Barclays Capital 2010 Global Financial Services Conference

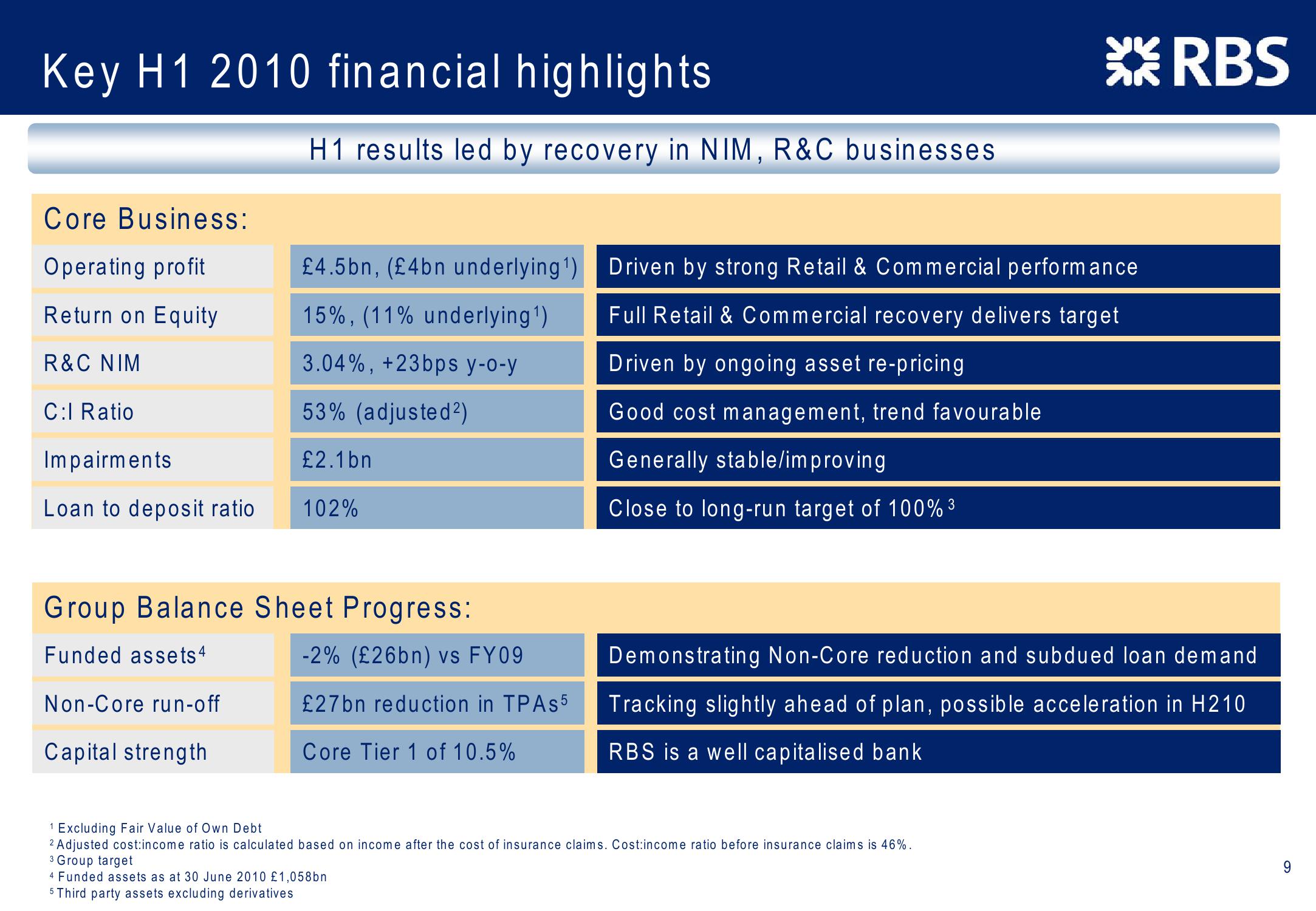

Key H1 2010 financial highlights

H1 results led by recovery in NIM, R&C businesses

XRBS

Core Business:

Operating profit

Return on Equity

R&C NIM

£4.5bn, (£4bn underlying 1)

15%, (11% underlying 1)

3.04%, +23bps y-o-y

C:l Ratio

53% (adjusted²)

Impairments

£2.1bn

Loan to deposit ratio

102%

Group Balance Sheet Progress:

Driven by strong Retail & Commercial performance

Full Retail & Commercial recovery delivers target

Driven by ongoing asset re-pricing

Good cost management, trend favourable

Funded assets 4

-2% (£26bn) vs FY09

Non-Core run-off

£27bn reduction in TPAs 5

Capital strength

Core Tier 1 of 10.5%

Generally stable/improving

3

Close to long-run target of 100% ³

Demonstrating Non-Core reduction and subdued loan demand

Tracking slightly ahead of plan, possible acceleration in H210

RBS is a well capitalised bank

1 Excluding Fair Value of Own Debt

2 Adjusted cost:income ratio is calculated based on income after the cost of insurance claims. Cost:income ratio before insurance claims is 46%.

3 Group target

4 Funded assets as at 30 June 2010 £1,058bn

5 Third party assets excluding derivatives

6View entire presentation