SoftBank Results Presentation Deck

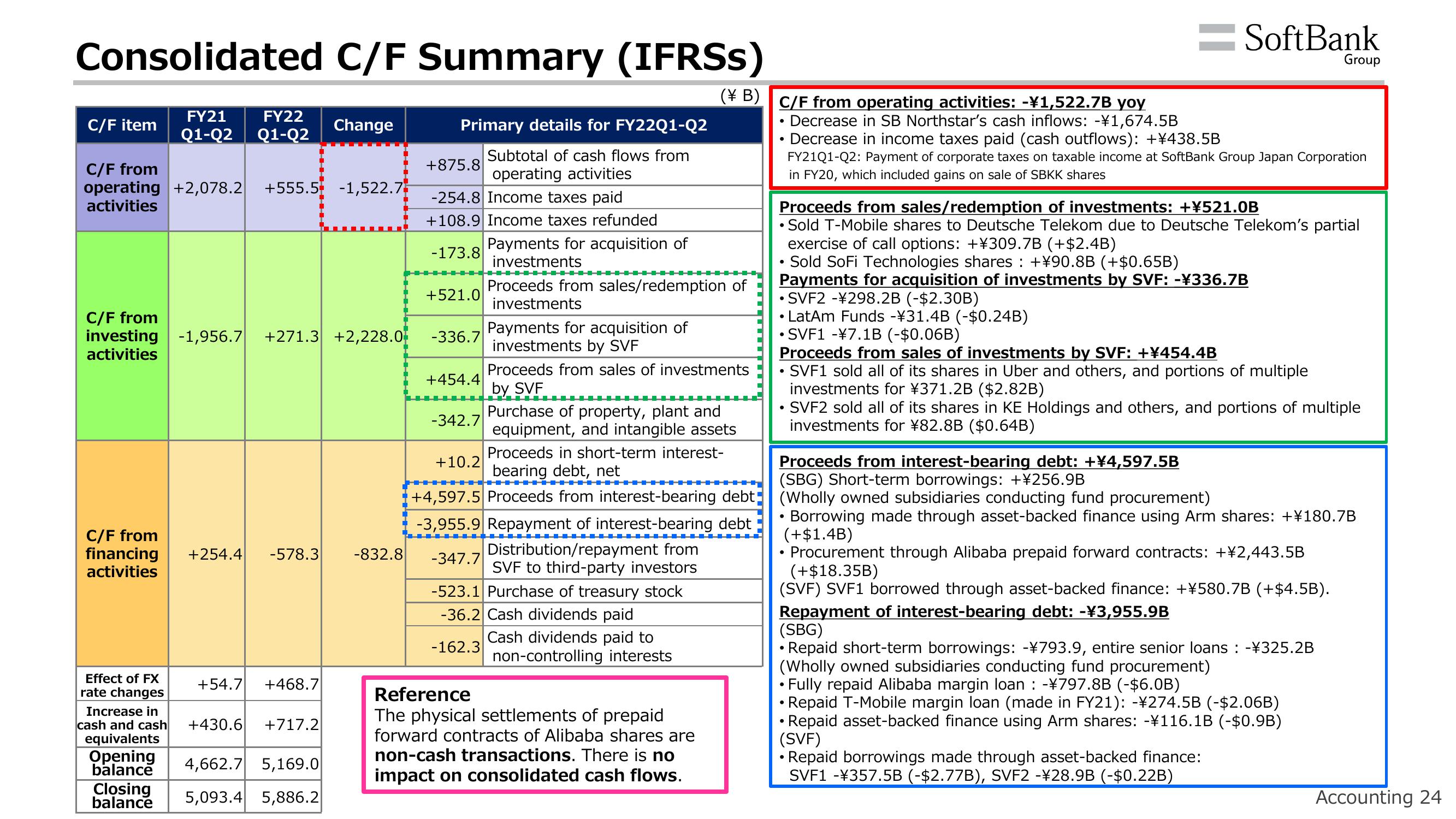

Consolidated C/F Summary (IFRSs)

FY21 FY22

Q1-Q2 Q1-Q2

C/F item

C/F from

operating +2,078.2 +555.5 -1,522.7

activities

C/F from

investing -1,956.7 +271.3 +2,228.0

activities

C/F from

financing

activities

+254.4 -578.3

Effect of FX

rate changes

Increase in

cash and cash

equivalents

Opening

balance 4,662.7 5,169.0

Closing

balance 5,093.4 5,886.2

Change

+54.7 +468.7

+430.6 +717.2

-832.8

Primary details for FY22Q1-Q2

Subtotal of cash flows from

operating activities

+875.8

-254.8 Income taxes paid

+108.9 Income taxes refunded

-173.8

+521.0

-336.7

+454.4

-342.7

Payments for acquisition of

investments

+10.2

Proceeds from sales/redemption of

investments

Payments for acquisition of

investments by SVF

Proceeds from sales of investments

by SVF

(B) C/F from operating activities: -¥1,522.7B yoy

Decrease in SB Northstar's cash inflows: -¥1,674.5B

Decrease in income taxes paid (cash outflows): +¥438.5B

FY21Q1-Q2: Payment of corporate taxes on taxable income at SoftBank Group Japan Corporation

in FY20, which included gains on sale of SBKK shares

Purchase of property, plant and

equipment, and intangible assets

Proceeds in short-term interest-

bearing debt, net

+4,597.5 Proceeds from interest-bearing debt

-3,955.9 Repayment of interest-bearing debt

Distribution/repayment from

-347.7

SVF to third-party investors

-523.1 Purchase of treasury stock

-36.2 Cash dividends paid

-162.3

Cash dividends paid to

non-controlling interests

Reference

The physical settlements of prepaid

forward contracts of Alibaba shares are

non-cash transactions. There is no

impact on consolidated cash flows.

•

●

Proceeds from sales/redemption of investments: +¥521.0B

• Sold T-Mobile shares to Deutsche Telekom due to Deutsche Telekom's partial

exercise of call options: +¥309.7B (+$2.4B)

●

Sold SoFi Technologies shares: +¥90.8B (+$0.65B)

Payments for acquisition of investments by SVF: -¥336.7B

— SoftBank

●

SVF2 -¥298.2B (-$2.30B)

• LatAm Funds -¥31.4B (-$0.24B)

SVF1 -7.1B (-$0.06B)

Proceeds from sales of investments by SVF: +¥454.4B

SVF1 sold all of its shares in Uber and others, and portions of multiple

investments for ¥371.2B ($2.82B)

• SVF2 sold all of its shares in KE Holdings and others, and portions of multiple

investments for ¥82.8B ($0.64B)

●

Group

Proceeds from interest-bearing debt: +¥4,597.5B

(SBG) Short-term borrowings: +¥256.9B

(Wholly owned subsidiaries conducting fund procurement)

• Borrowing made through asset-backed finance using Arm shares: +¥180.7B

(+$1.4B)

.

Procurement through Alibaba prepaid forward contracts: +¥2,443.5B

(+$18.35B)

(SVF) SVF1 borrowed through asset-backed finance: +¥580.7B (+$4.5B).

Repayment of interest-bearing debt: -¥3,955.9B

(SBG)

• Repaid short-term borrowings: -¥793.9, entire senior loans : -¥325.2B

(Wholly owned subsidiaries conducting fund procurement)

• Fully repaid Alibaba margin loan : -¥797.8B (-$6.0B)

• Repaid T-Mobile margin loan (made in FY21): -¥274.5B (-$2.06B)

• Repaid asset-backed finance using Arm shares: -¥116.1B (-$0.9B)

(SVF)

• Repaid borrowings made through asset-backed finance:

SVF1 -¥357.5B (-$2.77B), SVF2 -¥28.9B (-$0.22B)

Accounting 24View entire presentation