Selina SPAC

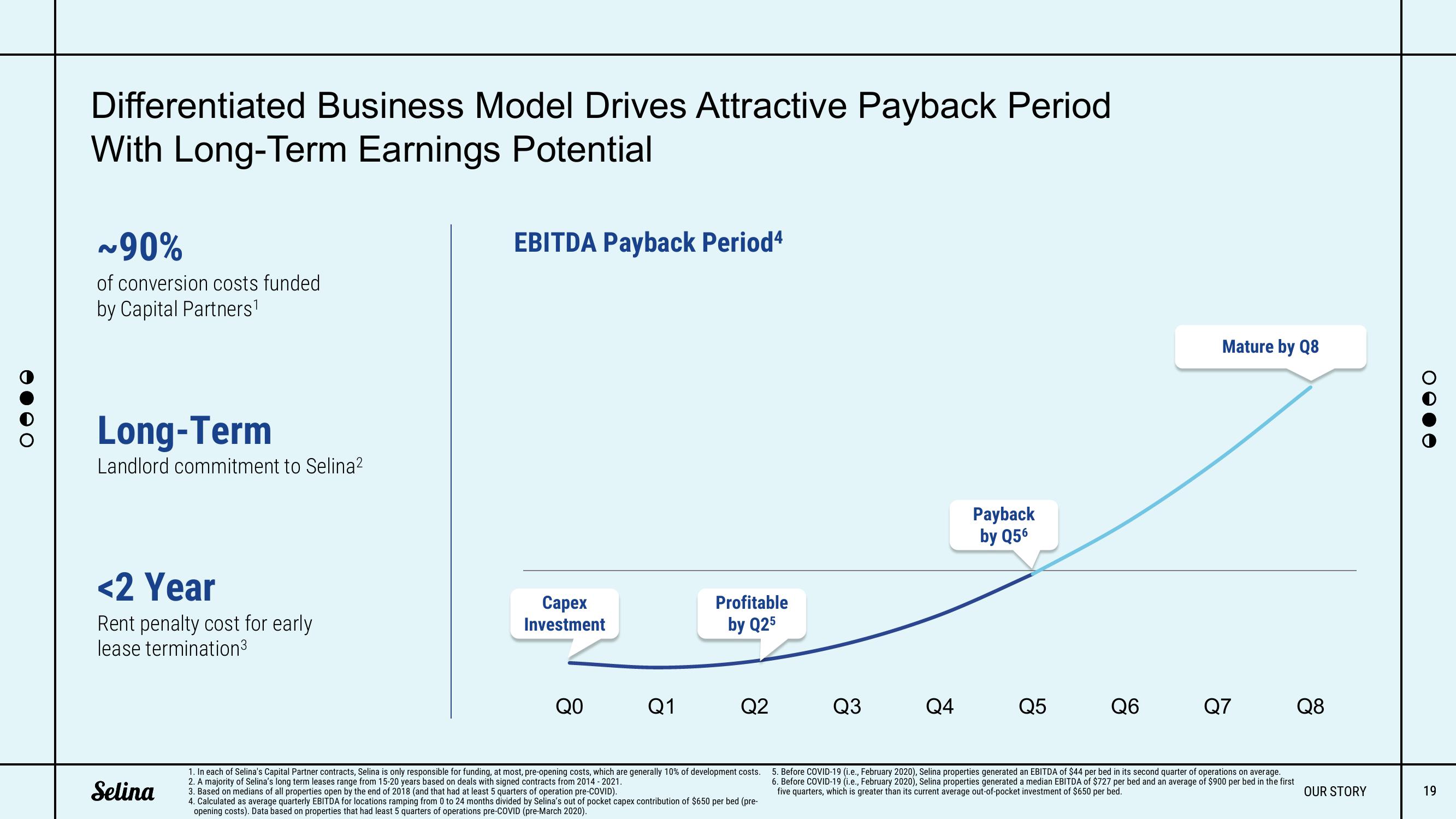

Differentiated Business Model Drives Attractive Payback Period

With Long-Term Earnings Potential

~90%

of conversion costs funded

by Capital Partners¹

Long-Term

Landlord commitment to Selina²

<2 Year

Rent penalty cost for early

lease termination³

Selina

EBITDA Payback Period4

Capex

Investment

8

QO

Q1

Profitable

by Q25

Q2

1. In each of Selina's Capital Partner contracts, Selina is only responsible for funding, at most, pre-opening costs, which are generally 10% of development costs.

2. A majority of Selina's long term leases range from 15-20 years based on deals with signed contracts from 2014-2021.

3. Based on medians of all properties open by the end of 2018 (and that had at least 5 quarters of operation pre-COVID).

4. Calculated as average quarterly EBITDA for locations ramping from 0 to 24 months divided by Selina's out of pocket capex contribution of $650 per bed (pre-

opening costs). Data based on properties that had least 5 quarters of operations pre-COVID (pre-March 2020).

Q3

Q4

Payback

by Q56

Q5

Q6

Mature by Q8

Q7

5. Before COVID-19 (i.e., February 2020), Selina properties generated an EBITDA of $44 per bed in its second quarter of operations on average.

6. Before COVID-19 (i.e., February 2020), Selina properties generated a median EBITDA of $727 per bed and an average of $900 per bed in the first

five quarters, which is greater than its current average out-of-pocket investment of $650 per bed.

Q8

OUR STORY

● ● ● ●

19View entire presentation