Kinnevik Results Presentation Deck

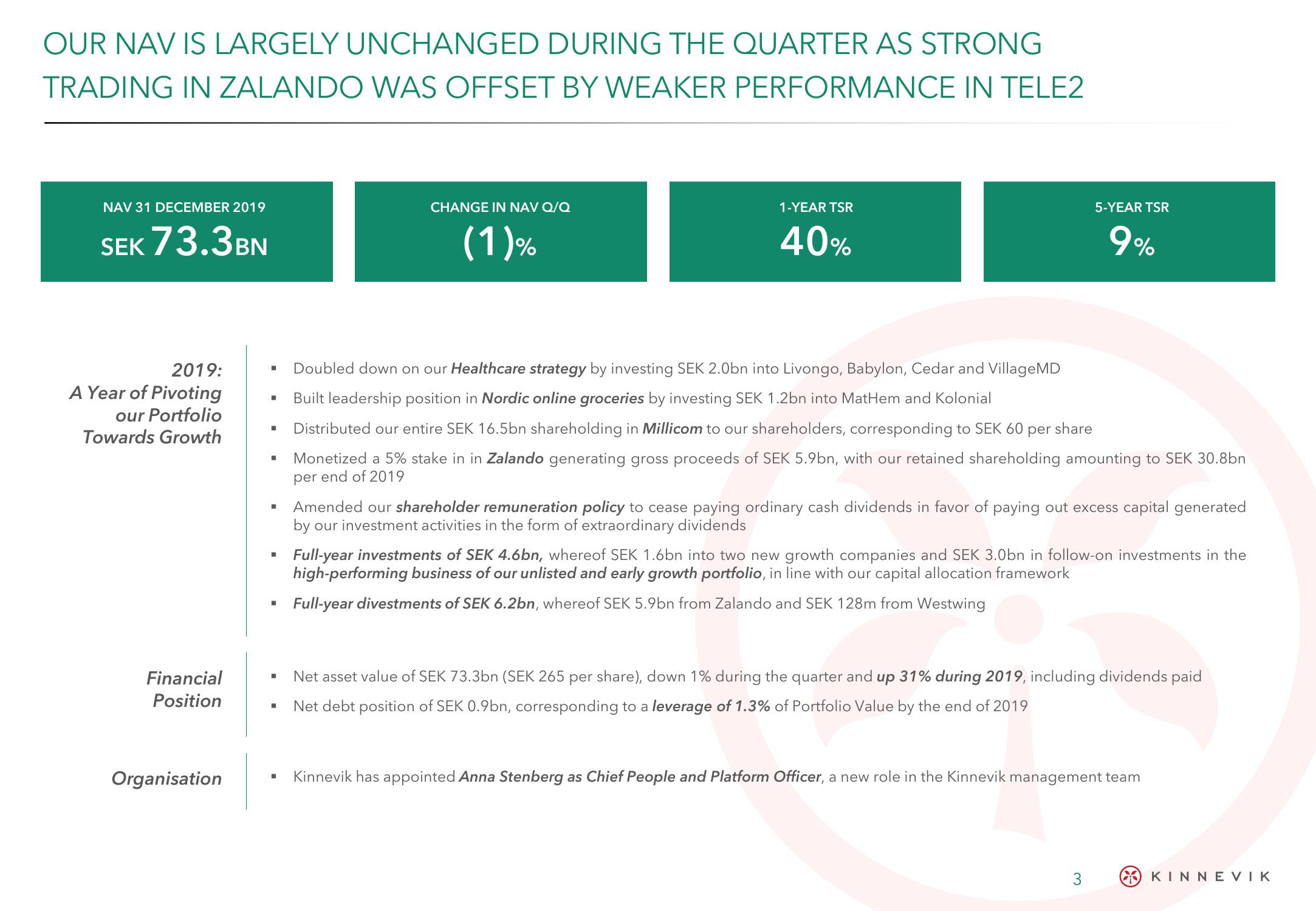

OUR NAV IS LARGELY UNCHANGED DURING THE QUARTER AS STRONG

TRADING IN ZALANDO WAS OFFSET BY WEAKER PERFORMANCE IN TELE2

NAV 31 DECEMBER 2019

SEK 73.3BN

2019:

A Year of Pivoting

our Portfolio

Towards Growth

Financial

Position

Organisation

■

■

■

I

■

■

CHANGE IN NAV Q/Q

(1)%

■

1-YEAR TSR

40%

▪ Full-year investments of SEK 4.6bn, whereof SEK 1.6bn into two new growth companies and SEK 3.0bn in follow-on investments in the

high-performing business of our unlisted and early growth portfolio, in line with our capital allocation framework

▪ Full-year divestments of SEK 6.2bn, whereof SEK 5.9bn from Zalando and SEK 128m from Westwing

5-YEAR TSR

9%

Doubled down on our Healthcare strategy by investing SEK 2.0bn into Livongo, Babylon, Cedar and VillageMD

Built leadership position in Nordic online groceries by investing SEK 1.2bn into MatHem and Kolonial

Distributed our entire SEK 16.5bn shareholding in Millicom to our shareholders, corresponding to SEK 60 per share

Monetized a 5% stake in in Zalando generating gross proceeds of SEK 5.9bn, with our retained shareholding amounting to SEK 30.8bn

per end of 2019

Amended our shareholder remuneration policy to cease paying ordinary cash dividends in favor of paying out excess capital generated

by our investment activities in the form of extraordinary dividends

Net asset value of SEK 73.3bn (SEK 265 per share), down 1% during the quarter and up 31% during 2019, including dividends paid

Net debt position of SEK 0.9bn, corresponding to a leverage of 1.3% of Portfolio Value by the end of 2019

Kinnevik has appointed Anna Stenberg as Chief People and Platform Officer, a new role in the Kinnevik management team

3

KINNEVIKView entire presentation