Spotify Results Presentation Deck

Free Cash Flow

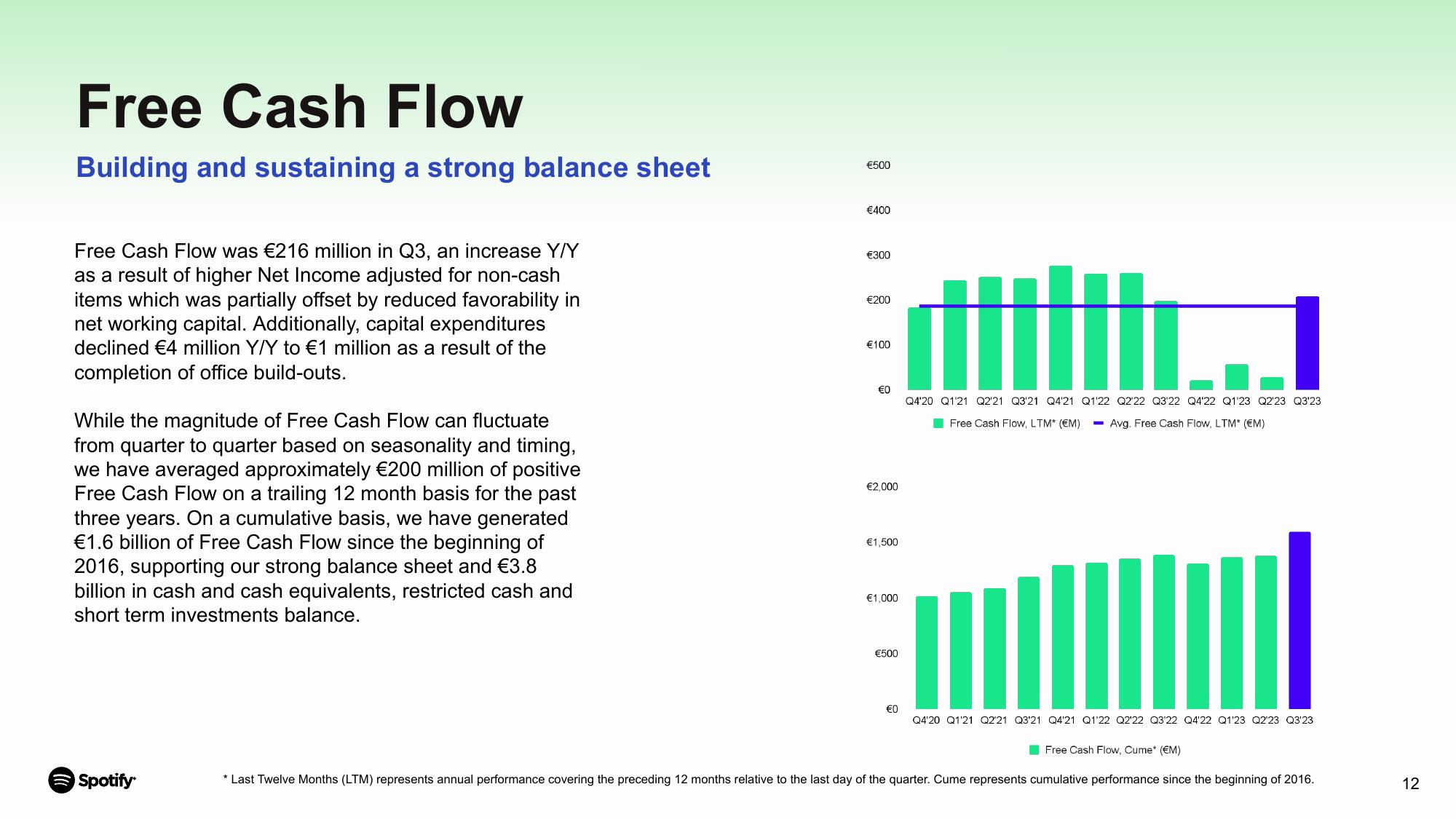

Building and sustaining a strong balance sheet

Free Cash Flow was €216 million in Q3, an increase Y/Y

as a result of higher Net Income adjusted for non-cash

items which was partially offset by reduced favorability in

net working capital. Additionally, capital expenditures

declined €4 million Y/Y to €1 million as a result of the

completion of office build-outs.

While the magnitude of Free Cash Flow can fluctuate

from quarter to quarter based on seasonality and timing,

we have averaged approximately €200 million of positive

Free Cash Flow on a trailing 12 month basis for the past

three years. On a cumulative basis, we have generated

€1.6 billion of Free Cash Flow since the beginning of

2016, supporting our strong balance sheet and €3.8

billion in cash and cash equivalents, restricted cash and

short term investments balance.

Spotify

€500

€400

€300

€200

€100

€0

€2,000

€1,500

€1,000

€500

€0

MMM....

Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23

Free Cash Flow, LTM* (EM) Avg. Free Cash Flow, LTM* (EM)

Q4'20 Q1'21 Q221 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23

Free Cash Flow, Cume* (€M)

* Last Twelve Months (LTM) represents annual performance covering the preceding 12 months relative to the last day of the quarter. Cume represents cumulative performance since the beginning of 2016.

12View entire presentation