Bank of America Investment Banking Pitch Book

(4)

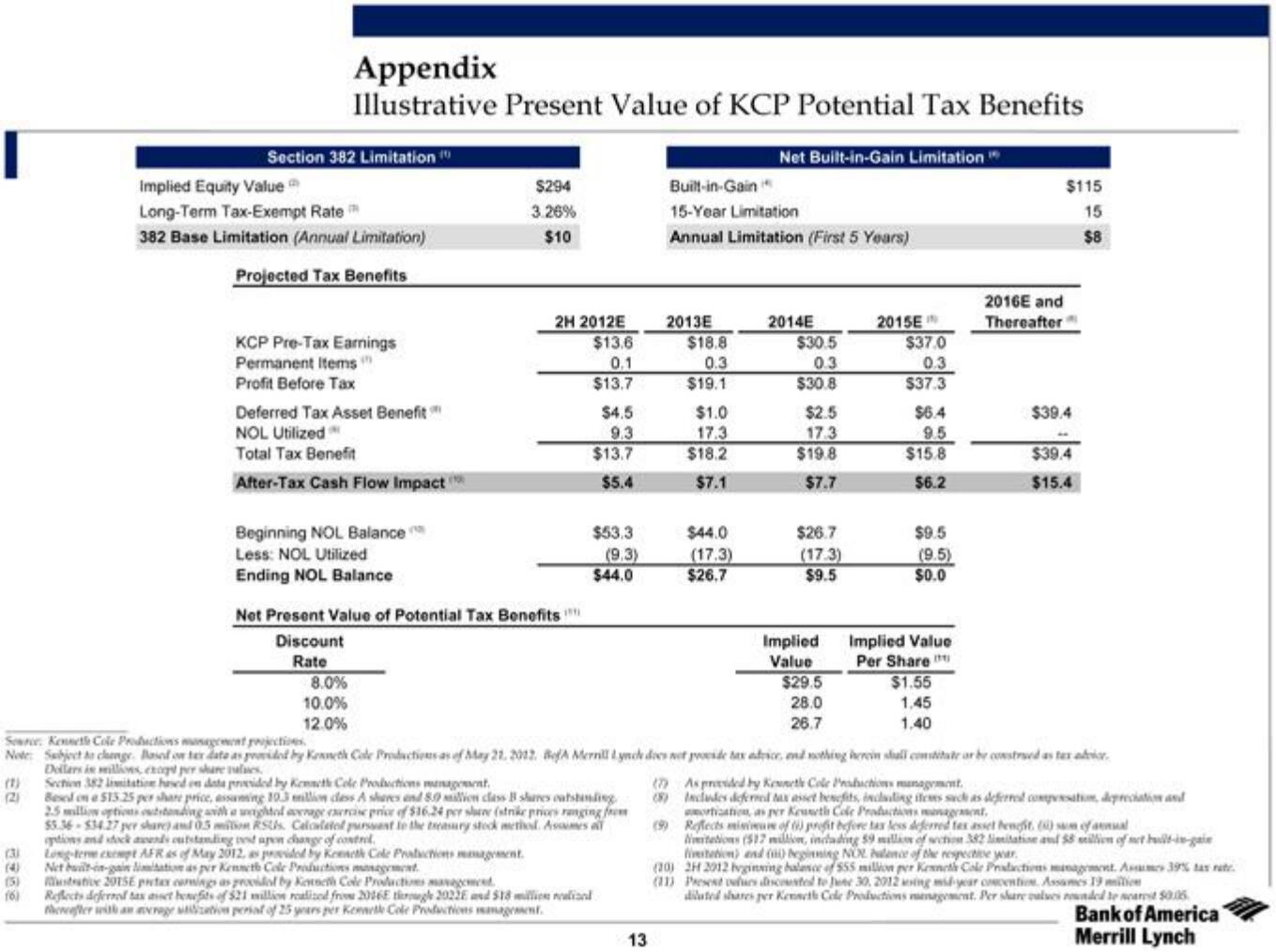

Appendix

Illustrative Present Value of KCP Potential Tax Benefits

Section 382 Limitation (

Implied Equity Value

Long-Term Tax-Exempt Rate

382 Base Limitation (Annual Limitation)

Projected Tax Benefits

KCP Pre-Tax Earnings

Permanent Items

Profit Before Tax

Deferred Tax Asset Benefit

NOL Utilized™

Total Tax Benefit

After-Tax Cash Flow Impact (

Beginning NOL Balance

Less: NOL Utilized

Ending NOL Balance

8.0%

10.0%

12.0%

$294

3.26%

$10

2H 2012E

Net Present Value of Potential Tax Benefits

Discount

Rate

$13.6

0.1

$13.7

$4.5

9.3

$13.7

$5.4

$53.3

(9.3)

$44.0

13

Built-in-Gain

15-Year Limitation

Annual Limitation (First 5 Years)

2013E

$18.8

0.3

$19.1

$1.0

17.3

$18.2

$7.1

Net Built-in-Gain Limitation

$44.0

(17.3)

$26.7

2014E

$30.5

0.3

$30.8

$2.5

17.3

$19.8

$7.7

$26.7

(17.3)

$9.5

Implied

Value

$29.5

28.0

26.7

2015E

$37.0

0.3

$37.3

$6.4

9.5

$15.8

$6.2

$9.5

(9.5)

$0.0

Implied Value

Per Share

$1.55

1.45

1.40

2016E and

Thereafter

$115

15

$8

$39.4

Source: Kenneth Cole Productions management projections

Note: Subject to change. Based on ter date as provided by Kenneth Cole Productions as of May 21. 2012 BefA Merrill Lynch does not pude tax advice, and nothing herein shall constitute or be construed as tax ador

Dollars is millions, except per share values.

(1) Section 382 limitation based on data provided by Kenneth Cole Productions management,

(2)

Besed on a 515.25 per share price, assuming 10.3 million class A shares and 89 milion class shares outstanding

2.5 million options outstanding with a ghted average exercise price of $16.24 per sher (strike prices ranging from

55.36-534.27 per share) and 0.5 milion RSL C Calculated pursuant to the treasury stock method. Acumes all

options and stock and outstanding ned apen change of contr

Long-term exempt AFR as of May 2012, as provided by Kenneth Cole Productions management.

Net built-in-gain mitation as per Kenneth Cole Productions management.

Mustrative 2015E pretex comings as provided by Kenneth Cole Productions management

Reflects deferred tax avset benefits of $21 million realized from 2016E througe 2022E and $18 million ind

thereafter with an average sitzation perial of 25 years per Kenneth Cole Productions management.

$39.4

$15.4

(7) As provided by Kenneth Cole Productions management.

(8)

Includes deferned MAX asset benefits, including items such as deferred compensation, depreciation and

amortization, as per Kenneth Cole Production management,

(9)

Reflects misure of i) profit before tax less deferred tex asset hengit() sum of annual

Nimitations (517 million, including 59 millim of wction 382 limitation and 58 million of net build-in-gaie

Nitation) and (ii) beginning NOL Palence of the respective war.

(20) 2H 2012 begining balance of 555 million per Kenneth Cole Practions management Assames39% tax rate

(11) Present ofurs discounted to June 30, 2012 ing mid-year convention Assames 19 milion

dilated shares per Kenneth Cole Productions management. Per share calves rounded te nearest $0.05.

Bank of America

Merrill LynchView entire presentation