OppFi SPAC Presentation Deck

42

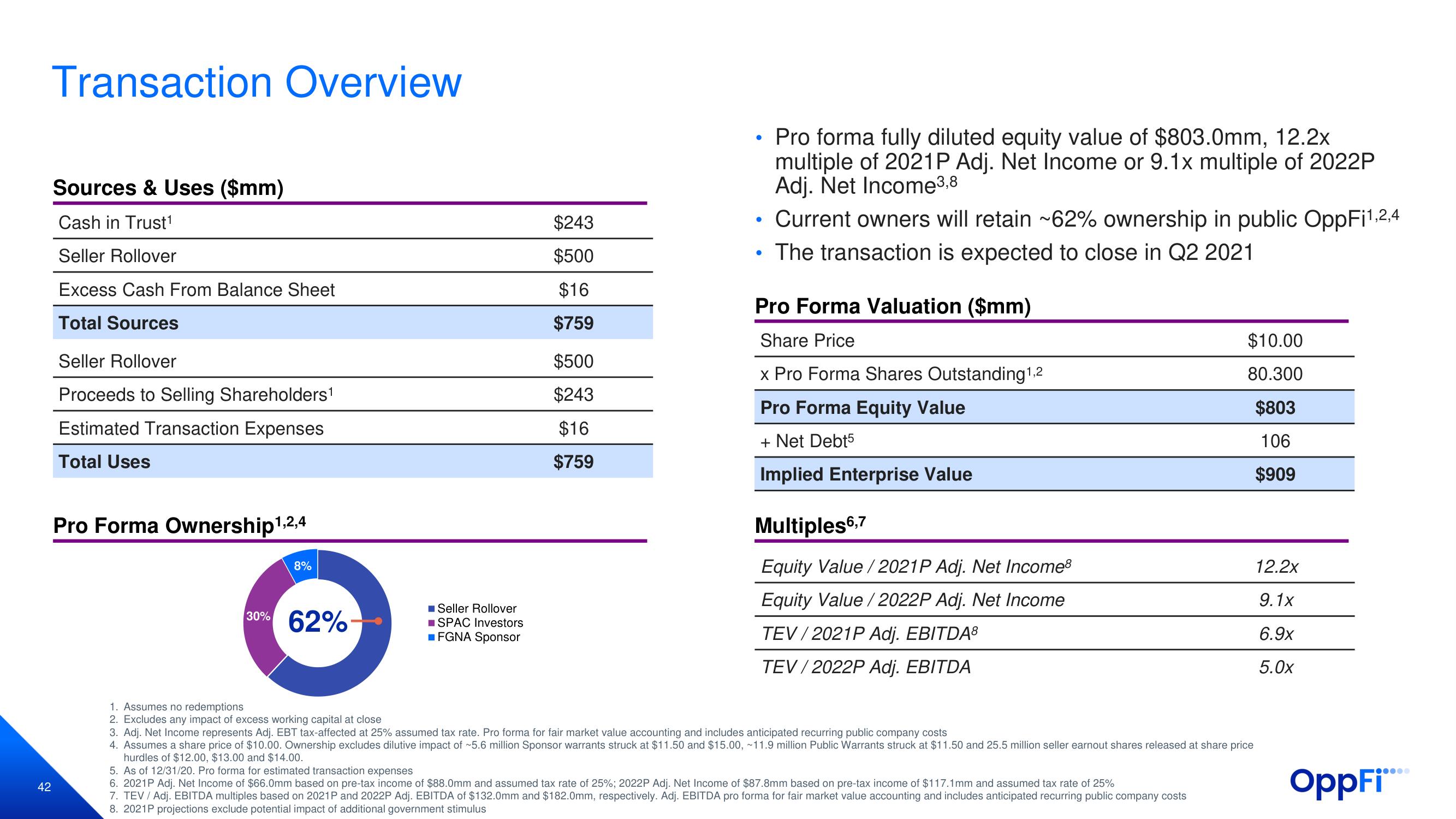

Transaction Overview

Sources & Uses ($mm)

Cash in Trust¹

Seller Rollover

Excess Cash From Balance Sheet

Total Sources

Seller Rollover

Proceeds to Selling Shareholders¹

Estimated Transaction Expenses

Total Uses

Pro Forma Ownership¹,2,4

8%

30% 62%

■Seller Rollover

■SPAC Investors

■FGNA Sponsor

$243

$500

$16

$759

$500

$243

$16

$759

●

●

●

Pro forma fully diluted equity value of $803.0mm, 12.2x

multiple of 2021P Adj. Net Income or 9.1x multiple of 2022P

Adj. Net Income3,8

Current owners will retain ~62% ownership in public OppFi¹,2,4

The transaction is expected to close in Q2 2021

Pro Forma Valuation ($mm)

Share Price

x Pro Forma Shares Outstanding 1,2

Pro Forma Equity Value

+ Net Debt5

Implied Enterprise Value

Multiples 6,7

Equity Value/2021P Adj. Net Income8

Equity Value/2022P Adj. Net Income

TEV/2021P Adj. EBITDA³

TEV/2022P Adj. EBITDA

$10.00

80.300

$803

106

$909

1. Assumes no redemptions

2. Excludes any impact of excess working capital at close

3. Adj. Net Income represents Adj. EBT tax-affected at 25% assumed tax rate. Pro forma for fair market value accounting and includes anticipated recurring public company costs

4. Assumes a share price of $10.00. Ownership excludes dilutive impact of ~5.6 million Sponsor warrants struck at $11.50 and $15.00, ~11.9 million Public Warrants struck at $11.50 and 25.5 million seller earnout shares released at share price

hurdles of $12.00, $13.00 and $14.00.

5. As of 12/31/20. Pro forma for estimated transaction expenses

6. 2021P Adj. Net Income of $66.0mm based on pre-tax income of $88.0mm and assumed tax rate of 25%; 2022P Adj. Net Income of $87.8mm based on pre-tax income of $117.1mm and assumed tax rate of 25%

7. TEV / Adj. EBITDA multiples based on 2021P and 2022P Adj. EBITDA of $132.0mm and $182.0mm, respectively. Adj. EBITDA pro forma for fair market value accounting and includes anticipated recurring public company costs

8. 2021P projections exclude potential impact of additional government stimulus

12.2x

9.1x

6.9x

5.0x

OppFi****View entire presentation