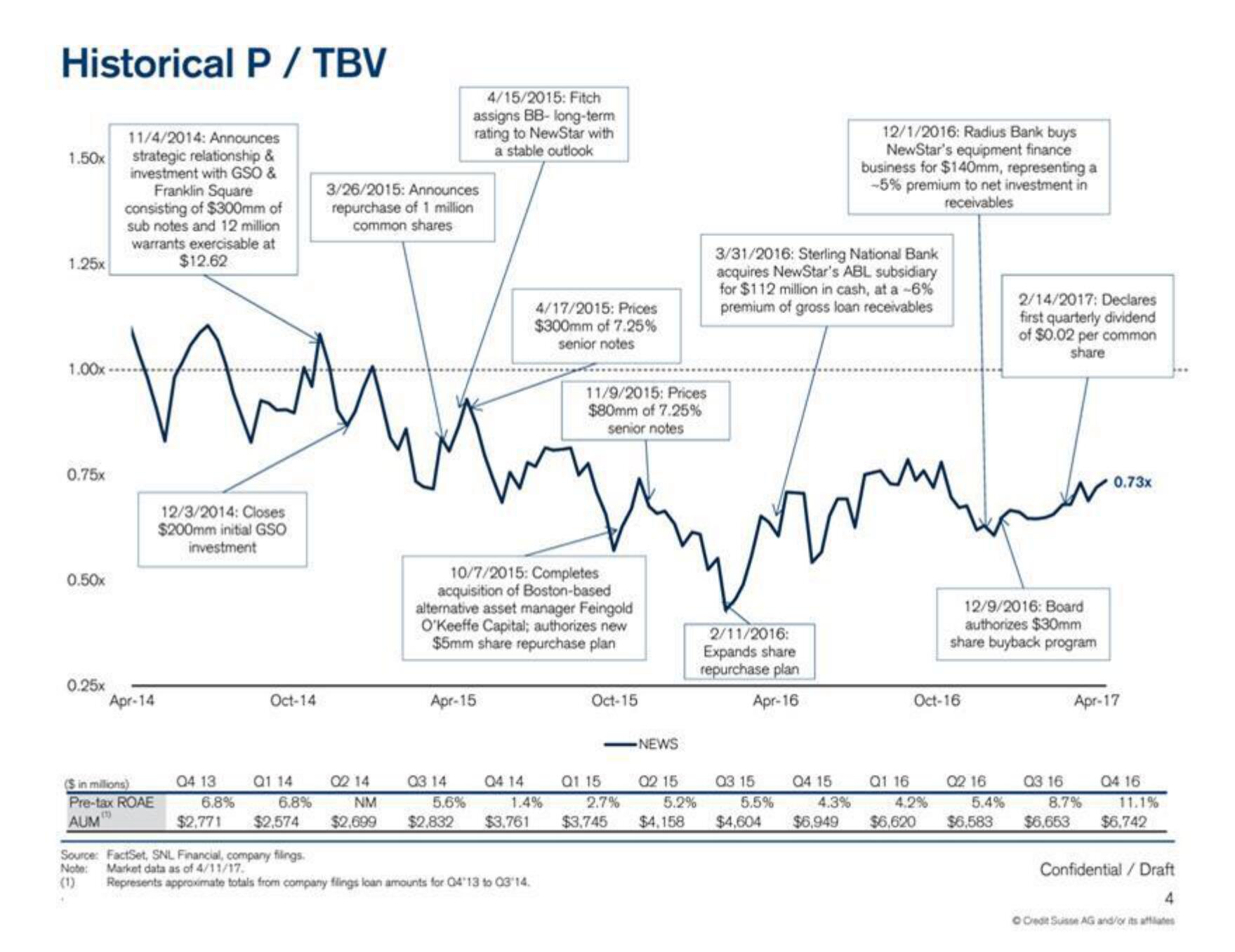

Historical P/TBV

11/4/2014: Announces

1.50x strategic relationship &

investment with GSO &

1.25x

1.00x

0.75x

0.50x

0.25x

Franklin Square

consisting of $300mm of

sub notes and 12 million

warrants exercisable at

$12.62

V

Apr-14

($ in millions)

Pre-tax ROAE

AUM

12/3/2014: Closes

$200mm initial GSO

investment

Q4 13

6.8%

$2,771

Oct-14

Q1 14

6.8%

$2,574

3/26/2015: Announces

repurchase of 1 million

common shares

02 14

NM

$2,699

4/15/2015: Fitch

assigns BB- long-term

rating to NewStar with

a stable outlook

Apr-15

03 14

10/7/2015: Completes

acquisition of Boston-based

alternative asset manager Feingold

O'Keeffe Capital; authorizes new

$5mm share repurchase plan

5.6%

$2,832

Q4 14

4/17/2015: Prices

$300mm of 7.25%

senior notes

1.4%

$3.761

Source: FactSet, SNL Financial, company filings.

Note:

Market data as of 4/11/17.

(1)

Represents approximate totals from company filings loan amounts for 04'13 to 03'14.

11/9/2015: Prices

$80mm of 7.25%

senior notes

Oct-15

Q1 15

2.7%

$3,745

NEWS

02 15

5.2%

$4,158

3/31/2016: Sterling National Bank

acquires NewStar's ABL subsidiary

for $112 million in cash, at a -6%

premium of gross loan receivables

2/11/2016:

Expands share

repurchase plan

Apr-16

03 15

5.5%

$4,604

12/1/2016: Radius Bank buys

NewStar's equipment finance

business for $140mm, representing a

-5% premium to net investment in

receivables

Q4 15

4.3%

$6,949

Oct-16

Q1 16

4.2%

$6,620

12/9/2016: Board

authorizes $30mm

share buyback program

2/14/2017: Declares

first quarterly dividend

of $0.02 per common

share

02 16

5.4%

$6,583

0.73x

Apr-17

03 16

8.7%

$6.653

Q4 16

11.1%

$6,742

Confidential / Draft

O Credit Suisse AG and/or its affiliatesView entire presentation