J.P.Morgan 4Q23 Earnings Results

JPMORGAN CHASE & CO.

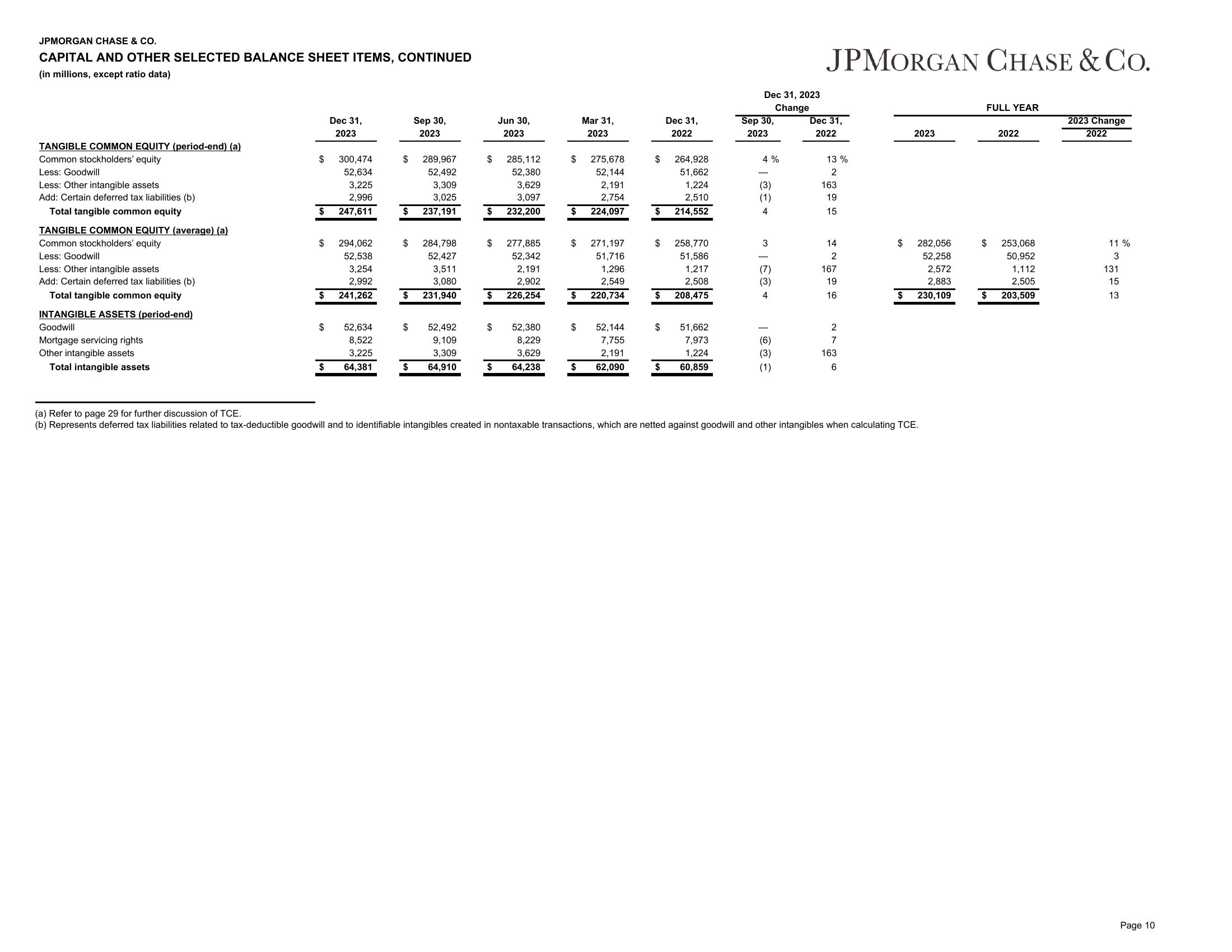

CAPITAL AND OTHER SELECTED BALANCE SHEET ITEMS, CONTINUED

(in millions, except ratio data)

TANGIBLE COMMON EQUITY (period-end) (a)

Common stockholders' equity

Less: Goodwill

Less: Other intangible assets

Add: Certain deferred tax liabilities (b)

Total tangible common equity

TANGIBLE COMMON EQUITY (average) (a)

Common stockholders' equity

Less: Goodwill

Less: Other intangible assets

Add: Certain deferred tax liabilities (b)

Total tangible common equity

INTANGIBLE ASSETS (period-end)

Goodwill

Mortgage servicing rights

Other intangible assets

Total intangible assets

$

$

$

$

$

$

Dec 31,

2023

300,474

52,634

3,225

2,996

247,611

294,062

52,538

3,254

2,992

241,262

52,634

8,522

3,225

64,381

$

$

$

$

Sep 30,

2023

$

289,967

52,492

3,309

3,025

237,191

284,798

52,427

3,511

3,080

231,940

52,492

9,109

3,309

$ 64,910

Jun 30,

2023

$ 285,112

52,380

3,629

3,097

$ 232,200

$

277,885

52,342

2,191

2,902

226,254

$ 52,380

8,229

3,629

$ 64,238

$

275,678

52,144

2,191

2,754

$ 224,097

Mar 31,

2023

$ 271,197

51,716

1,296

2,549

220,734

$

$ 52,144

7,755

2,191

$ 62,090

$

$

$

$

$

$

Dec 31,

2022

264,928

51,662

1,224

2,510

214,552

258,770

51,586

1,217

2,508

208,475

51,662

7,973

1,224

60,859

Dec 31, 2023

Change

Sep 30,

2023

4%

♡ | +

3

(7)

(3)

4

-

(3)

(1)

JPMORGAN CHASE & Co.

Dec 31,

2022

13%

2

163

19

15

14

2

167

19

16

2

7

163

6

2023

$ 282,056

52,258

2,572

2,883

$ 230,109

(a) Refer to page 29 for further discussion of TCE.

(b) Represents deferred tax liabilities related to tax-deductible goodwill and to identifiable intangibles created in nontaxable transactions, which are netted against goodwill and other intangibles when calculating TCE.

FULL YEAR

2022

$ 253,068

50,952

1,112

2,505

203,509

$

2023 Change

2022

11 %

3

131

15

13

Page 10View entire presentation